What is a Cold Wallet?

AI summary

Cold wallets, which store cryptocurrency private keys offline, offer enhanced security against online threats compared to hot wallets but can be less convenient and require careful handling to avoid physical loss or damage. The article explains different types of cold wallets—paper, sound, and hardware—with hardware wallets being the most secure and user-friendly option. It highlights the Tangem Wallet as a modern cold wallet solution, combining strong security with ease of use and durability.

"Not your keys, not your coins." This means that if you don't have custody of your private keys, you don't control the assets associated with the wallet. With the value of cryptocurrency rising, you must find a reliable way to control your keys and store them securely.

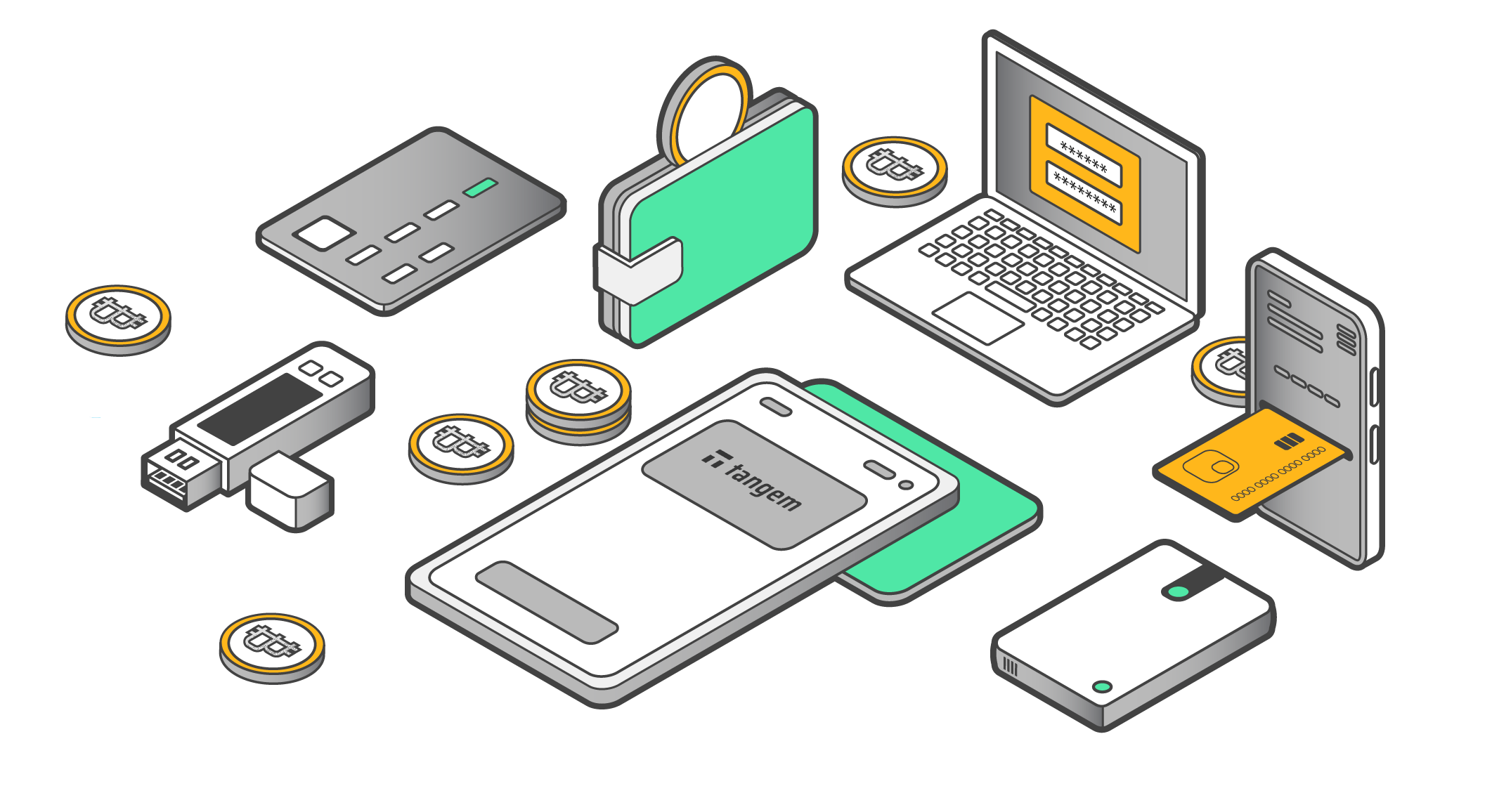

The terms 'cold crypto wallet' and 'hardware wallet' are often used interchangeably, but this is not quite right. Cold wallets can take different forms, and not all are hardware wallets. To understand this better, let's first look at what a cold crypto wallet does.

What is a cold wallet?

Cold wallets are crypto wallets that store private keys offline, making them immune to online attacks. The most common type is the hardware wallet. Getting a cold crypto wallet is a great idea for protecting your valuable crypto assets. Its security measures keep your keys offline and defend you from on-chain threats.

Types of cold wallets

While they keep your private keys offline, you should consider their differences in terms of accessibility.

Paper wallets

One option for storing cryptocurrency is using paper wallets with private keys printed on them, often in the form of a QR code. Users can use the paper wallet address to transact with their cryptocurrency, sending and receiving as needed.

While this method keeps your keys offline, paper wallets can be easily damaged or lost, and since they don't use secret recovery phrases, you cannot recover your keys if this happens.

In addition, transferring cryptocurrency from a paper wallet can be challenging. To import it into a software wallet, you must connect to the internet, compromising your keys' privacy and security.

Moreover, if your paper wallet ends up in the wrong hands, your assets could be lost forever since the private keys are all an attacker needs to access your account.

Sound wallets

Storing private keys on sound wallets is more durable than paper wallets since they save private keys as audio files. However, sound wallets still have their weaknesses, as they are still susceptible to physical damage. Losing access to your accounts because of a scratched CD that stores private keys is not ideal.

Additionally, sound wallets can be expensive to maintain because they need specific tools to decode private keys, like a spectroscope application. This complexity makes it inaccessible to beginners and average users.

Hardware wallets

A hardware wallet is a safe and convenient way to keep your private keys offline. These physical devices, which look like smartcards or USB sticks, can be connected to your smartphone or computer using apps, allowing you to access your assets efficiently.

The hardware wallet's firmware generates cryptographic signatures inside the device using the private key. When a transaction is created, it is sent to the wallet, which signs it locally without exposing the private key. Hardware wallets often have an NFC, USB, or Bluetooth interface for communicating with a computer or smartphone. However, this connection does not transmit sensitive information (like the private key).

Many hardware wallets use dedicated secure elements, which are tamper-resistant chips that protect private keys from physical and software attacks. Cold wallets use seed phrases (typically 12-24 words) to back up private keys. This phrase can restore a wallet if the device is lost or damaged.

Hardware wallets are the safest and most reliable cold wallets. Learn more about hardware wallets here.

How does a cold wallet work?

Private keys are generated offline through a computer or hardware random number generator, completely disconnected from any network (an air-gapped machine). Open-source software like BitAddress or MyEtherWallet can be used to generate these keys. The generated private keys are stored in the chip or in physical form (often a printed QR code or alphanumeric string).

Learn more about public and private keys.

Access to cold storage is tightly controlled to prevent unauthorized access. Cold wallets use various types of access control systems to ensure the security of private keys and restrict unauthorized access.

These systems include PIN codes, access codes, passphrases, recovery phrases, biometric authentication, multisig authentication, 2FA integration, and more.

When a transaction is required, the private key is retrieved from cold storage to sign the transaction offline. This offline signing process adds an extra layer of security by preventing exposure to online threats. Once signed, the transaction can be broadcast to the network using an internet-connected device, ensuring seamless and secure asset management.

How to use a cold wallet?

A cold wallet is an excellent option for securing Bitcoin and other cryptocurrencies. Check out this detailed guide to setting up and using a cold wallet.

Buy a hardware wallet.

You can purchase a hardware wallet from an online retailer using your credit card or from nearby stores to get started. At Tangem, you can buy a hardware wallet with fiat and cryptocurrencies, including BTC, ETH, USDT, USDC, XRP, APE, SOL, TRX, MATIC, ADA, ALGO, LTC, Doge, BCH, Shiba Inu, and DAI. Here's what you should know before buying a Tangem hardware wallet.

Set up your wallet

Once you've purchased the wallet, the next step is to set it up by following the instructions. During the setup process, you'll need to create an access code. Write the seed phrase on a reliable surface and keep it in a secure location.

Import cryptocurrency

Once your hardware wallet is set up, you can import cryptocurrency by accessing the wallet's interface either through a desktop or mobile application provided by the manufacturer.

Next, you'll need to navigate to the section of the wallet app that allows you to import funds. This usually involves adding/enabling some tokens and networks. Then, select "receive" or "add funds" in the wallet interface.

Here, the wallet will generate a unique receiving address, which you will use to transfer your cryptocurrency from its current storage location, such as an exchange or another wallet.

Transfer cryptocurrency from the source to this address after getting the receiving address from your hardware wallet.

You can also import cryptocurrencies using a seed phrase.

Differences between a cold wallet and a hot wallet

Hot wallets store their keys online, while cold wallets store them offline. The debate between hot and cold wallets is widespread, with each having its own preference for different reasons. Let's look at the various aspects that differentiate the two types of wallets.

Security

Cold wallets are considered more secure than hot wallets because they aren't connected to any online server and aren't prone to hacking and other risks. In contrast, hot wallets store the private key online, making them vulnerable to attacks. Some hot wallets—like exchange wallets—are also custodial, leaving users with little control over their assets.

User experience

Hot wallets are more convenient than cold wallets for moving assets around, as they often don't require extra steps for signing transactions. Using a cold wallet may require more technical knowledge, but it's a crucial step in securing your assets.

Compatibility

Regarding capacity, people prefer hot wallets because they support many networks and tokens, including anonymous cryptocurrencies. Integrating a new network or token into a cold wallet takes time, so most cold wallets don't support every cryptocurrency.

Learn more about the differences between hot and cold wallets here.

What are the pros and cons of crypto cold wallets?

Cryptocurrency cold wallets offer several advantages and disadvantages:

Pros of cold wallets

- Cold wallets store private keys offline, making them immune to online hacking and cyber threats. This significantly reduces the risk of unauthorized access and theft.

- Users have full control over their private keys and funds stored in cold wallets. You don't have to rely on third-party services for greater autonomy and security.

- Cold wallets are ideal for the long-term storage of cryptocurrencies. They offer a secure and reliable way to hold large amounts of digital assets for extended periods without constant monitoring.

- Storing cryptocurrencies in cold wallets mitigates the risk of losing funds in case of a cryptocurrency exchange hack or insolvency. Funds stored offline are not affected by exchange-related issues.

Cons of cold wallets

- Accessing funds stored in cold wallets for transactions might require manual intervention, as private keys must be retrieved from offline storage. This can be less convenient than hot wallets, especially for frequent traders.

- Cold wallets, particularly hardware wallets and paper wallets, are susceptible to physical damage, loss, or theft. If you don't properly back them up or store your recovery seed properly, you might lose access to your funds permanently.

- Setting up a cold wallet, especially a hardware wallet, may involve a learning curve. Users need to follow specific instructions for initialization, seed phrase generation, and safe storage of the wallet device.

- Hardware wallets, one of the most popular cold wallets, come with a cost. While the investment in a hardware wallet is often justified by its enhanced security, it can deter some users, especially those with smaller cryptocurrency holdings.

Conclusion

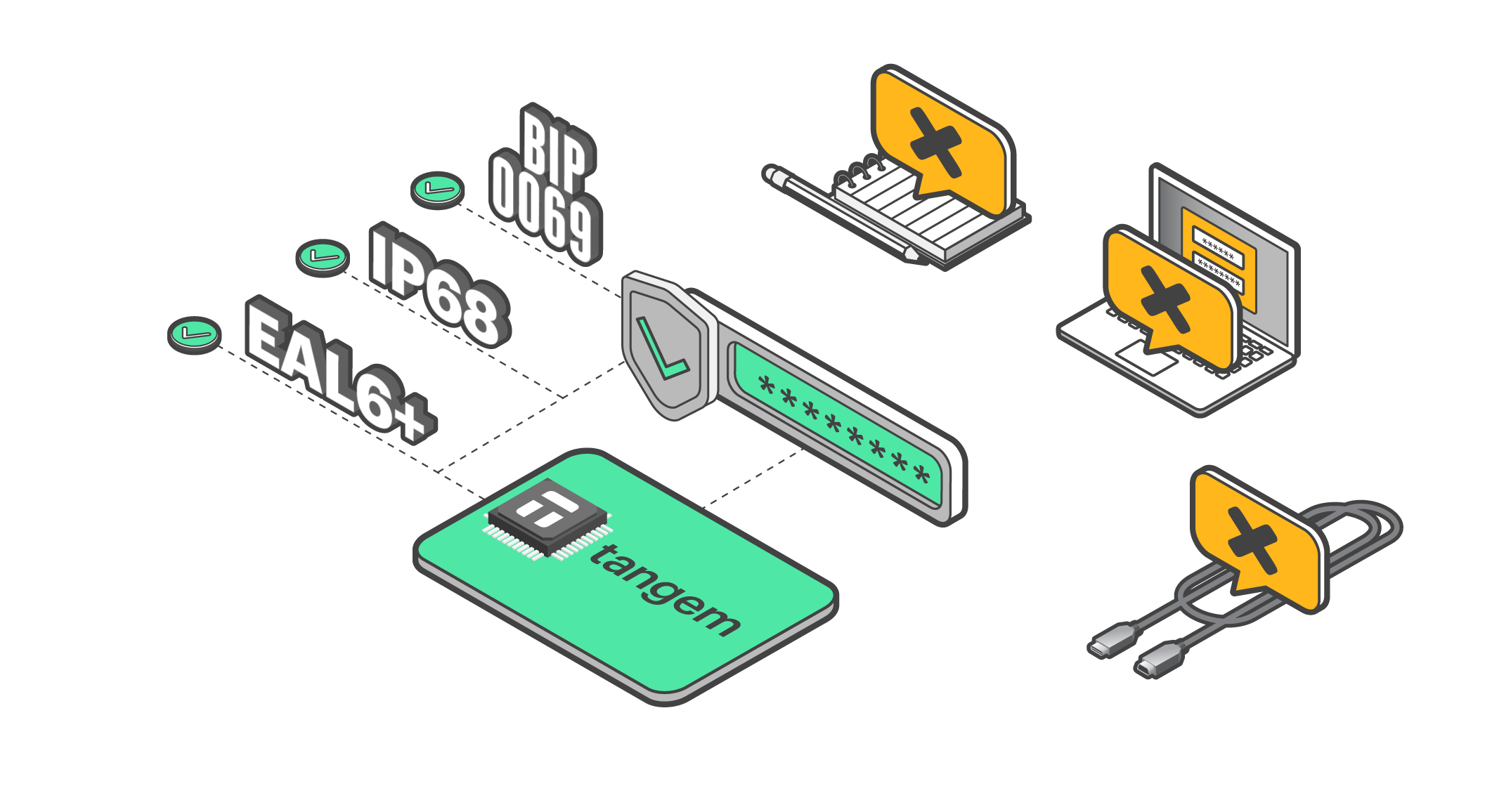

The Tangem Wallet is an optimal cold wallet solution that effectively mitigates the limitations of traditional cold wallets. It provides a user-friendly interface that simplifies accessing and managing funds stored offline. Its intuitive design and seamless integration with mobile devices offer convenient access to cryptocurrency holdings without compromising security.

Tangem Wallets—Tangem Ring and Tangem cards—are made from monolithic materials, making them highly durable and resistant to physical tampering. This ensures secure storage of private keys and access to funds without worrying about damage or loss.

FAQs about cold wallets

1. What is a cold wallet?

A cold wallet, or cold storage wallet, is a secure method of storing cryptocurrencies offline. It involves keeping the private keys of your digital assets offline, away from internet-connected devices, and reducing the risk of unauthorized access by hackers.

2. How does a cold wallet differ from a hot wallet?

Cold wallets differ from hot wallets primarily in their connectivity to the internet. Hot wallets are connected to the internet, allowing for easier access and transactions, while cold wallets remain offline, providing enhanced security by reducing exposure to online threats.

3. What are the advantages of using a cold wallet?

Cold wallets offer several advantages, including enhanced security, protection against cyber threats, and control over private keys. They are more secure than a bank account.

4. How can I set up a cold wallet?

Setting up a cold wallet involves the following steps:

Choose a reputable cold wallet provider. Here's a guide on choosing a cold crypto wallet to buy.

Generate your private keys. To generate your private keys securely. Follow the instructions provided by the wallet provider to generate your private keys.

Create backups and recovery: Back up your private keys and implement a recovery plan in case your cold wallet is lost or damaged.

5. Can I use a cold wallet for all types of cryptocurrencies?

Yes, most cold wallets support many cryptocurrencies, including popular ones like Bitcoin, Ethereum, Litecoin, etc. However, checking compatibility with specific cryptocurrencies is essential before choosing a cold wallet solution.

6. What precautions should I take when using a cold wallet?

To maximize security when using a cold wallet, consider the following precautions:

- Keep your private keys secure: Store your private keys in a safe and inaccessible location to prevent unauthorized access.

- Regularly update your wallet software: Keep your cold wallet software updated with the latest security patches and updates

- Verify transactions carefully: Double-check transaction details before confirming them to avoid potential errors or fraudulent activities.

Discover more tips on using a cold storage wallet.

7. Can I transfer funds between cold and hot wallets?

Yes, it is possible to transfer funds between a cold wallet and a hot wallet. However, following recommended security practices and ensuring that both wallets are properly secured is essential to minimize the risk of unauthorized access or loss of funds during the transfer process.

8. Is Tangem a cold wallet?

The Tangem Wallet is a cold wallet, designed to be as simple, reliable, and secure as possible.