Crypto Exchange vs Crypto Wallet: What's the Difference?

AI summary

The article explains the key differences between crypto exchanges and crypto wallets, emphasizing that exchanges are platforms for buying, selling, and trading cryptocurrencies, while wallets are tools for securely storing and managing digital assets. It outlines various types of exchanges and wallets, noting that wallets—especially hardware wallets—offer greater security and control over private keys compared to exchanges. The article concludes by recommending that users store long-term holdings in secure wallets and use exchanges primarily for trading activities.

One Bitcoin surpassed the US$100,000 mark, and traditional institutions are exposed to crypto via ETFs. The Trump administration promises to boost the crypto industry by aiding regulatory clarity and passing pro-crypto capital gains tax legislation.

As expected, more people are searching for secure methods to buy, sell, store, and manage Bitcoin and other cryptocurrencies. Two fundamental tools in the cryptocurrency landscape are crypto exchanges and crypto wallets.

Although both are crucial, they have different purposes and functionalities. This article highlights the primary differences between a crypto exchange and a crypto wallet.

What is a crypto exchange?

A cryptocurrency exchange is a digital platform for buying, selling, and trading various cryptocurrencies. These exchanges function as intermediaries, facilitating transactions between buyers and sellers while charging fees for their services. Many crypto exchanges are on the market, each offering various features, supported cryptocurrencies, and fee structures.

Types of crypto exchanges

Here are the main types of crypto exchanges.

- Centralized Exchanges (CEXs)

Centralized exchanges are platforms operated by a company that acts as an intermediary between buyers and sellers. They manage order books, hold custody of users’ funds, and often require identity verification (KYC). CEXs are typically easy to use, highly liquid, and offer fast transactions, but they also introduce counterparty risk since users must trust the exchange with their funds. Examples include Binance, Coinbase, and Kraken.

- Decentralized Exchanges (DEXs)

Decentralized exchanges allow peer-to-peer trading directly on the blockchain without a central authority. Users maintain full control over their private keys, enhancing security and privacy. DEXs like Uniswap and PancakeSwap rely on smart contracts and automated market makers (AMMs) instead of traditional order books. While they offer more trustless trading, they can have lower liquidity and higher fees on some networks. - Instant Crypto Exchanges

Instant exchanges are non-custodial services that allow quick swaps between cryptocurrencies without requiring an account or storing funds. They aggregate liquidity from multiple platforms and find the best available rate for the user. ChangeHero is an example of an instant exchange—users can swap Bitcoin, Ethereum, or other altcoins directly, often with no sign-up required. ChangeHero is simpler and faster than both CEX and DEX. It’s non-custodial like a DEX but doesn’t require interacting with smart contracts. It also avoids the complexity and regulatory hurdles of a CEX while offering better rates via liquidity aggregation.

- Hybrid Exchanges

Hybrid exchanges combine features of both centralized and decentralized models. They aim to offer the liquidity and user experience of a CEX while allowing users to retain control of their private keys like on a DEX. Platforms like DeversiFi and Loopring are examples of hybrid exchanges that use layer-2 solutions to provide faster, cheaper, and more secure trading.

- Peer-to-Peer (P2P) Exchanges

P2P exchanges connect individual buyers and sellers directly, often using escrow services to ensure fair transactions. They are popular in regions with restricted access to global crypto markets. LocalBitcoins and Paxful are well-known examples. While they provide flexibility in payment methods and better privacy, they may require more trust between counterparties and have slower trade execution.

What is a crypto wallet?

A cryptocurrency wallet is a tool for securely storing, sending, swapping, and receiving cryptocurrencies. Crypto wallets do not keep coins; they store private keys linked to your digital assets. Private keys are essential since they allow you to access and manage cryptocurrencies and must always be secured.

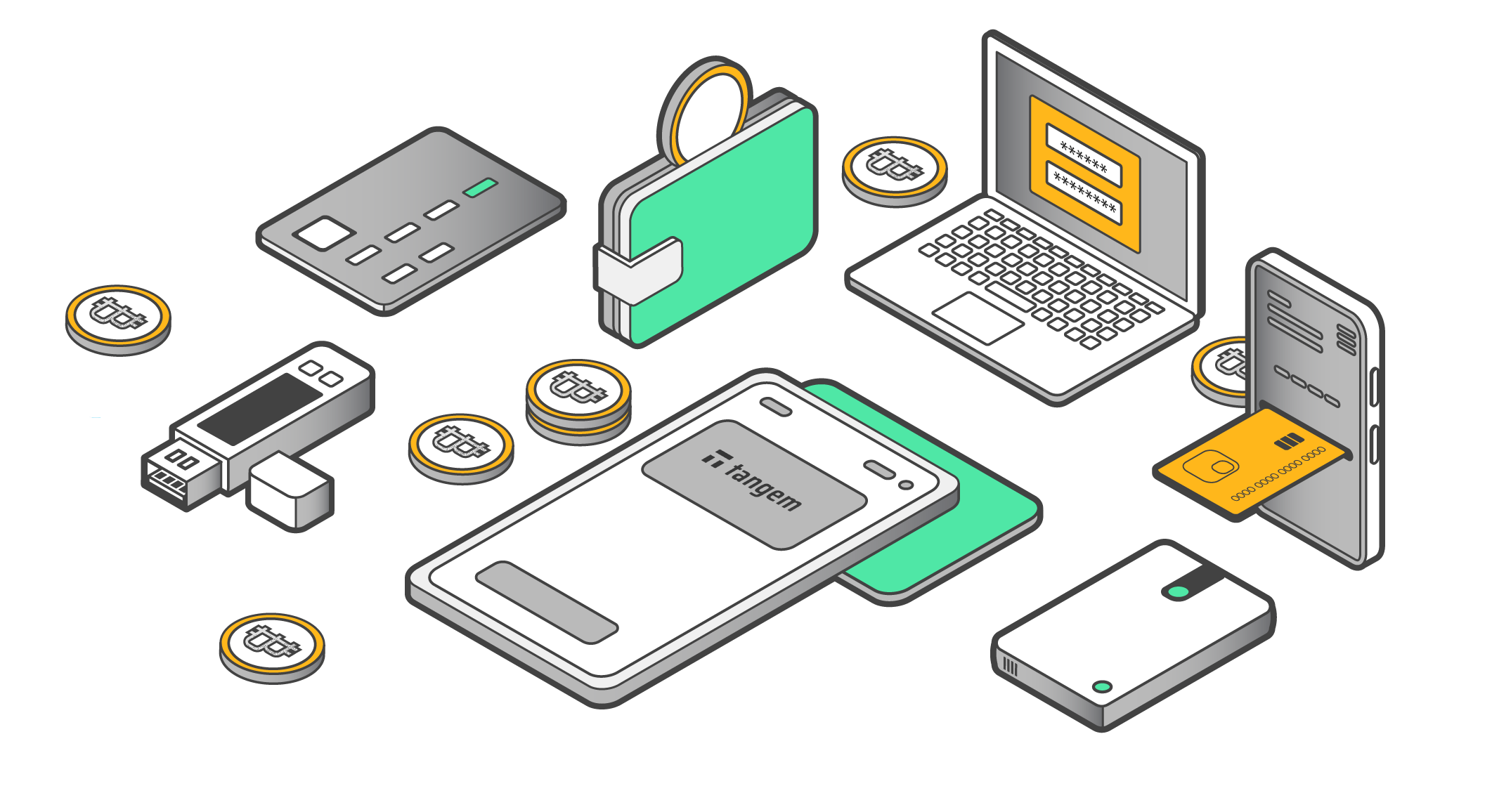

Types of crypto wallets

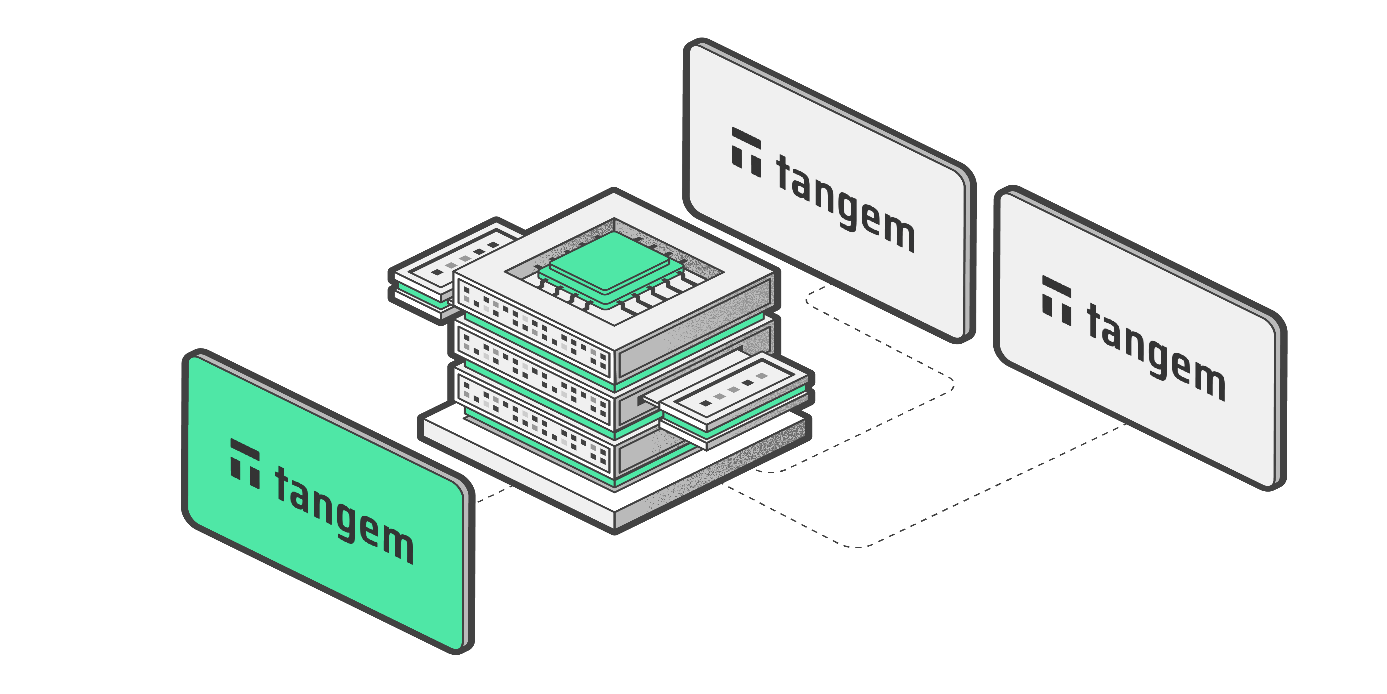

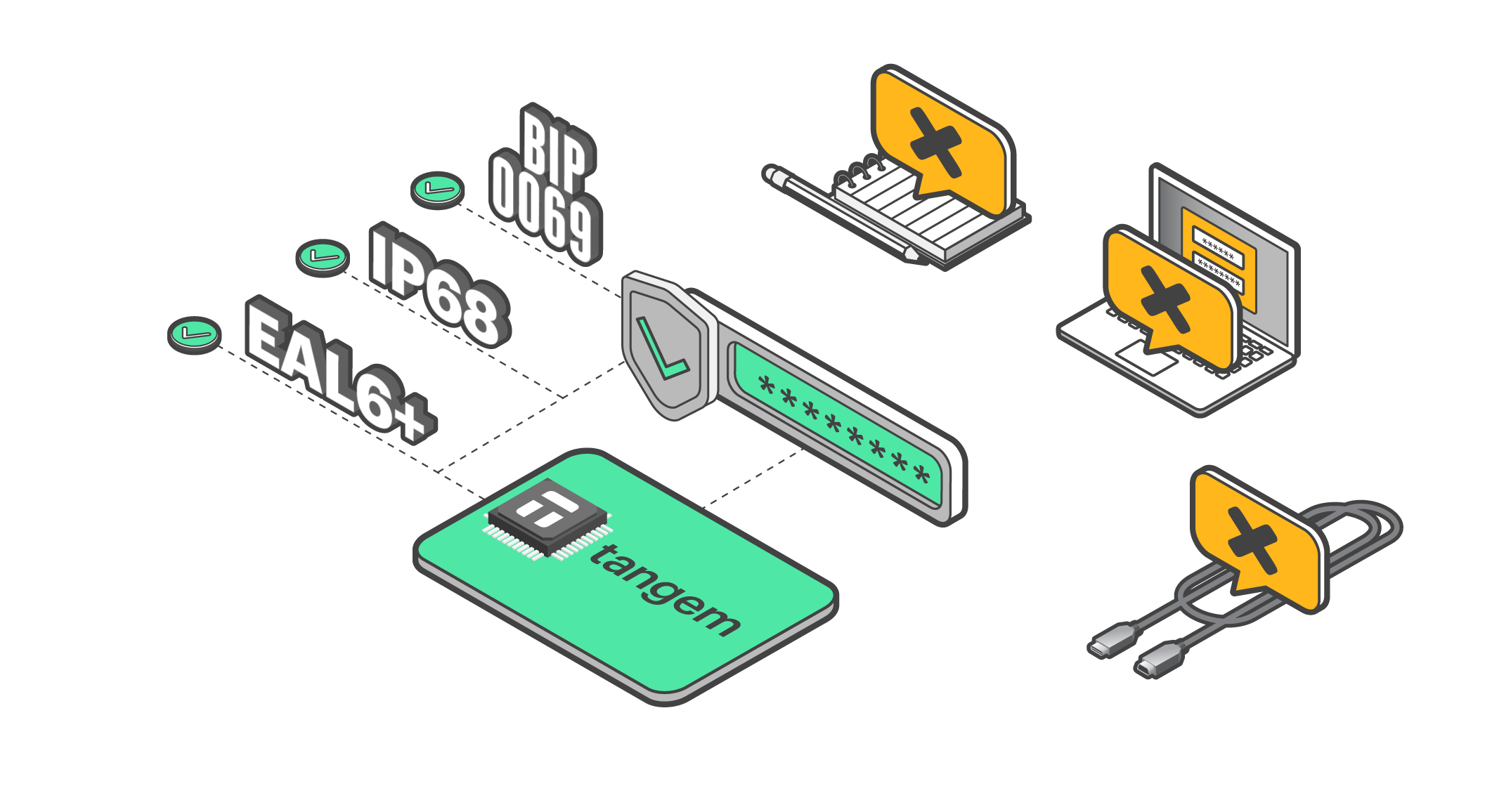

There are various cryptocurrency wallets, such as hardware and software. Hardware wallets, including Tangem and Ledger, are physical devices intended to securely keep private keys offline, providing better protection against hacking and theft.

You can install software wallets on a desktop or mobile device or as browser extensions; they all provide different levels of security.

When receiving crypto payments, you give the sender your wallet's public address. This address functions like a bank account number, allowing others to send funds to your wallet.

3 differences between a crypto wallet and a crypto exchange

Here are three key differences between a crypto wallet and a crypto exchange:

- Primary function

While crypto exchanges enable the buying, selling, and trading of cryptocurrencies, crypto wallets are meant to store and manage your assets securely.

- Security and risk

Regarding security, crypto wallets typically provide a greater level of protection than exchanges. Exchanges manage users' funds and private keys, exposing them to hacking and theft. Wallets, mainly hardware wallets, offer a more secure alternative since they allow you to keep your private keys offline, thus reducing the chances of unauthorized access.

- Ownership and control

Another significant difference between exchanges and wallets is the degree of control over funds. With a crypto wallet, you maintain complete control over your private keys and digital assets.

In contrast, using a centralized exchange involves trusting your funds to the platform. This might lead to complications if the exchange experiences downtime or a security breach.

Conclusion

Both crypto exchanges and wallets are crucial for crypto users. Exchanges enable you to buy, sell, and trade digital assets, while wallets offer a safe storage solution for managing these assets. When it comes to managing your cryptocurrencies, you can use both an exchange and a wallet that suits your individual needs and provides the necessary level of security and functionality.

As a general recommendation, you should keep your long-term cryptocurrency holdings in a secure wallet, preferably a hardware wallet. Exchanges, however, can be used for trading and converting your digital assets when necessary.

By understanding the key differences between crypto exchanges and wallets, you can make informed decisions about safely managing your cryptocurrency investments.