The majority of people who attempt to make money with cryptocurrency don’t look beyond mining and trading. These are, however, far from the only ways of making money in the world of crypto, and some of those other methods are much better. In fact, there are lots of other options for earning passive income in the crypto industry. We’ll take a look at them in this article.

Masternodes

Masternodes are a relatively profitable tool for passive earnings in crypto. A masternode is a node (server) in the blockchain which stores a copy of the chain and is also responsible for verifying and confirming transactions. The masternode also has a role in determining the development of the network.

Masternodes function in a similar way to mining – adding blocks to the network for a predetermined reward. The main differences are that:

- the network rewards the nodes that have gone the longest without receiving a payment;

- powerful computing equipment like video cards and application-specific integrated circuits (ASICs) aren’t needed.

Requirements for launching a masternode:

- a crypto wallet;

- synchronization with the network;

- a stable internet connection;

- collateral in the form of the network’s cryptocurrency.

In order to start earning income with a masternode, you need to choose a cryptocurrency to invest in, rent a virtual server, install special software, including a crypto wallet that’s synchronized with the blockchain and set up, and deposit tokens as collateral.

Deposits vary significantly depending on the network and can be anything in the range of tens of dollars to tens (and even hundreds) of thousands. At the same time, it’s worth remembering that if a masternode operator violates the rules of the network, the deposit can be confiscated in full. Income also varies greatly and is between a couple of dollars and several tens of dollars per day on average.

The way a masternode functions depends on the network it’s operating within. On the Dash network, for example, Masternodes process anonymous transactions without queues.

For a list of Masternodes, information about returns on investment, and more, see masternodes.online.

Staking

Staking is another way to passively earn with crypto, and can be done on networks that use the proof-of-stake (PoS) consensus algorithm. This is an alternative to resource-intensive mining, where rewards are not issued in return for complex calculations using powerful technology but for the “storage” of coins. You don’t need to purchase expensive equipment in order to make money by staking and can instead set aside a certain number of native tokens of the network you’re trying to earn money on, either in your wallet or on a special platform.

A fairly large initial outlay is usually required for staking. On the Ethereum network, for example, you need to stake 32 ETH (almost $60,000 based on the exchange rate at the time of writing) in order to become a validator. Most ETH stakers, therefore, join staking pools via centralized/decentralized exchanges and automated market makers.

Members of pools on networks using the proof-of-work (PoW) algorithm are known as miners, while PoS pool members are called forgers.

Income levels from staking depend on the number of locked coins and the period of storage of the crypto assets.

Crypto lending

This method of generating a passive income is similar to a bank deposit. You lend your funds directly through P2P platforms or via an intermediary (a decentralized lending platform or a centralized exchange) with an interest rate.

This means your crypto assets work on your behalf, and the intermediary (if you lend using one) guarantees the fulfillment of all the conditions of the transaction, meaning that you don’t need to trade on the market and risk your savings in order to receive income. In exchange for providing guarantees, the platform takes a certain percentage of your profits.

A list of crypto lending platforms can be found on defillama.com, in the “Lending” column.

Farming

Another popular way to earn passive income in crypto is farming/yield farming. Crypto is stored in a liquidity pool, and in exchange, you receive LP tokens (liquidity provider tokens), which you can also use to earn additional income by staking them.

A liquidity pool is a collection of tokens locked in a smart contract. They are used to facilitate decentralized trading, lending, and other functions.

If you want to buy a certain amount of crypto – ETH for USDT, for example – you don't need to wait until someone wants to sell the amount of ETH you need in exchange for USDT. The funds will be taken from the liquidity pool, and the exchange will be executed instantly.

A pair of cryptocurrencies is placed in the liquidity pool. Users who add pairs to the pool are called liquidity providers (LPs). The remuneration for providing liquidity is calculated as a percentage of the commissions on transactions conducted via the pool, paid in the native coin of the network (for example, UNI tokens on Uniswap) and calculated based on the LP’s share of the total volume of liquidity.

Coins can be farmed on 1inch, PancakeSwap, Uniswap, Curve Finance and many other decentralized platforms. You can view the level of profitability of different pools on coinmarketcap.com or on the platform where you are planning to farm.

Liquidity mining

Liquidity mining is very similar to farming, and it also involves adding liquidity to a pool. The difference is that you earn a percentage of the commission rather than LP tokens.

Income can be made both on centralized exchanges and on DeFi platforms. In the first case, incomes will be lower, since liquidity pools for most coins have long been established on well-known CEXs, and competition among investors is very high. On long-standing DeFi platforms, it’s essentially the same story. Earning opportunities are higher with new projects (recently launched exchanges and special exchangers), where the early investors always receive large percentages from liquidity mining. You should however be careful not to fall for scammers or projects that have no potential and are likely to shut down quickly.

Crypto funds

Investing in cryptocurrency funds can provide a good solution for those who want to make money with crypto, but have no experience with it.

Crypto funds are organizations that provide private investors with crypto trading and investing services.

When using a crypto fund, all risks are negotiated in advance, and investors can avoid the worries associated with trading crypto assets independently and without the sufficient skills and knowledge.

When selecting a fund, the following factors should be considered:

- the project’s popularity, history and reputation;

- openness with regard to documentation;

- earning strategies and service costs.

Another thing to bear in mind is the fact that crypto funds backed by professional financiers and traders aren’t a guarantee of success either. Cryptocurrencies are very volatile assets, so no one can guarantee you a 100% profit.

Dividends

Some crypto projects pay dividends to holders of their cryptocurrencies. This encourages users to hold tokens and continue supporting the projects. The model is similar to paying dividends to shareholders in traditional finance. The level of income is based on the number of assets acquired and is between 3% and 10% on average. As a rule, the crypto must be stored on the project’s official crypto wallet. Projects offering dividends include NEO, KuCoin, Komodo and Neblio.

Guilds

Earning money via GameFi takes a lot of time, because you have to play a lot in order to earn money. Joining a guild, however, is a completely different matter, as they generate passive income.

Guilds are platforms that allow investors and gamers to collaborate. The former invest money and other assets in projects, while the latter use them to earn money in games. The profits are shared between investors, players, and often other intermediaries, such as managers who create educational materials for gamers.

There are a number of famous guilds, including Yield Guild Games (YGG), Good Games Guild (GGG) and Merit Circle.

Partner programmes

Some crypto projects offer rewards for bringing in new users. These can take the form of referral programs, affiliate links, etc.

If you’re active on social media and have a lot of subscribers, then these programmes can provide a good source of additional income. It is worth remembering, however, that there are many fraudulent schemes and low-quality projects on the cryptocurrency market, so before recommending a specific project to somebody, you should to look at it in depth to make sure that you aren’t implicating anybody in a scam.

A tiny bit of self-promotion: Tangem offers partnership and referral programmes too.

NFTs

This method of generating passive income involves the creation, purchase and resale of NFTs. The first thing you need to know about NFTs, however, is that in many cases they are essentially a lottery.

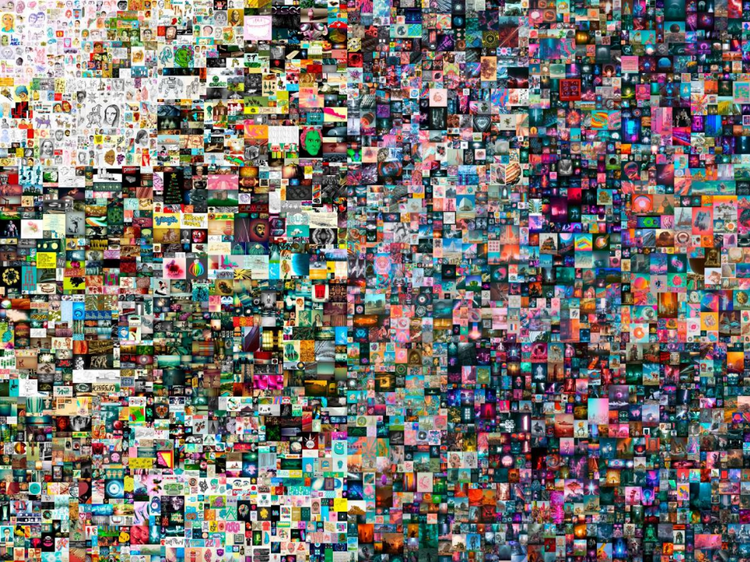

There is the possibility that you create or buy something really valuable and sell it for a lot of money. The painting Everydays: the First 5000 Days by artist Mike Winkelmann (aka Beeple) was sold as an NFT, bringing its creator a record $69.3 million.

Cases like this, however, are rare. You could spend a lot of money on an NFT and lose it all. The well-known youtuber Logan Paul is somebody who likes to invest in NFTs (in 2021 he bought 4,500 NFTs for a total of $2.6 million). He purchased Azuki’s Bumblebee NFT for $623,000, and by 2022 its price had collapsed to $10.

This isn’t the only unsuccessful investment made by Paul. In August 2021, he purchased Genesis Rocks #65 and #68 for a total of $155,000. Token #65 has since been valued at $25.

Conclusion

There are many ways to earn passive income in the crypto industry. Some of them are worth investing in and some are not. There are risky options and not so risky ones. Ultimately, it’s your choice. The main thing is approaching everything with caution and not expecting easy money. Unfortunately, the analogy of cheese in a mousetrap has its mirror image in crypto.