Soft Fork vs Hard Fork: Definition, Differences, and Real-World Examples

AI summary

The article explains the concepts of hard forks and soft forks in blockchain networks like Bitcoin and Ethereum. Hard forks involve major, non-backward-compatible changes that can split a blockchain into separate networks and potentially create new cryptocurrencies, while soft forks are backward-compatible upgrades that maintain network unity. The article also discusses the risks and reasons for forks, provides notable historical examples, and compares the key differences between the two types of protocol changes.

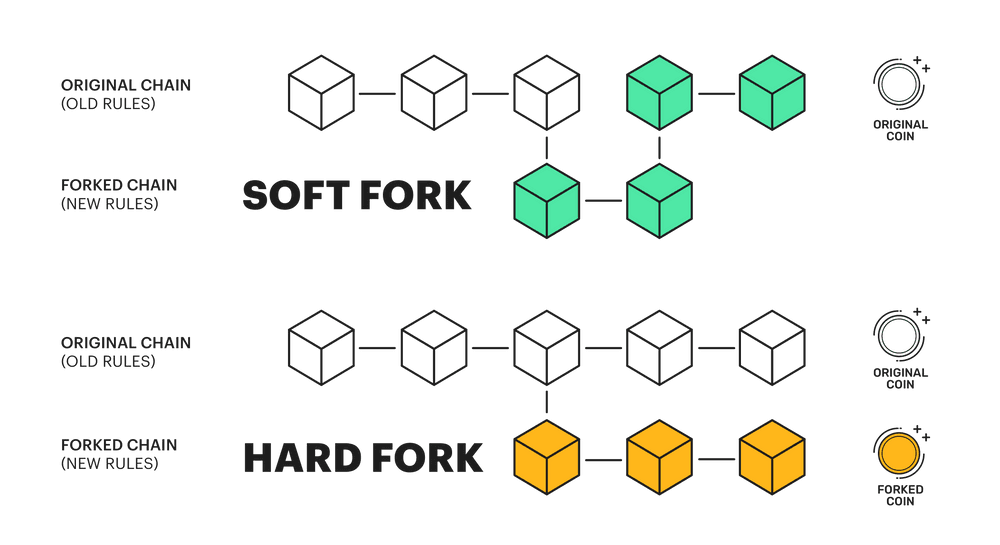

Cryptocurrencies like Bitcoin and Ethereum run on decentralized, open-source blockchains governed by protocols that define how nodes create, validate, and add blocks. When developers or the community change these rules, a fork occurs, requiring node operators to update their software to stay aligned with the latest version. Since every node stores the whole blockchain and checks new transactions against historical rules, any change to those rules affects how the network operates. Forks fall into two main categories: hard forks, which introduce changes that break compatibility with older versions, and soft forks, which update the protocol while maintaining backward compatibility.

What Is a Hard Fork?

A hard fork introduces a significant change to the blockchain’s core rules. This update is not backward compatible, meaning older nodes cannot validate blocks created under the new regulations. When consensus breaks, the blockchain can split into two independent networks.

Teams often use hard forks to:

- Launch a new cryptocurrency

- Add significant features

- Modify tokenomics

- Reverse or alter questionable transactions

- Patch critical security issues

Because a hard fork can divide miners, validators, and users, it carries risk. Splits can weaken the network, making it more vulnerable to attacks.

Hard Forks and 51% Attacks

A 51% attack happens when a miner or group gains most of the network’s hashing power, allowing them to reorganize the chain and potentially double-spend funds. Networks created through hard forks sometimes face these attacks if they inherit lower security or fragmented mining power.

Replay Attacks

Some hard forks lack replay protection. When this occurs, a valid transaction on one chain can be duplicated on the other, enabling malicious actors to transfer funds without authorization.

Why Do Hard Forks Happen?

Hard forks occur for several reasons:

- New Features: Major upgrades often require rewriting substantial portions of the blockchain software.

- Security Fixes: Developers may hard fork to patch vulnerabilities that could endanger user funds.

- Community Disputes: If developers, validators, or users disagree on the network’s future, the blockchain may split.

- Transaction Reversals: In rare cases, teams may use a hard fork to roll back a major exploit, as happened with the 2016 DAO hack.

Accidental Hard Forks

Unintentional hard forks occur more often than many realize. Two miners may discover valid blocks at nearly the exact moment, temporarily splitting the chain. The network resolves this naturally by following the longer chain. No transactions are lost, but one miner’s reward is invalidated. Coding errors can also cause short-lived forks. For example, in 2013, specific Bitcoin nodes failed to process a large block, which temporarily split the chain; however, developers quickly resolved the issue.

Participants in a Hard Fork

Hard forks require broad community participation. The process usually involves:

- Proposal and discussion

- Code development

- Testing

- Validator and miner support

If validators refuse to adopt the update, the network will be unable to function under the new rules. Decentralization ensures that protocol changes occur only with community agreement.

Blockchains Created Through Hard Forks

When consensus breaks down, competing rule sets survive independently. Well-known hard-fork-derived networks include:

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

- Bitcoin Gold (BTG)

- Bitcoin Diamond (BTCD)

- Bitcoin SV (BSV)

What Is a Soft Fork?

A soft fork is a backward-compatible upgrade. Nodes running the older version still recognize the blocks created under the new rules. This type of fork is less disruptive because it does not split the network in half. Only some nodes must upgrade for a soft fork to be activated.

Soft forks are used to:

- Improve network efficiency

- Lower transaction fees

- Enhance privacy

- Strengthen security

- Add minor features

Soft forks modify behavior but leave the blockchain. They don’t create new coins or separate networks.

Famous Soft Forks

- SegWit (Bitcoin): Increased the adequate block size and improved scalability

- Pay-to-Script-Hash (P2SH): Changed Bitcoin address format

- Replace-by-Fee (Litecoin): Allowed fee adjustments on pending transactions.

Hard Fork vs Soft Fork: Key Differences

Feature | Hard Fork | Soft Fork |

Compatibility | Not backward compatible | Backward compatible |

Risk of Chain Split | High | Low |

Creation of New Coins | Possible | No |

Node Upgrade Requirements | All validators must update | Only some nodes must update |

Nature of Change | Major protocol changes | Minor rule changes |

Analogy | Switching to a brand-new operating system | Updating your current operating system |

A helpful comparison is thinking about updating your phone. A soft fork is similar to updating the operating system while all your apps continue to run normally. A hard fork is like switching to an entirely new OS that older apps can’t recognize.

Notable Hard Fork Examples

1. Bitcoin Cash and SegWit2x

SegWit2x attempted to scale Bitcoin by doubling its block size. The proposal, developed behind closed doors and without the involvement of Bitcoin Core developers, divided the community.

Opponents argued:

- Larger blocks could centralize the network

- The process lacked transparent governance

- Replay protection was inadequate

Supporters wanted:

- Lower fees

- Higher transaction throughput

On August 1, 2017, a group of larger-block advocates created Bitcoin Cash, starting with an 8 MB block size, and later expanded it to 32 MB. BCH remains a separate blockchain with its own supporters and philosophy. This event sparked the creation of multiple Bitcoin-based forks, including BTG and BTCD.

2. The 2016 DAO Hack and the Birth of Ethereum Classic

The DAO raised $150 million in ETH, making it one of the earliest large-scale experiments in decentralized governance. After a code exploit drained $60 million worth of ETH, the Ethereum community split over how to respond.

The community initially proposed a soft fork to freeze the stolen funds; however, the attacker threatened legal consequences and tried to influence the miners. The community eventually opted for a hard fork that reverted the chain to a point before the hack. Those who opposed altering blockchain history continued to use the original chain, now known as Ethereum Classic (ETC).

3. Bitcoin Cash Hash Wars: ABC vs SV

In 2018, Bitcoin Cash itself split into:

- Bitcoin Cash ABC (BCHA)

- Bitcoin Cash SV (BSV)

Disputes over technical direction triggered the split. BCHA sought incremental improvements, while BSV pushed for massive block size increases. Both sides fought for the BCH ticker by accumulating hashing power. Exchanges eventually recognized Bitcoin Cash ABC as the official BCH chain, while the other network became BSV.

FAQ: Hard Forks and Soft Forks

What triggers a blockchain fork?

Forks happen when developers or community members change a blockchain’s rules. If the change is backward compatible, it becomes a soft fork. If not, it becomes a hard fork.

Do hard forks always result in the creation of new cryptocurrencies?

No. Hard forks only create new coins when both chains continue independently. Some hard forks simply upgrade the network without leaving a split.

Are soft forks safer than hard forks?

Generally yes. Soft forks maintain compatibility and keep the network unified, reducing the risk of attacks or user confusion.

Can you lose funds during a fork?

Direct loss is rare, but poorly handled hard forks can expose users to replay attacks or network instability.

Who decides whether a blockchain should undergo a hard fork?

Developers propose changes, but miners, validators, exchanges, and the broader community must support them. Decentralized networks require broad consensus.

What’s the main difference between a fork and an update?

A fork is a specific type of update. Soft forks function like traditional software upgrades, while hard forks create new rule sets that may diverge into separate blockchains.

Why do Bitcoin and Ethereum have so many forks?

Both networks are open-source and widely used. Disagreements among developers or scaling challenges often lead to competing visions and new protocol versions.