What is Ravencoin?

We recently added RVN, the native coin of the Ravencoin ecosystem, to our wallet. For those of you who might be wondering what we’re talking about, we’ll try to explain what it is and how Ravencoin differs from other crypto projects.

So, let’s get started. Ravencoin is a fork of Bitcoin that uses the proof-of-work blockchain consensus algorithm. Its core principle has been described by its creators as follows: “Ravencoin is a blockchain and platform optimized for transferring assets, such as tokens, from one holder to another”. While it might seem as though this description could be applied to numerous projects, the key phrase here is “transferring assets”.

Many blockchains, starting with Bitcoin, were originally conceived as an alternative to fiat money. It quickly became clear, however, that the blockchain served as an excellent tool for tokenization. Nevertheless, neither Bitcoin nor Ethereum – which uses smart contracts – were designed to support people holding "auxiliary” assets, and their developers don’t see this as an important aspect of their respective ecosystems.

Ravencoin’s creators have claimed that, despite the level of development in the industry, the tools currently in place only allow users to easily interact with cryptocurrencies, when in fact the blockchain makes it possible to tokenize anything. They had the idea of creating a system that would let people to create their own tokens and exchange them without needless contortions.

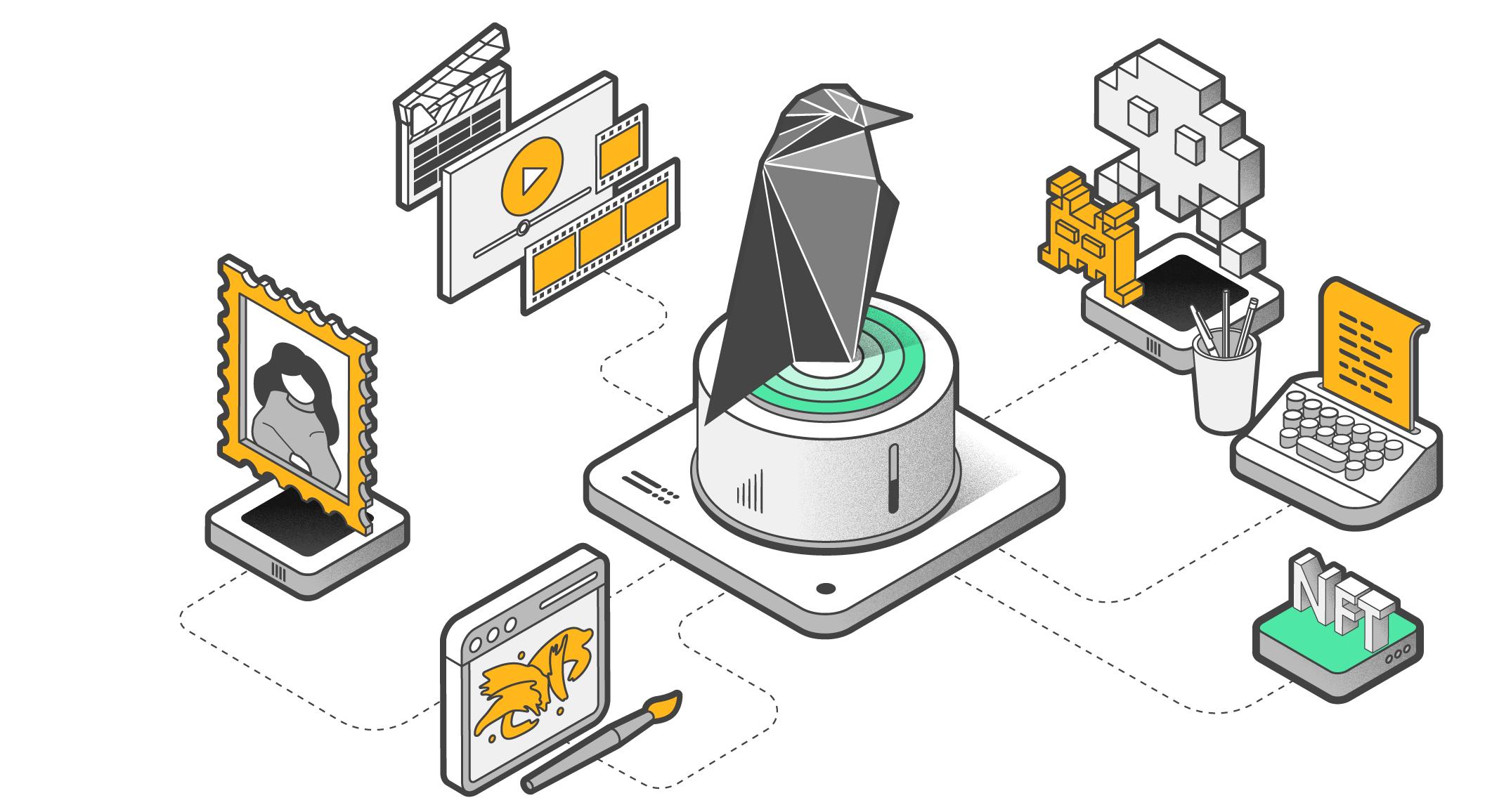

Put more simply, you can create a digital token that will grant ownership over any real asset: a share in real estate, a painting, or a precious gem. You can create digital assets that represent any service, virtual items in games, and more. What’s more, there’s nothing stopping people from launching their own cryptocurrency based on Ravencoin that could be used for settlements within a given community. You can also create NFTs using Ravencoin, of course, including via the RVN wallet platform MangoFarmAssets.

Unlike other crypto projects, you don’t need to know how to create a smart contract in order to create your own token. All you need to do is install the official wallet, click on the “Create asset” button and enter the parameters of the future asset. The cost to mint your own uniquely named asset is 500 RVN, which at the time of this writing is about USD $10. When your tokens are minted, those RVN are burned.

How it all works

As we mentioned earlier, this project is a fork of Bitcoin and the basic principles of how it operates are the same. According to the creators, however, Bitcoin has one significant drawback: as BTC grew in price, mining first switched to graphics processing units (GPUs), then field-programmable gate arrays (FPGAs), and finally application-specific integrated circuits (ASICs), which are specially designed for mining. As a result, mining on other equipment became unprofitable and a gradual centralization of the network began to be observed, with computing power becoming concentrated among the owners of large mining farms and pools.

This is why the creators of Ravencoin made the KAWPOW hashing algorithm one of its key features. KAWPOW hinders the use of ASICs in Ravencoin mining, helping to make the process fairer. Developing an ASIC that could mine Ravencoin is not only difficult, but also (as a result of the developer’s policy) makes no sense. All you’d need to do is change the protocol and the device would be about as useful as a chocolate teapot.

Another difference between Ravencoin and its parent is speed. With the former, the block size is over 2 MB and blocks are mined once per minute. The blockchain can process around 116 transactions per second.

The project’s native coin is RVN. For each block mined, the miner receives a reward of 2,500 RVN. To create your own token, you need to burn a given number of coins. By the way, the popularity of RVN grew just after its hard fork and subsequent transition to KAWPOW, when ASIC miners departed the network. Another increase in popularity occurred after the transition of Ethereum to proof-of-stake, as miners who were previously mining ETH migrated their capacities to work with Ravencoin.

What else can it do?

It’s worth thinking about the developer’s approach here. From the very beginning of the project, they have adhered to a highly democratic policy on the distribution of tokens and are fairly consistent when it comes to issues around centralization: at the launch (in 2018) there was no ICO, no pre-mining, no private sales and no distribution of coins to project participants. In 2020, the Ravencoin Foundation was created in order to gain independence from Medici Ventures, which funded the project at the start.

Who uses it?

In theory, of course, the project is great. Without real-world examples of how Ravencoin is used, however, we can’t get the full picture. Below are a few projects whose creators are harnessing the power of this blockchain to tokenize physical assets.

Tokenized wine

The creators of the Vinsent Wine platform decided to try a new approach to distribution in the wine industry and offer customers the chance to try rare wines by linking them directly with wineries. As shops are removed from the supply chain, prices are lowered and customers can order wine at the time of harvest, before it’s bottled. Tokenization ensures a transparent process and, in combination with a system of special barcodes (Laava Smart Fingerprints) unique to each item, allows you to be sure that you’re receiving exactly what you ordered.

…and water

Do you remember us telling you at the very beginning of this article that anything can be tokenized? What about water? The WETx project offers a solution for simplifying transactions involving water resources. Its creators decided to build an alternative to the complicated process of transferring water rights – a pressing issue for the Western United States. With WETx, you can make fast and secure transactions, confirm ownership history and more.

…and art

The blockchain also supports the minting of NFTs of course. Ravencoin even has its own platform for this, RVNFT. There are several other projects offering a variety of tokens related to art. UnWoke Funding, for example, helps independent filmmakers with crowdfunding and offers fans the change to purchase tokenized film scripts, props and access to exclusive content.