Lending & borrowing are the foundational pillars reshaping traditional banking paradigms in decentralized finance (DeFi). The rise of DeFi has increased blockchain implementation in financial services development and raised large sums of capital for individuals and businesses alike.

However, grasping this DeFi lending often means going through terms that can confuse even the most experienced web3 participants. In this article, we'll explain how DeFi lending works and the risks involved when using lending platforms.

What is DeFi lending?

DeFi lending is a financial system that operates on blockchain technology, removing the need for traditional intermediaries like banks. It allows people to borrow and lend cryptocurrencies directly to one another in a peer-to-peer manner.

Unlike traditional lending, which relies on credit scores and extensive paperwork, DeFi lending uses smart contracts to automate lending agreements, making it more accessible and efficient for users worldwide.

Smart contracts are self-executing contracts with the terms of the agreement directly written into computer code, ensuring transparency and automation.

Borrowers can provide collateral in cryptocurrencies, which are locked in a smart contract. At the same time, lenders supply the funds, earning interest in return.

The loan terms and interest rates are determined by demand and supply dynamics within the DeFi platform, offering users a decentralized, borderless, and inclusive financial system.

How does defi lending work?

DeFi lending fundamentally transforms the way traditional lending works. Users (lenders) deposit their cryptocurrency into a lending pool. This pool is then used to provide loans to other users (borrowers).

The interest rates on these loans are much higher than traditional loans, making them attractive to lenders. However, the risk is higher because borrowers could default on their loans due to the market's volatility and lose their collateral.

Components of DeFi lending

- Smart contracts:

Smart contracts are self-executing contracts that contain the terms of the agreement directly written into code. In DeFi lending, smart contracts automate the borrowing and lending process, ensuring transparency and trust.

- Protocols:

DeFi lending platforms are built on specific blockchain protocols. Famous examples include Compound, Aave, and MakerDAO. These protocols set the rules, interest rates, collateral requirements, and other parameters for lending and borrowing.

- Liquidity providers:

Liquidity providers or lenders are users who supply their cryptocurrency assets to the lending platform. By doing so, they earn interest on their deposits. This process is similar to depositing money into a savings account.

- Borrowers:

Borrowers are users who want to access funds. They provide collateral (usually in the form of cryptocurrency) to secure their loans. This collateral is held in escrow by the smart contract.

- Collateralization:

DeFi lending platforms implement a collateralization ratio — the minimum amount of collateral required to borrow a certain amount of assets. For instance, a 150% collateralization ratio means a borrower must provide collateral worth 1.5 times the borrowed amount.

- Interest rates and yield:

Borrowers pay interest on the amount they borrow. Interest rates are dynamic and can change based on the loan demand and available liquidity.

- Lending yield:

Liquidity providers earn yield (interest) for providing their assets. This yield is often a share of the interest paid by borrowers.

- Liquidation:

If the collateral's value falls below a certain threshold (as defined by the collateralization ratio), the smart contract may automatically liquidate the collateral to repay the lender. This ensures that lenders are protected from severe losses.

- Flash loans:

Flash loans are a unique attribute of DeFi lending platforms. They allow borrowers to borrow large amounts without providing collateral if the borrowed assets are returned within the same transaction block. This attribute facilitates rapid arbitrage and other trading strategies.

- Governance tokens:

Some DeFi lending platforms have their own native tokens. These tokens often allow holders to participate in the platform's governance, including decisions on interest rates, collateral types, and protocol upgrades.

How does DeFi lending differ from traditional lending?

Borrowing, lending, margin, and spot trading are all available through the traditional financial system. The DeFi ecosystem, on the other hand, has evolved and can now provide comparable financial services.

One significant distinction between DeFi and traditional lending is that conventional banking involves time-consuming processes and continuous checks on a customer's status. DeFi grants loans more quickly if the individual meets all collateral requirements.

The smart contracts handle the entire review process, making things more painless for both the borrower and the lender. When compared to traditional lending markets, DeFi lending typically provides higher returns.

How DeFi lending benefits users

DeFi lending primarily encourages participants to contribute funds by depositing them at higher interest than traditional banks. There are other advantages to DeFi lending over the conventional lending system, including:

- Better accountability

The Blockchain is an immutable public ledger that can provide on-demand records of all DeFi loans and the policies and rules that guide those loans. When a DeFi loan is granted, the public distributed ledger primarily serves as proof of all financial transactions.

- Lending analytics

A fully digital lending process helps users assess and monitor the borrowing and lending market. In addition, data from analytics can be used to optimize funds. It also enables various DeFi lending platforms to gain insights into loan sources, which can help them improve loan performance.

- Faster loan approvals

DeFi loans are processed quickly, and the loan amount is available immediately after approval. These loans are processed relatively faster because DeFi lending platforms are powered by cloud services that aid in the detection of fraud and other DeFi lending risks.

- Permissionless access

Anyone with a DeFi crypto loan wallet has permissionless and open access to decentralized lending. Regardless of geographical location, anyone can easily access the DeFi apps built on blockchain networks.

- Interoperability

The interoperable software stack ensures that the DeFi lending protocols complement and integrate. Furthermore, smart contracts are highly programmable, allowing for the creation of more financial instruments and digital assets.

Disadvantages and risks of defi lending

While innovative and potentially lucrative, DeFi lending has its fair share of disadvantages and risks. Here are some of the key considerations:

- Smart contract vulnerabilities:

DeFi lending platforms operate on smart contracts. If there are vulnerabilities or bugs in the code, it can lead to exploits and the loss of funds.

- Scalability:

DeFi lending may face difficulties in maintaining scalability for the host blockchain. Transactions require more time for confirmation during congestion periods and become slightly more expensive. Overall, this harms scalability.

- Market volatility:

The cryptocurrency market is known for its high volatility. The value of collateral can fluctuate significantly, potentially leading to liquidation if it falls below the required threshold.

Borrowers may face situations where they need to repay the loan or provide additional collateral quickly, which can be challenging during extreme market volatility.

- Impermanent loss:

Impermanent loss can occur when the price of the assets in the liquidity pool changes. This can lead to lower returns for liquidity providers compared to simply holding the assets. Lenders may not always earn as much as they expect. In some cases, they could even experience a net loss.

- Over-liquidation:

Over-collateralization—while essential for risk management—can sometimes lead to a situation where borrowers' assets are liquidated even if the value hasn't dropped significantly. Borrowers could lose a significant portion of their collateral, especially in cases of sudden market downturns.

- Regulatory uncertainty:

The DeFi space is still relatively new, and regulations are evolving. There's uncertainty about how governments will regulate DeFi lending platforms. In addition, changes in the regulatory landscape can affect how DeFi platforms operate, and users might face challenges in compliance.

- Lack of consumer protection

DeFi platforms operate without the same level of consumer protection provided by traditional financial institutions. Therefore, users have limited alternatives to recover their assets in cases of fraud or platform failure.

- Platform risks

Not all DeFi platforms are created equal. Some may lack proper auditing transparency or have untested governance mechanisms. Users may inadvertently choose a less secure or unreliable platform, putting their funds at risk.

You must thoroughly research, understand the associated risks, and use best practices for security. Diversifying your assets and using well-audited platforms can help mitigate some risks.

Popular DeFi projects

Let's take a quick look at some popular DeFi platforms.

Aave

Aave stands out in the DeFi lending space through its innovative approach to liquidity provision and user-centric qualities. One of its groundbreaking features is the introduction of flash loans, allowing users to borrow large sums of money without collateral as long as they repay it within the same transaction blocks.

Aave also provides a diverse range of interest rates calculated algorithmically based on supply and demand. Furthermore, it uses a new interest rate model that dynamically adjusts rates to maintain equilibrium between borrowers and lenders, improving efficiency and fairness in the lending ecosystem.

Uniswap

Uniswap has an innovative approach to liquidity provision by operating as an automated decentralized exchange (DEX) using liquidity pools. These pools allow users to swap various cryptocurrencies seamlessly without relying on order books.

What sets Uniswap apart is its permissionless nature, enabling anyone to create a liquidity pool and contribute assets, democratizing access to DeFi. Moreover, it uses an automated market maker (AMM) model, ensuring constant liquidity, even for less commonly traded assets.

MakerDAO (MKR)

MakerDAO uses a decentralized autonomous organization (DAO) model, which allows MKR token holders to collectively govern platform parameters such as stability fees and collateral types. This ensures high transparency and community-driven decision-making.

In addition, MakerDAO pioneered the concept of generating the DAI stablecoin via overcollateralized loans, which aids in its stability even in volatile markets. This mechanism ensures that DAI remains softly pegged to the US dollar, providing a trustworthy store of value. MakerDAO also supports various collateral assets, which benefits risk diversification and platform resilience.

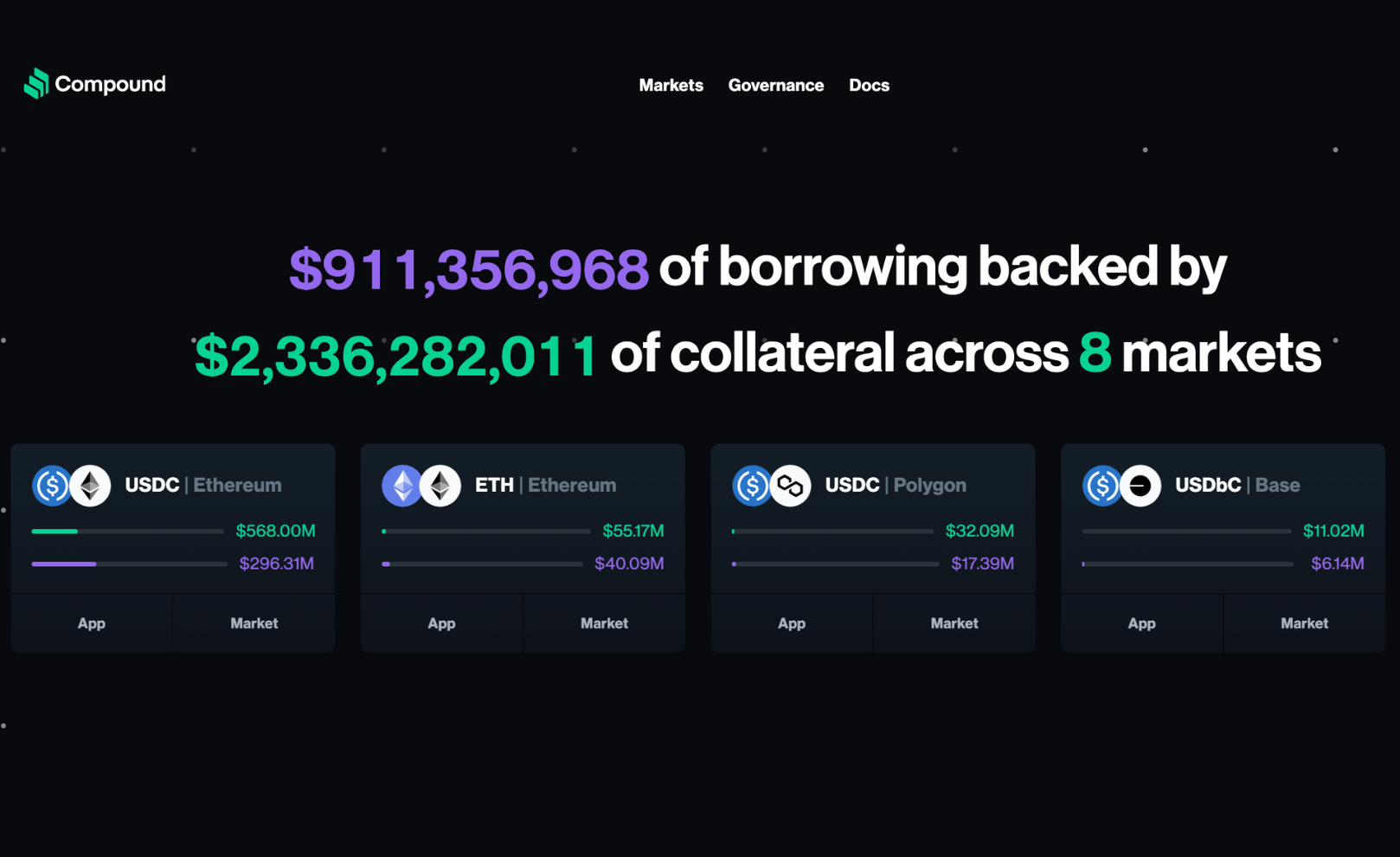

Compound

Compound Finance is a popular DeFi lending platform based on the Ethereum blockchain. Compound's algorithmically determined interest rates, which adjust dynamically based on supply and demand for each supported asset, are one of its distinguishing features.

This keeps interest rates competitive and responsive to market conditions. Furthermore, the governance token COMP enables users to participate in decision-making by influencing parameters such as interest rates and collateral factors.

Curve Finance

Unlike other decentralized exchanges, Curve is designed specifically for low slippage and efficient swapping of stablecoins such as DAI, USDC, USDT, and others. Curve's automated market-making (AMM) algorithm is one of its distinguishing features, focusing on providing low-risk, low-return opportunities for liquidity providers. This distinguishes it because it caters to users who want to maximize capital efficiency while minimizing market volatility.

What is the Future of DeFi Lending?

Several DeFi-based projects are gaining traction as more investors invest in cutting-edge financial technologies. Flash loans are becoming more popular. However, these loans are more susceptible to suspicious and fraudulent activities. Despite technological advances, DeFi loan processing continues to fall behind in security. The current decentralized financial system is experimental, new, and has flaws, particularly in scalability and security. But Tangem remains optimistic that the best is yet to come.

Comprehensive DeFi Lending FAQs

What is DeFi lending?

DeFi lending, short for decentralized finance lending, is a financial system built on blockchain technology that allows individuals to lend and borrow cryptocurrency assets without relying on traditional financial intermediaries like banks.

How does lending work in DeFi?

DeFi lending operates through smart contracts on blockchain platforms. Users can either lend their cryptocurrency assets and earn interest or borrow assets by providing collateral in the form of other cryptocurrencies.

What is the advantage of using DeFi lending over traditional lending? DeFi lending offers greater accessibility, faster transaction processing, reduced reliance on centralized institutions, and potentially higher interest rates compared to traditional lending.

What is over-collateralization in DeFi lending?

Over-collateralization is a risk management strategy in DeFi lending where borrowers must provide more collateral than the value of the loan they seek. This provides a safety net for lenders in case the value of the collateral drops.

What is impermanent loss in DeFi lending?

Impermanent loss occurs in liquidity-providing activities in DeFi, particularly in automated market makers. It's the temporary loss of funds due to price fluctuations when providing liquidity, compared to simply holding the assets.

What are flash loans in DeFi lending?

Flash loans are uncollateralized loans that must be borrowed and repaid within a single transaction block. They are typically used for specific purposes like arbitrage opportunities and require a fee to be paid if the loan is successful.

What are the risks of DeFi lending?

Risks include smart contract vulnerabilities, market volatility leading to collateral liquidation, impermanent loss for liquidity providers, potential regulatory changes, user error in managing private keys, and platform risks if using less reputable services.

How are interest rates determined in DeFi lending?

Interest rates in DeFi lending are influenced by supply and demand dynamics on lending platforms. They can be determined algorithmically, and they tend to be higher due to the risks associated with cryptocurrency volatility.

What happens if a borrower defaults in DeFi lending?

If a borrower defaults, the collateral provided by the borrower is used to repay the lender. This process is automated through smart contracts and ensures that lenders are protected.

How can I choose a reputable DeFi lending platform?

You should conduct thorough research, look for platforms with a history of successful operation, check for audits of their smart contracts, assess the community's trust and feedback, and consider the platform's compliance with relevant regulations.

Can I lose all my assets in DeFi lending?

While DeFi lending offers opportunities for earning interest, it's important to remember that risks are involved. Due diligence, diversification, and understanding the risks associated with each platform are crucial to minimize potential losses.

Is DeFi lending regulated?

DeFi lending operates in a relatively unregulated space, providing innovation opportunities. However, users should be aware that regulations in the space may change, and they should always be mindful of compliance with relevant laws.

What are DeFi lending borrowing protocols?

DeFi lending borrowing protocols are sets of smart contracts and rules that govern lending and borrowing activities on decentralized platforms. They facilitate interactions between lenders and borrowers while ensuring security and transparency.

How do DeFi lending protocols make money?

DeFi lending protocols generate revenue primarily through interest fees charged on loans. They also often have their own native tokens, which can be used for governance, staking, or other value-capture mechanisms.

How does a DeFi loan get liquidated?

A DeFi loan gets liquidated when the value of the collateral falls below a certain threshold, known as the liquidation ratio. This triggers an automated process where the collateral is sold to repay the loan, protecting the lender's investment.

What is the risk of liquidation in DeFi?

The risk of liquidation in DeFi arises from market volatility. Suppose the value of the collateral drops significantly. In that case, borrowers may face liquidation, potentially resulting in losing a portion of their assets.

Is DeFi borrowing taxable?

Taxation of DeFi borrowing varies by jurisdiction. In many countries, borrowing itself is not a taxable event. However, interest earned on borrowed assets may be subject to taxation.

Why do people borrow in DeFi?

People borrow in DeFi for various reasons, including leveraging their existing holdings for additional investments, participating in yield farming, arbitrage opportunities, or accessing liquidity without selling their crypto assets.

What is the largest DeFi lending protocol? Aave and Compound are among the largest DeFi lending protocols.

What is the difference between DeFi and CeFi lending?

DeFi lending operates on blockchain platforms without reliance on traditional financial intermediaries. CeFi (Centralized Finance) lending involves traditional banks or financial institutions as intermediaries in lending and borrowing activities.

What is the difference between DeFi lending and traditional lending? DeFi lending is decentralized, using smart contracts for lending and borrowing activities. Traditional lending involves centralized institutions like banks that facilitate loans based on their terms and conditions.

What are the classifications of risks in DeFi?

Risks in DeFi can be classified into smart contract, market, regulatory, operational, and governance risks, among others.

What are the threats of DeFi?

Threats in DeFi include smart contract vulnerabilities, potential exploits, market manipulation, regulatory crackdowns, and the risk of user error.

Who is a liquidator in DeFi? A liquidator in DeFi is a participant responsible for executing the liquidation process. They buy undercollateralized assets from a borrower at a discounted price to repay the lender and maintain the stability of the lending platform.

Final thoughts

DeFi lending leverages blockchain technology and smart contracts to create a trustless, automated, transparent lending ecosystem. It offers borrowers and liquidity providers opportunities to earn interest and access funds in a decentralized manner.

However, you should be aware of the associated risks and stay updated with the latest developments in the DeFi space.

More reading