¿Qué es un puente cross-chain y por qué es necesario en cripto?

- AI summary

- ¿Qué es un puente cross-chain?

- ¿Por qué son esenciales los puentes cross-chain?

- ¿Cómo funcionan los puentes cross-chain?

- El papel de los smart contracts y oráculos

- Tipos de puentes cross-chain

- Principales puentes en 2026

- Uso seguro con Tangem Wallet

- Futuro de la tecnología cross-chain

- Conclusión

AI summary

El artículo explica la importancia de los puentes cross-chain, que permiten transferir activos y datos entre distintas blockchains, resolviendo problemas de fragmentación y mejorando la interoperabilidad en el ecosistema cripto. Describe sus tipos (descentralizados, centralizados e híbridos), ventajas, riesgos y la relevancia de la seguridad. Concluye que, usados con precaución, los puentes cross-chain son esenciales para un futuro multicadena más conectado y eficiente.

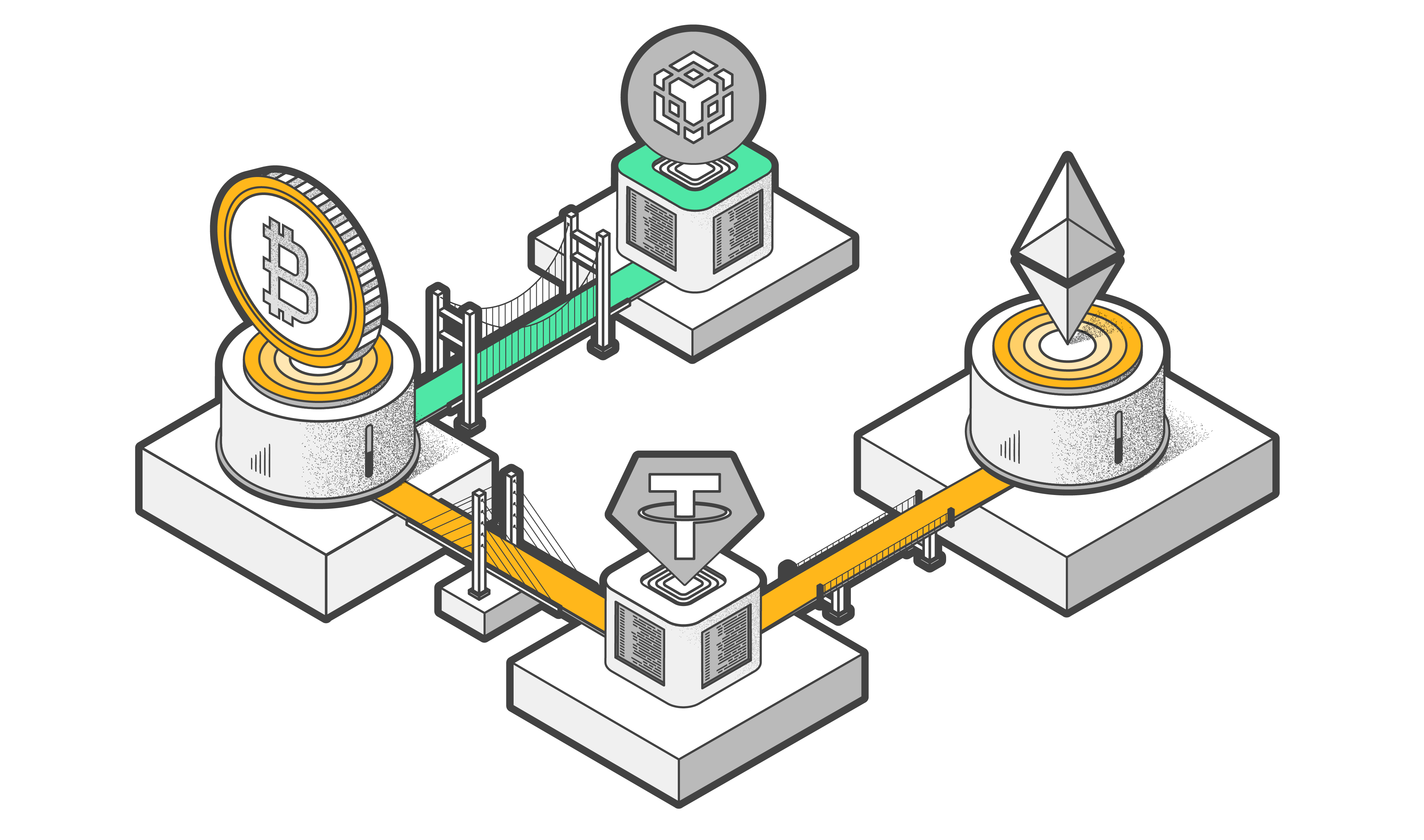

El ecosistema cripto no nació como un mundo multicadena. Primero existió Bitcoin, luego llegó Ethereum y hoy hay cientos de blockchains, cada una optimizada para objetivos distintos, como la velocidad, la seguridad, la privacidad o los contratos inteligentes. Esta diversidad es poderosa, pero genera un problema: la mayoría de las blockchains no pueden comunicarse entre sí. Los puentes cross-chain resuelven este problema al permitir la transferencia de activos y datos entre diferentes blockchains. Sin ellos, tus criptomonedas quedan atrapadas en una sola red. Con ellos, puedes usar tus activos donde existan mejores oportunidades.

¿Qué es un puente cross-chain?

Un puente cross-chain es un protocolo que permite transferir tokens, NFTs o datos entre dos o más blockchains. Actúa como traductor y mensajero. Por ejemplo, si tienes USDC en Ethereum y quieres usarlo en Solana, el puente bloquea o quema tus USDC en Ethereum y libera o acuña el equivalente en Solana.

¿Por qué son esenciales los puentes cross-chain?

Las blockchains se especializan:

- Ethereum domina DeFi

- Solana ofrece velocidad y bajas comisiones

- Bitcoin prioriza la seguridad

Los puentes resuelven tres problemas clave:

- Fragmentación de liquidez

- Fricción para los usuarios

- Limitaciones para la innovación

Convierten las blockchains aisladas en un ecosistema conectado.

¿Cómo funcionan los puentes cross-chain?

Los modelos más comunes son:

- Bloquear y acuñar

- Quemar y acuñar

Pasos habituales:

- Conectar la wallet

- Elegir cadenas

- Aprobar la transacción

- Pagar comisiones

- Recibir los activos

El papel de los smart contracts y oráculos

Los smart contracts gestionan los activos. Los oráculos verifican eventos entre cadenas. Si fallan, los fondos pueden perderse. Por eso la seguridad es crítica.

Tipos de puentes cross-chain

1. Puentes descentralizados

Pros | Contras |

Transparencia | Mayor complejidad |

Menos puntos únicos de fallo | Transacciones más lentas |

2. Puentes centralizados

Pros | Contras |

Rapidez | Riesgo de custodia |

Facilidad de uso | Dependencia de terceros |

3. Puentes híbridos

Combinan la descentralización con componentes centralizados para mejorar la experiencia.

Principales puentes en 2026

- Multichain

- Celer cBridge

- Portal Token Bridge

- Synapse Bridge

- Umbria Narni Bridge

Beneficios clave

- Acceso a más DeFi y DApps

- Menores comisiones

- Mejor distribución de liquidez

Riesgos y desafíos

- Vulnerabilidades de seguridad

- Retrasos o fallos

Cómo reducir riesgos

- Usar puentes auditados

- Probar con pequeñas cantidades

Uso seguro con Tangem Wallet

Tangem mantiene las claves privadas offline.

Pasos

- Seleccionar activo

- Conectar vía WalletConnect

- Revisar y confirmar

Futuro de la tecnología cross-chain

La interoperabilidad será estándar. Soluciones como Chainlink CCIP buscan unificar la comunicación entre cadenas.

Preguntas frecuentes

¿Qué es un puente cross-chain?

Permite transferir activos entre blockchains.

¿Cross-chain vs multi-chain?

Cross-chain mueve activos. Multi-chain solo opera en varias redes.

¿Por qué fallan los swaps?

Falta de gas, congestión o retrasos.

Conclusión

Los puentes cross-chain ofrecen flexibilidad, pero requieren precaución. Usados correctamente, son una herramienta clave para el futuro multicadena.