What is USDD

What is USDD

History

USDD was launched in May 2022 by the TRON DAO Reserve, an organization associated with the TRON blockchain. The stablecoin was introduced as part of TRON's efforts to create a decentralized financial ecosystem that can provide a reliable and stable digital currency for transactions and DeFi (decentralized finance) applications. The launch of USDD came in response to the growing demand for decentralized stablecoins and as part of a broader trend within the cryptocurrency industry to develop alternatives to centralized stablecoins like USDT and USDC. Although the launch was successful, it attracted scrutiny, particularly given the collapse of the Terra ecosystem’s UST stablecoin just prior to USDD's release.

Creators and Developers

The TRON DAO Reserve, which is responsible for the development and issuance of USDD, is closely associated with Justin Sun, the founder of the TRON blockchain. Justin Sun is a well-known figure in the cryptocurrency space and has been involved in multiple projects aimed at expanding the TRON ecosystem. The TRON DAO Reserve manages the stability of USDD and its peg to the US dollar through a reserve mechanism that involves multiple cryptocurrencies.

Technology

USDD operates on the TRON blockchain, which is known for its high throughput, low transaction fees, and scalability. The stablecoin uses an algorithmic stabilization mechanism that involves a mix of algorithmic and collateralized approaches. This mechanism helps maintain the 1:1 peg to the US dollar by adjusting the supply of USDD based on market demand. In addition, USDD is supported by a decentralized reserve consisting of various cryptocurrencies like BTC, TRX, and USDT, which can be used to stabilize the currency in case of volatility.

Mining and Issuance

USDD is not mined in the traditional sense. Instead, its issuance is controlled by the TRON DAO Reserve. The supply of USDD is adjusted algorithmically to maintain its peg to the US dollar. This process involves minting new USDD tokens when demand increases and burning them when demand decreases. The decentralized reserve plays a key role in this process, as it provides the collateral needed to back the issuance and redemption of USDD.

Networks and Support

While USDD primarily operates on the TRON blockchain, it is also available on other blockchains through cross-chain bridges. For instance, USDD is available on Ethereum and Binance Smart Chain (BSC), allowing for broader use across various decentralized applications (dApps) and platforms. These cross-chain bridges enable users to transfer USDD between different blockchains, enhancing its liquidity and utility in the broader DeFi ecosystem.

Applications and Use Cases

USDD is primarily used within the DeFi ecosystem for applications such as lending, borrowing, trading, and liquidity provision. Its stability makes it a preferred choice for users seeking a reliable medium of exchange and store of value within decentralized environments. Additionally, USDD is used in yield farming, staking, and other financial services where stablecoins are essential.

Popularity and Market Capitalization

Since its launch, USDD has gained significant traction, particularly within the TRON ecosystem. Its market capitalization has seen substantial growth, reflecting its adoption in various DeFi applications. However, like many algorithmic stablecoins, USDD's peg has occasionally been tested, leading to discussions about its long-term viability and stability.

Unique Features

What sets USDD apart from other stablecoins is its hybrid approach to maintaining its peg. By combining algorithmic mechanisms with collateralized reserves, USDD aims to offer greater stability and security than purely algorithmic stablecoins. Additionally, its integration across multiple blockchains enhances its versatility and appeal to a broader user base.

Partnerships and Integrations

USDD has formed various partnerships within the TRON ecosystem and beyond. It is integrated with several DeFi platforms, exchanges, and financial services, which support its use in various applications. Notably, its cross-chain availability has made it a versatile stablecoin for users operating on different blockchains.

Community and Media

The USDD community is primarily active within the TRON ecosystem, with discussions and updates frequently shared on platforms like Twitter, Telegram, and Reddit. The project has received coverage in crypto media, particularly in discussions about stablecoin innovations and the future of decentralized finance. However, like many projects in the space, it has also faced criticism and skepticism, particularly in the wake of algorithmic stablecoin failures elsewhere in the industry.

Legal Status and Regulation

As with many stablecoins, USDD operates in a regulatory gray area. Its decentralized nature and the involvement of the TRON DAO Reserve add layers of complexity to its legal status. However, stablecoins generally are subject to increasing scrutiny from regulators worldwide, and USDD is likely to face similar challenges as the regulatory landscape evolves.

Examples of Use Cases

USDD is used across various DeFi protocols for trading, lending, and borrowing. For instance, it can be used as collateral in lending platforms to borrow other assets, or it can be staked to earn yields. These use cases demonstrate its utility as a stable and reliable medium of exchange within decentralized financial ecosystems.

Supported Networks

Tangem Wallet supports USDD on these networks

- Ethereum

- BNB Smart Chain

- Tron

- Avalanche C-Chain

- Arbitrum

USDD official links

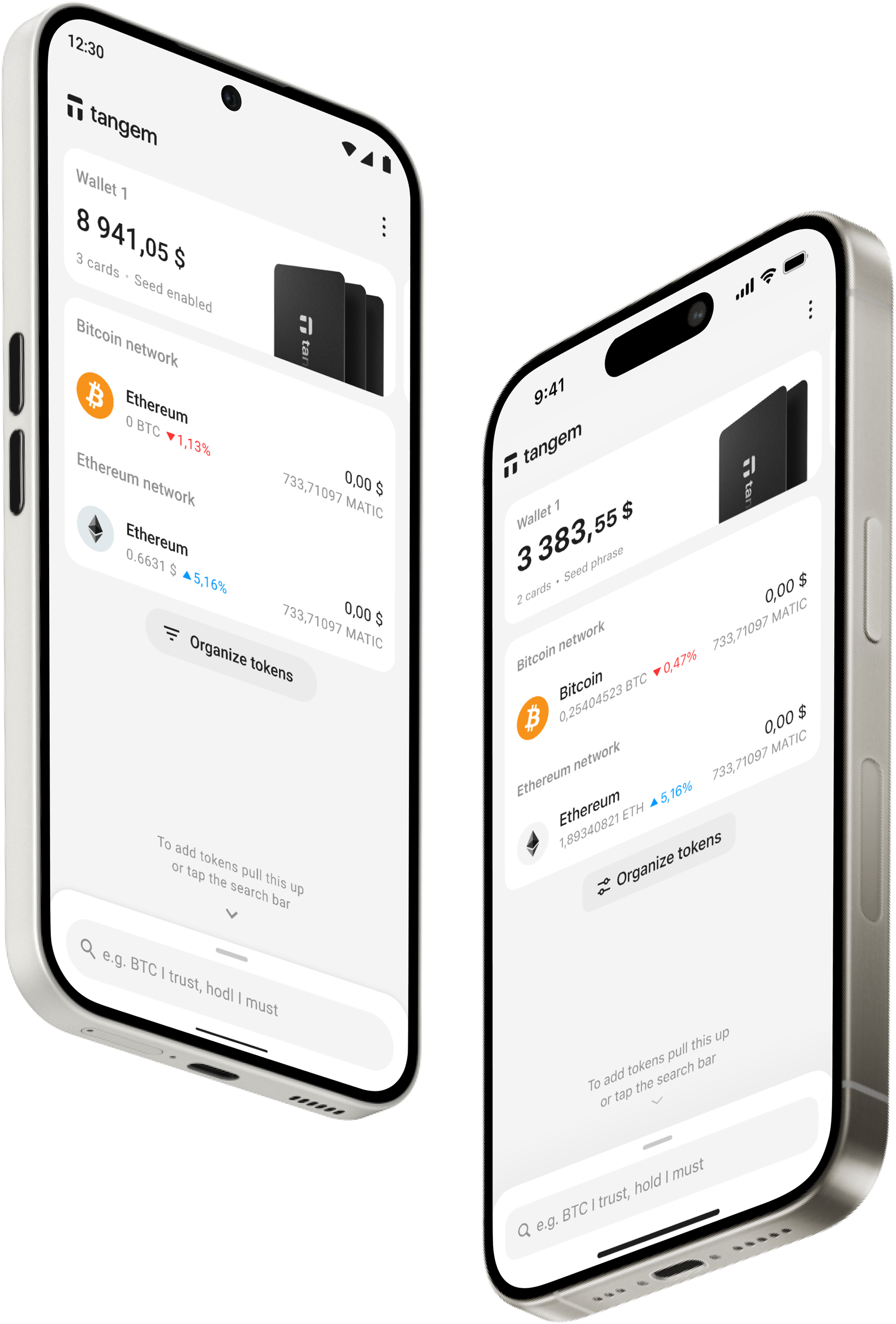

Discover the power of crypto with the Tangem App.

Install the app on your phone or download APKHow to buy USDD in Tangem Wallet.

The Tangem mobile app lets you buy cryptocurrency directly using a bank card and choose the best exchange rate.

USDD FAQ

- Owning cryptocurrency can be important for several reasons: it provides a decentralized way to store and transfer value, offers potential for investment growth, enables participation in emerging financial technologies, and can be used for secure and private transactions.

- A cryptocurrency wallet is a tool or device that allows you to store, manage, and use your cryptocurrency. It keeps your private keys secure and enables you to interact with various blockchain networks, including Bitcoin and Ethereum.

- When choosing a cryptocurrency wallet, consider factors such as security, ease of use, and cryptocurrencies supported. Also determine whether you prefer a hardware or software wallets. Research reviews and compare features to find the best option for your needs.

- USDD maintains its peg through an algorithmic mechanism that adjusts its supply based on market demand. When USDD's price rises above $1, the protocol incentivizes users to mint more USDD, increasing supply and driving the price down. Conversely, if the price drops below $1, the protocol encourages users to burn USDD, reducing supply and raising the price back to $1.

- TRON is the blockchain on which USDD operates, providing the infrastructure for its smart contracts and transactions. TRON's high throughput and low transaction costs make it a suitable platform for USDD, ensuring fast and cost-effective transfers of the stablecoin. Additionally, TRON's decentralized nature aligns with USDD's goals of transparency and decentralized finance.

- USDD differs from USDT, which is fiat-backed, and DAI, which is collateral-backed, by being algorithmic. While USDT relies on reserves and DAI on over-collateralization, USDD's stability comes from its algorithmic supply adjustments. This makes USDD less dependent on external assets but also introduces different risks, such as potential price volatility if the algorithm fails to respond effectively to market conditions.

Why choose USDD wallet with Tangem.

Private. No registration and KYC required to use the app. We don't track your data.

Secure. Your private keys are encrypted and never leave your device. Only you have control over your funds.

Innovative Design Options. Choose from a variety of elegant designs, including unique co-branded editions and our innovative ring-form factor wallet, ensuring both style and functionality.

24/7 Online Support. Fast support for your needs. Live chat and email support for customers from all over the globe.

Other crypto assets supported in Tangem Wallet.

Stay connected.

Don’t miss out on our progress and latest updates. Have an impact — join our community today!

Something went wrong