Bitcoin At $100K: Safest way to Buy, Sell, or Hodl Bitcoin

Bitcoin has hit the $100,000 mark, a big source of joy for most of us.

However, the industry has not changed much in terms of securing user assets. Let's review some figures.

Cryptocurrency thefts surged significantly In the first half of 2024, with hackers stealing approximately $1.38 billion by June 24. This figure is nearly double the $657 million stolen during the same period in 2023.

This spike was largely driven by a few large-scale incidents, including a $243 million heist that leveraged phishing and social engineering tactics.

Ransomware attacks also escalated, with a record $75 million in ransomware payments made in July 2024. Bitcoin ATM scammers stole $65 million in the year's first half.

These numbers prove that a phantom menace still plagues the crypto sector, and you must adopt stronger security measures and remain vigilant. Knowing how to securely buy, sell, and store your Bitcoin is essential.

Understanding Bitcoin ownership

When you buy Bitcoin with fiat currency like USD or Euros, you gain access to a unique pair of keys:

- Public key: Functions like a bank account number used to receive funds. You can share this to receive funds. Learn more about Bitcoin addresses here.

- Private key: This key can be a seed phrase of 12 or 24 words such as: reduce strategy reward burst gun castle album burger clap donate canoe black.

It could also be a 64-character hexadecimal key like this:

b474cbf6f6652057e81ece47a43eeb313205e0ed620d3df339ece61fd16966a78b795bd43fdb5f99b5ae122ae3353536a74b413387f5c7890c9a53878da02cdd

Under no circumstances should you give this key to anyone or leave it unguarded carelessly.

Bitcoin transactions are recorded on the blockchain, a highly secure system resistant to tampering. However, your wallet's private key is the weak link, making its storage crucial.

Types of Bitcoin storage

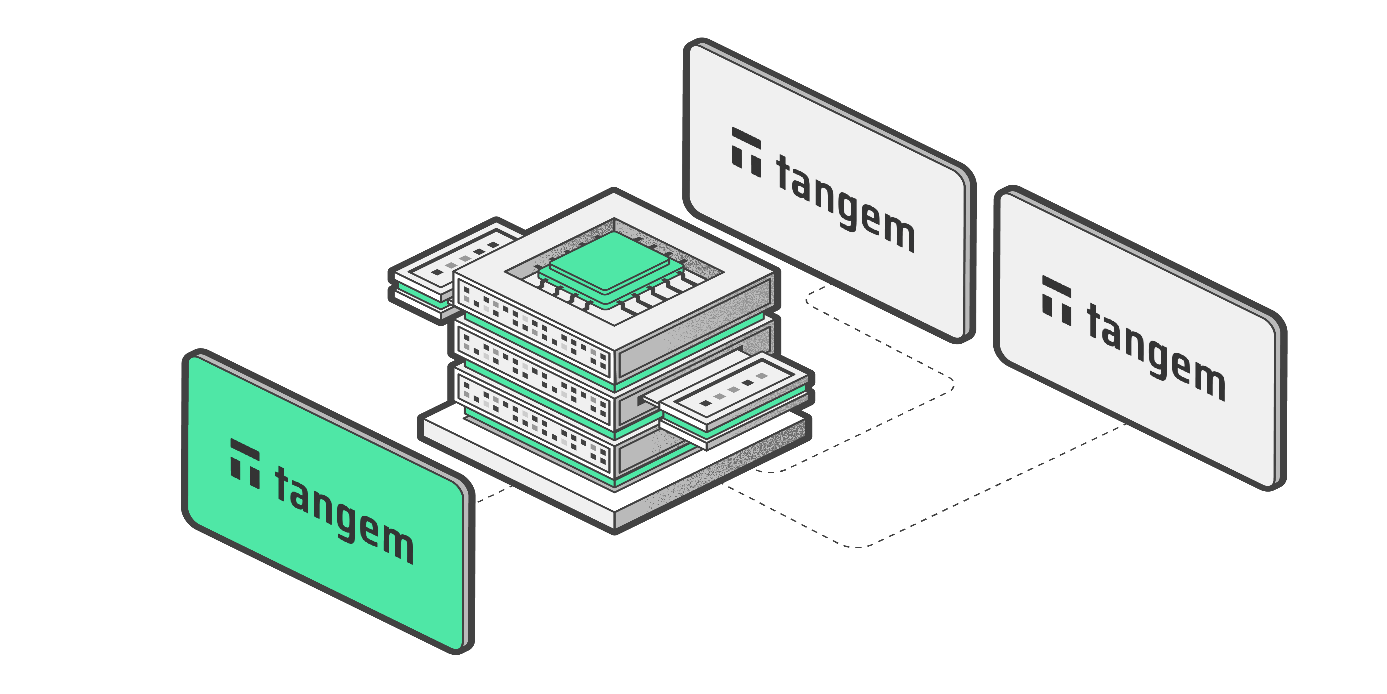

You can buy, sell, and hold Bitcoin on a cryptocurrency exchange or in a crypto wallet. All types of Bitcoin storage can be classified into custodial or non-custodial and as hot (internet-connected) or cold (offline).

Custodial wallets

These crypto wallets are managed by third parties like exchanges (e.g., Coinbase and Binance). They create and store your private keys. Unfortunately, despite enhanced security measures, these wallets can be targets for hackers. However, the greater threat and common occurrences are exchange downtime, random account locking and denial of access, and mismanaging users' funds.

Non-custodial wallets

Non-custodial or self-custody wallets allow you to create and control your own private keys, offering more independence, security, and reliability. Depending on connectivity, they're available as hot or cold wallets.

Hot wallets are internet-connected software wallets. They're quite convenient but vulnerable to hacking. Cold wallets are offline wallets, including hardware wallets and other solutions. They are the safest option for storing your Bitcoin.

How to Buy and sell Bitcoin securely

Start by buying Bitcoin on a reputable exchange with strong security features, such as two-factor authentication (2FA). Once you’ve bought Bitcoin, transfer it to your cold wallet immediately to reduce exposure to potential exchange vulnerabilities.

Always double-check the wallet address before sending funds to avoid mistakes.

When selling Bitcoin, transfer only the amount you plan to sell from your cold wallet to a hot wallet or directly to the exchange. Combining the security of a cold wallet and the flexibility of exchanges can help you minimize risks while buying or selling Bitcoin.

In Tangem's cold wallet, you can buy and sell Bitcoin directly via integrated third-party providers such as Mecuryo and MoonPay. Pay with your credit card, apple Pay, Google Pay, and more.

This saves you the hassle of dealing with a centralised exchange especially when large sums are involved.

What are your safest Bitcoin storage options?

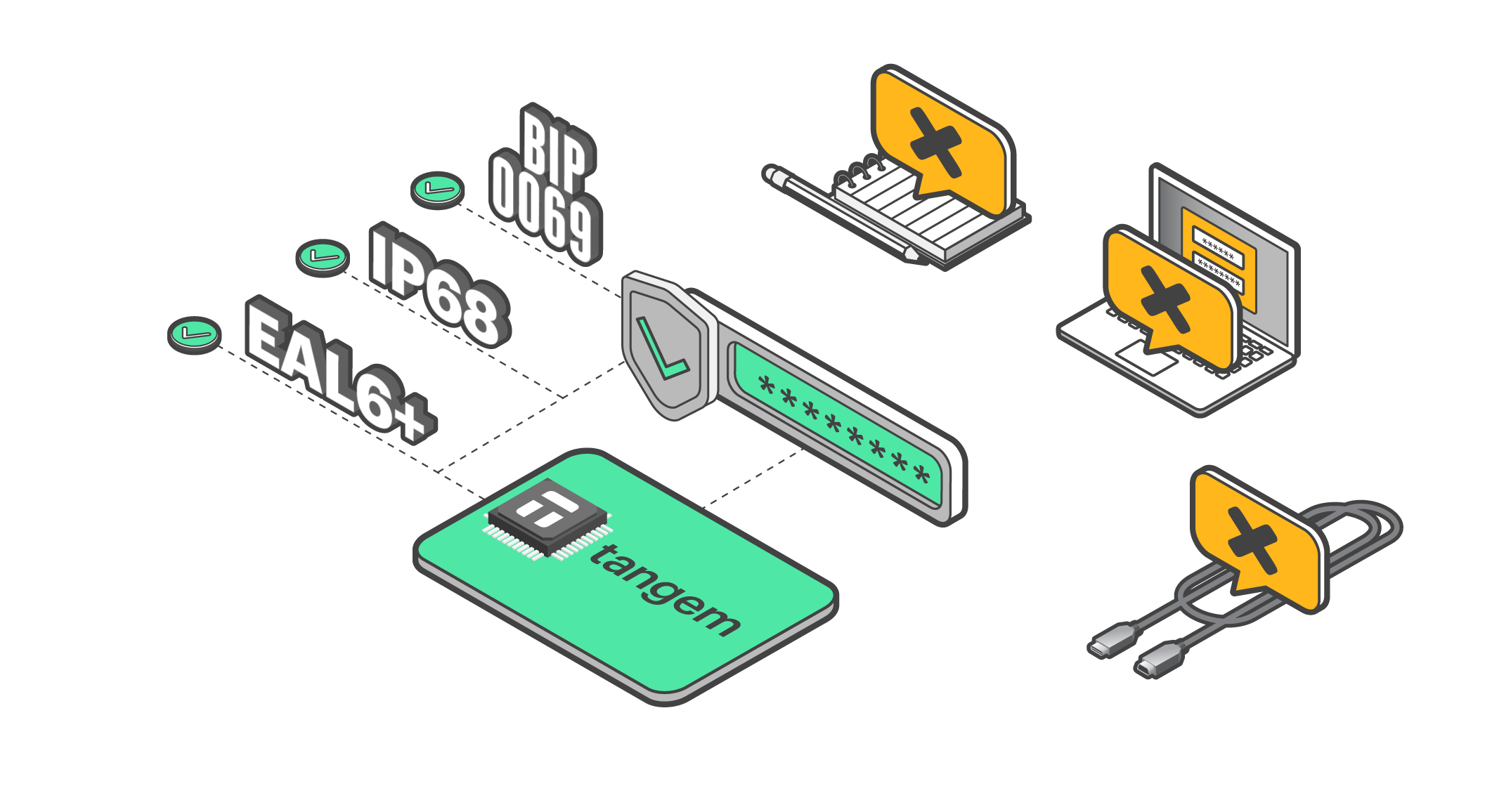

Crypto wallets like the Tangem Wallet always store your private keys, even when you sign transactions with them. Thus, the risks associated with these wallets are often minimal.

Paper wallets are another secure option. In these, private keys are printed on paper and stored safely. But good luck keeping that paper safe from disaster or ink fading.

How can I check if a non-custodial wallet is trustworthy?

To check if a non-custodial wallet is trustworthy, start by reviewing the company behind it. Look at its reputation in the crypto industry.

Trusted wallets often have an open-source codebase, which allows independent experts to review their security. Positive user reviews, endorsements, and long-standing reliability also indicate trustworthiness.

Examine the wallet’s features and security measures. Reliable non-custodial wallets provide secure encryption, backup options like seed phrases, and strong authentication methods.

Finally, check if the wallet supports regular software updates, which are essential to fixing vulnerabilities and improving functionality.

Additional security tips

- Back up your wallet.

- Store backups on multiple secure devices and encrypt them with strong passwords.

- Ensure your wallet and device software are up to date to protect against vulnerabilities.

- Protect your seed phrase. Store it securely, away from prying eyes. Consider metal storage for durability.

FAQ

Is Bitcoin safe from hackers?

Bitcoin's blockchain is highly secure and has not been hacked. However, there are vulnerabilities in crypto exchanges and hot wallets, making them potential cyberattack targets.

Investing in a Bitcoin ETF provides exposure to Bitcoin's price movements without directly holding the cryptocurrency, offering a regulated and convenient investment avenue.

The safest way to buy Bitcoin is through reputable centralized exchanges that offer robust security measures, including two-factor authentication and insurance against breaches.

Storing cryptocurrency offline can be achieved using cold storage solutions like hardware wallets, which keep private keys disconnected from the internet, thereby reducing hacking risks.

To make money investing in Bitcoin, consider strategies such as long-term holding, trading, or earning interest through lending platforms, each carrying its own risk profile.

Bitcoin can be a secure method for transferring money, especially for international remittances, due to its decentralized nature and lower transaction fees compared to traditional banking systems.

As of December 3, 2024, Bitcoin is trading at approximately $95,480 USD, reflecting its characteristic volatility and the importance of staying updated on market trends.