What is dYdX (Native)

What is dYdX (Native)

History

dYdX was created in 2017 by Antonio Juliano, a former software engineer at Coinbase and Uber. The platform was developed to provide decentralized alternatives to traditional financial products, specifically in the realm of derivatives and margin trading. The dYdX token was introduced in August 2021, marking a significant evolution in the protocol’s governance and utility. The launch of the token coincided with the rollout of dYdX's Layer 2 protocol, which aimed to improve the scalability and user experience of the platform.

Creators and Developers

Antonio Juliano is the primary figure behind dYdX, having founded the platform after gaining experience at Coinbase, where he worked on the company's exchange products. The development of dYdX is driven by a core team of engineers and DeFi experts, with support from prominent investors, including Andreessen Horowitz, Polychain Capital, and Paradigm. The protocol has also benefited from the open-source community's contributions, further enhancing its development and security.

Technology

dYdX operates on the Ethereum blockchain, initially leveraging its smart contract capabilities to offer decentralized trading. However, to address the scalability issues associated with Ethereum, the dYdX protocol transitioned to a Layer 2 solution based on StarkWare’s StarkEx technology. This transition enabled faster transaction speeds, lower fees, and greater efficiency, making it more suitable for high-frequency trading and large-scale operations.

The dYdX token itself is an ERC-20 token on the Ethereum network. It is used for various purposes within the ecosystem, including governance, staking, and rewards for active participants. The protocol also incorporates a decentralized autonomous organization (DAO) structure, allowing token holders to vote on protocol upgrades, treasury management, and other key decisions.

Mining and Issuance

The dYdX token was not subject to traditional mining; instead, it was distributed through various mechanisms, including airdrops, liquidity mining programs, and rewards for active traders on the platform. The total supply of DYDX is capped at 1 billion tokens, which are distributed over a period of five years. The distribution plan allocates tokens to users, the dYdX community treasury, employees and consultants, and the dYdX Foundation, among others.

Networks and Support

dYdX is primarily supported on the Ethereum network, but with its Layer 2 implementation using StarkEx, it operates in a more scalable environment, reducing the load on the Ethereum mainnet. This Layer 2 solution is highly specialized for trading activities, offering users a seamless experience with low fees and fast transactions.

The protocol is also exploring cross-chain compatibility and has shown interest in integrating with other blockchain networks to enhance its interoperability and reach a broader user base. However, the primary focus remains on the Ethereum ecosystem, given its robustness and widespread adoption.

Applications and Use Cases

dYdX is primarily used for decentralized trading of derivatives, including perpetual contracts and margin trading. The protocol offers a wide range of trading pairs and allows users to leverage their positions up to 20x. In addition to trading, the dYdX token is used for governance, where holders can vote on protocol updates, changes to trading parameters, and other crucial aspects of the platform's development.

The token also plays a role in staking programs, where users can earn rewards by staking their DYDX tokens or providing liquidity to the platform. This incentive structure helps maintain the protocol's liquidity and overall health.

Popularity and Market Capitalization

Since its launch, the dYdX token has garnered significant attention in the DeFi space, particularly among traders and investors interested in decentralized derivatives. The token quickly achieved a notable market capitalization, reflecting its adoption and the platform’s growing user base. The platform’s innovative approach to trading, coupled with its strong backers, has made it a leading player in the decentralized derivatives market.

Unique Features and Advantages

One of the key features of dYdX is its focus on decentralized derivatives, a niche that remains underdeveloped compared to other DeFi sectors like lending and spot trading. The platform's Layer 2 solution, based on StarkEx, offers a unique combination of scalability, security, and speed, which is critical for derivatives trading.

Additionally, the governance model of dYdX empowers token holders to have a direct say in the protocol's future, fostering a more community-driven approach to its development. This decentralized governance, combined with the platform's technical innovations, sets dYdX apart from other DeFi projects.

Partnerships and Integrations

dYdX has established partnerships with various players in the blockchain space, including StarkWare, which provides the Layer 2 scaling solution, and other DeFi projects that contribute to its liquidity and user base. The protocol's integration with Chainlink oracles, for example, ensures accurate and reliable price feeds for its trading pairs, which is crucial for the platform’s operations.

Community and Media Presence

The dYdX community is active and engaged, with a strong presence on platforms like Twitter, Discord, and governance forums. The project regularly communicates updates, governance proposals, and educational content to its users, ensuring transparency and inclusiveness in its development process.

dYdX has also been featured in various media outlets and DeFi-focused publications, highlighting its innovations in decentralized trading and its role in the broader DeFi ecosystem.

Supported Networks

Tangem Wallet supports dYdX (Native) on these networks

- Ethereum

- Solana

dYdX (Native) official links

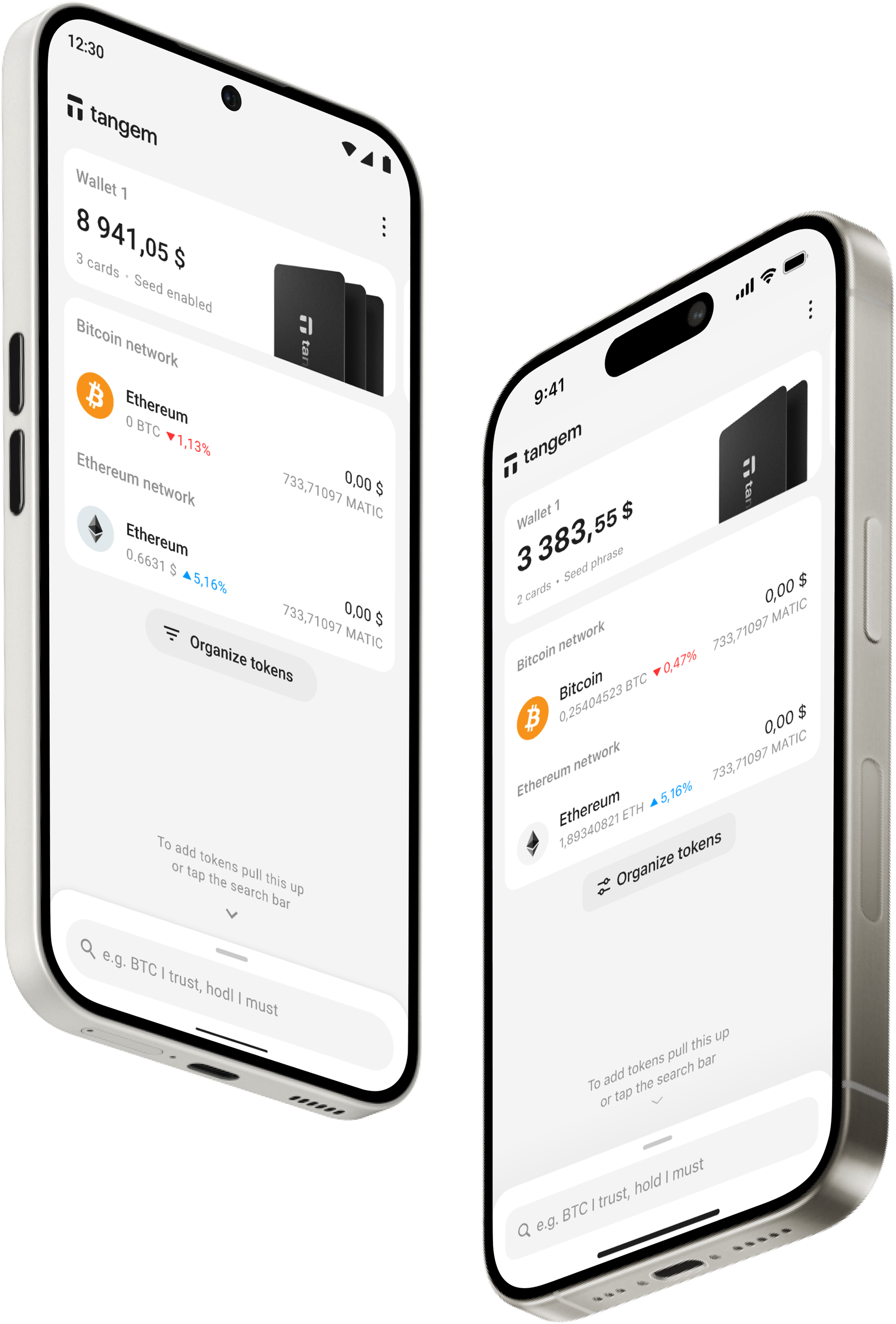

Discover the power of crypto with the Tangem App.

Install the app on your phone or download APKHow to buy dYdX (Native) in Tangem Wallet.

The Tangem mobile app lets you buy cryptocurrency directly using a bank card and choose the best exchange rate.

dYdX (Native) FAQ

- Owning cryptocurrency can be important for several reasons: it provides a decentralized way to store and transfer value, offers potential for investment growth, enables participation in emerging financial technologies, and can be used for secure and private transactions.

- A cryptocurrency wallet is a tool or device that allows you to store, manage, and use your cryptocurrency. It keeps your private keys secure and enables you to interact with various blockchain networks, including Bitcoin and Ethereum.

- When choosing a cryptocurrency wallet, consider factors such as security, ease of use, and cryptocurrencies supported. Also determine whether you prefer a hardware or software wallets. Research reviews and compare features to find the best option for your needs.

- dYdX leverages the Ethereum blockchain and smart contracts to ensure that all transactions are transparent and secure. This decentralized approach eliminates the need for a central authority, reducing the risk of hacks and fraud while allowing users to retain control of their funds.

- dYdX provides users with the benefits of decentralization, including increased security, no KYC requirements, and reduced counterparty risk. Additionally, users can trade directly from their wallets without needing to deposit funds into the exchange, making it more secure than traditional centralized exchanges.

- The DYDX token is used for governance, allowing holders to vote on protocol upgrades and decisions. It also offers trading fee discounts and rewards for users who actively participate in the ecosystem, such as liquidity providers and traders, creating a more engaging and community-driven platform.

- dYdX has integrated Layer 2 scaling solutions, such as StarkWare, to enhance transaction speed and reduce costs. This integration significantly improves the platform's usability by offering near-instantaneous trades with minimal fees, making it more competitive with centralized exchanges while maintaining the benefits of decentralization.

Why choose dYdX (Native) wallet with Tangem.

Private. No registration and KYC required to use the app. We don't track your data.

Secure. Your private keys are encrypted and never leave your device. Only you have control over your funds.

Innovative Design Options. Choose from a variety of elegant designs, including unique co-branded editions and our innovative ring-form factor wallet, ensuring both style and functionality.

24/7 Online Support. Fast support for your needs. Live chat and email support for customers from all over the globe.

Other crypto assets supported in Tangem Wallet.

Stay connected.

Don’t miss out on our progress and latest updates. Have an impact — join our community today!

Something went wrong