What is Dai

What is Dai

History

Dai (DAI) is a decentralized stablecoin that was launched in December 2017 by MakerDAO, an organization on the Ethereum blockchain. It was created with the goal of providing a stable cryptocurrency that is pegged to the value of the US dollar, but without reliance on a centralized entity for collateral or issuance. Unlike other stablecoins, which are typically backed by fiat reserves held by a centralized institution, Dai is backed by overcollateralized crypto assets, which are managed by smart contracts.

Originally, Dai was known as Single-Collateral Dai (SAI), where it was only backed by Ether (ETH). In November 2019, MakerDAO transitioned to Multi-Collateral Dai (MCD), allowing various crypto assets to be used as collateral. This transition represented a significant step in the evolution of Dai, as it increased the flexibility and scalability of the system. The upgrade also introduced the Dai Savings Rate (DSR), which allows holders of Dai to earn interest by locking their Dai into a smart contract.

Creators and Developers

MakerDAO, a decentralized autonomous organization (DAO), is responsible for the creation and development of Dai. MakerDAO was founded by Rune Christensen, a Danish entrepreneur, who started the project with the vision of creating decentralized finance (DeFi) tools. MakerDAO is governed by holders of MKR tokens, who vote on important issues related to the governance of Dai, such as risk parameters, collateral types, and stability fees. MakerDAO's development team is made up of a global network of developers, economists, and blockchain experts who contribute to the maintenance and improvement of the protocol.

Technology

Dai operates on the Ethereum blockchain and is built on smart contracts managed by the Maker Protocol. The stability of Dai is maintained through the use of collateralized debt positions (CDPs), now known as vaults, where users can lock up crypto assets (such as ETH, USDC, and others) as collateral to generate new Dai. This process is algorithmically governed by smart contracts that ensure the amount of Dai issued is always sufficiently backed by the collateral assets.

The Maker Protocol employs a system of price feeds and oracles to track the value of the collateral in real-time. If the value of the collateral drops below a certain threshold, the collateral can be liquidated to ensure that the value of Dai remains stable. This automated liquidation mechanism is key to maintaining Dai's peg to the US dollar, even during times of market volatility.

Mining and Issuance

Dai is not mined in the traditional sense, like Bitcoin or Ethereum. Instead, it is issued when users lock up their collateral in a MakerDAO vault. By depositing collateral into the vault, users can borrow against their assets and mint new Dai. This creates an over-collateralized loan, which remains in effect until the user pays back the borrowed Dai plus a stability fee. Once the loan is repaid, the collateral is unlocked, and the Dai is burned (destroyed).

The MakerDAO system supports multiple types of collateral, and the process of creating Dai is governed by the rules set by the MakerDAO community, including the minimum collateralization ratio and the stability fee. The Dai Savings Rate (DSR) also incentivizes users to hold Dai by allowing them to earn interest.

Networks and Support

Dai primarily operates on the Ethereum network but is also supported on several other blockchain platforms through the use of cross-chain solutions like bridges. These bridges allow Dai to be used on blockchains such as Binance Smart Chain, Polygon, and Avalanche, among others. Additionally, Dai is widely integrated into the decentralized finance (DeFi) ecosystem, supported by numerous decentralized exchanges (DEXs), lending protocols, and yield farming platforms.

Use Cases and Applications

Dai is widely used in the DeFi ecosystem as a stable medium of exchange, a unit of account, and a store of value. Its primary use case is in decentralized lending and borrowing platforms, where it serves as a stable asset that users can borrow or lend against. Dai is also used in payment systems, remittances, and as a hedge against the volatility of other cryptocurrencies.

One of the most notable features of Dai is its programmability, which makes it a foundational asset in DeFi protocols like Compound, Aave, and Uniswap. It is used as collateral in these platforms, as well as in yield farming strategies to earn additional rewards. Furthermore, Dai's stability makes it a popular choice for merchants and users looking to transact with cryptocurrency without the risks associated with price fluctuations.

Popularity and Market Capitalization

Dai has become one of the most popular stablecoins in the cryptocurrency market, with a market capitalization consistently in the billions of dollars. Its popularity surged alongside the growth of DeFi in 2020 and 2021, as more users sought stable assets to engage with decentralized lending, borrowing, and trading platforms. Despite competition from centralized stablecoins like USDT and USDC, Dai remains a preferred choice for users seeking a decentralized stablecoin solution.

Unique Features and Innovation

The decentralized nature of Dai distinguishes it from other stablecoins that rely on centralized institutions for issuance and collateral management. Its over-collateralization model ensures that each Dai is backed by crypto assets in excess of its value, which enhances the security and resilience of the system. The governance by the MakerDAO community ensures that decisions about collateral types, risk management, and system upgrades are made in a decentralized manner.

Dai is also notable for its adaptability to new collateral types, which allows it to remain relevant in the ever-evolving DeFi landscape. The introduction of the Dai Savings Rate (DSR) is another innovative feature, allowing users to earn interest on their Dai holdings simply by locking them in a smart contract.

Partnerships and Integrations

Dai is integrated into a wide variety of platforms and services within the cryptocurrency and DeFi space. Major DeFi protocols such as Aave, Compound, and Curve have integrated Dai as a key stable asset. Dai is also widely accepted on decentralized exchanges, payment gateways, and platforms like Chainlink and Kyber Network. It has formed partnerships with various blockchain projects to expand its usability across different ecosystems.

Community and Media

The Dai community is highly active and engaged, with discussions taking place across various forums, such as the MakerDAO governance forums, Reddit, and Discord channels. MakerDAO hosts regular governance calls where community members can participate in decision-making processes. Dai also receives significant coverage in the media, particularly in relation to its role in the DeFi boom and its resilience during periods of market instability.

Legal Status and Regulation

As a decentralized stablecoin, Dai occupies a unique position in the regulatory landscape. While centralized stablecoins are subject to scrutiny from financial regulators, Dai's decentralized nature and lack of a central issuer present different regulatory challenges. Regulatory discussions around stablecoins often focus on issues such as collateral backing and transparency, and while Dai is not immune to regulatory scrutiny, its decentralized structure provides a certain level of insulation from some of the pressures faced by centralized counterparts.

Supported Networks

Tangem Wallet supports Dai on these networks

- Ethereum

- BNB Smart Chain

- Solana

- Avalanche C-Chain

- Polygon POS

- Cronos

- Fantom

- Kava EVM

- Moonbeam

- Shibarium

- Aurora

- Moonriver

- Arbitrum

- Base

- Optimism

- zkEVM

- Gnosis Chain

- zkSync

Dai official links

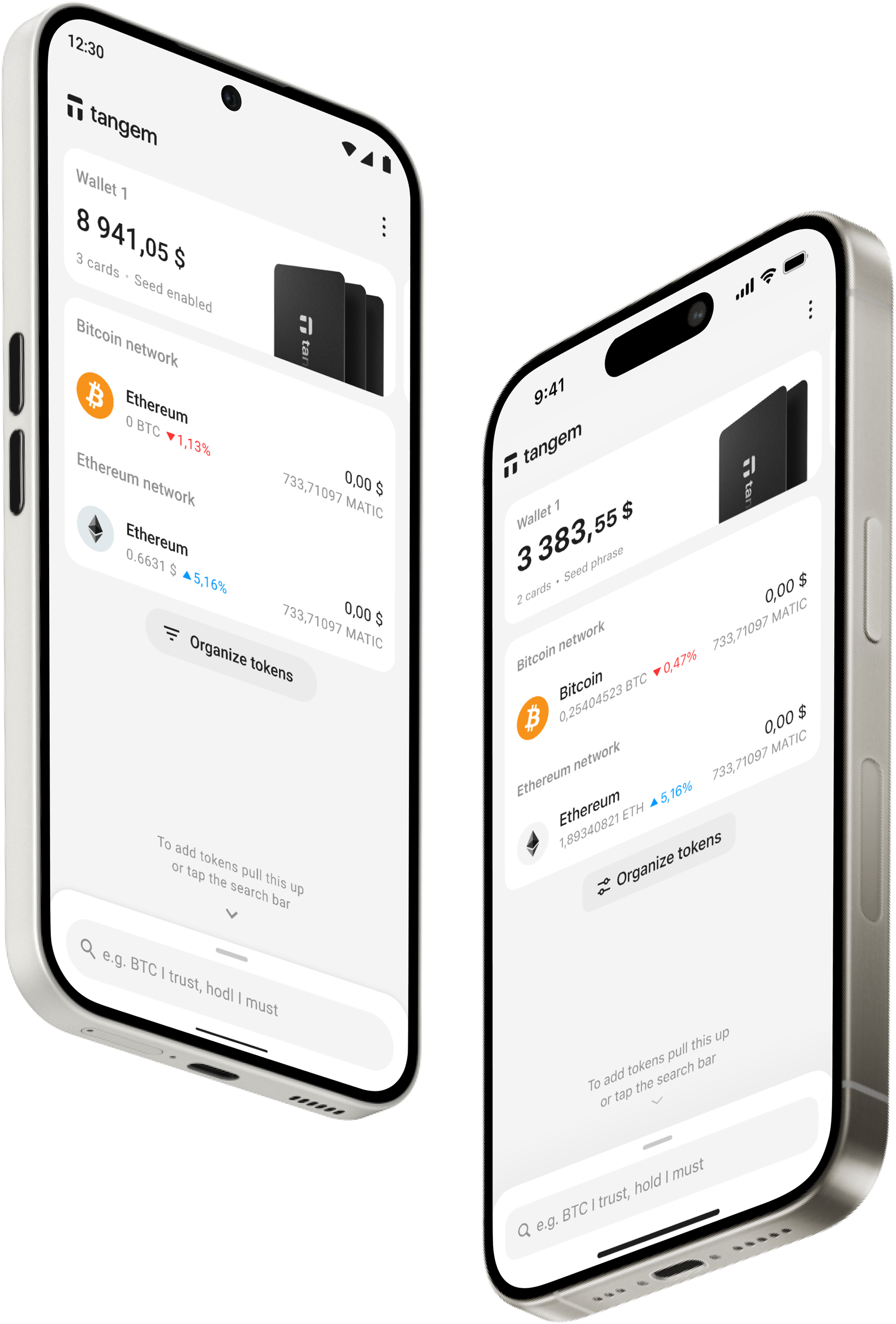

Discover the power of crypto with the Tangem App.

Install the app on your phone or download APKHow to buy Dai in Tangem Wallet.

The Tangem mobile app lets you buy cryptocurrency directly using a bank card and choose the best exchange rate.

Dai FAQ

- Owning cryptocurrency can be important for several reasons: it provides a decentralized way to store and transfer value, offers potential for investment growth, enables participation in emerging financial technologies, and can be used for secure and private transactions.

- A cryptocurrency wallet is a tool or device that allows you to store, manage, and use your cryptocurrency. It keeps your private keys secure and enables you to interact with various blockchain networks, including Bitcoin and Ethereum.

- When choosing a cryptocurrency wallet, consider factors such as security, ease of use, and cryptocurrencies supported. Also determine whether you prefer a hardware or software wallets. Research reviews and compare features to find the best option for your needs.

- Dai maintains its stable value through a system of smart contracts on the MakerDAO platform, where users lock up collateral (such as ETH) to generate Dai. The system dynamically adjusts the collateral requirements and can liquidate positions to ensure that Dai's value remains close to $1, even during market volatility.

- Unlike USDT or USDC, which are backed by fiat reserves held in a bank, Dai is decentralized and backed by cryptocurrency collateral. This means that Dai is not subject to centralized control or the risks associated with holding large amounts of fiat currency in traditional financial institutions.

- While Dai is designed to be stable, it is not without risks. The primary risks include the potential for the underlying collateral to drop in value, which could lead to liquidation of positions, and smart contract vulnerabilities. Additionally, extreme market conditions could challenge the stability mechanisms in place.

- Dai is widely used in the decentralized finance (DeFi) ecosystem as a stable medium of exchange, for lending and borrowing, and in yield farming. Its stability and decentralization make it a preferred choice for users who need a reliable store of value or wish to avoid the volatility of other cryptocurrencies.

Why choose Dai wallet with Tangem.

Private. No registration and KYC required to use the app. We don't track your data.

Secure. Your private keys are encrypted and never leave your device. Only you have control over your funds.

Innovative Design Options. Choose from a variety of elegant designs, including unique co-branded editions and our innovative ring-form factor wallet, ensuring both style and functionality.

24/7 Online Support. Fast support for your needs. Live chat and email support for customers from all over the globe.

Other crypto assets supported in Tangem Wallet.

Stay connected.

Don’t miss out on our progress and latest updates. Have an impact — join our community today!

Something went wrong