What is Mining in Cryptocurrency?

Mining is the act of creating new blocks on a blockchain. It involves verifying the legitimacy of transactions and adding them to the network, which requires miners to solve complex mathematical problems. These brute-force calculations are performed in order to find a hash – a type of mathematical function – with certain properties (the block’s hash value must be less than or equal to the network mining difficulty indicator). Whoever solves the problem first adds the block to the blockchain and receives a reward.

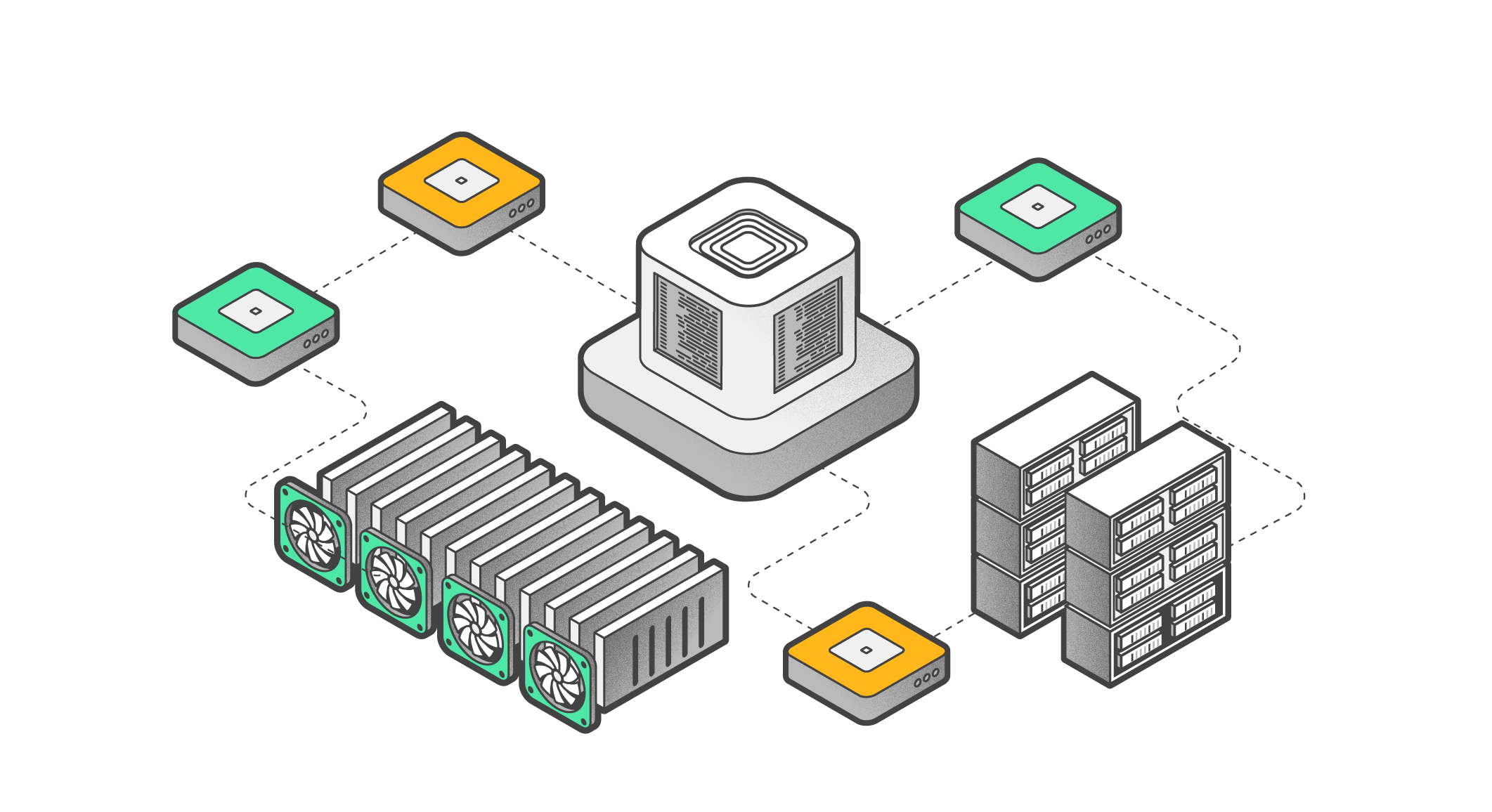

Miners support the operation of networks with powerful computing equipment, helping to keep them decentralized and secure. They receive rewards in the form of new crypto tokens and/or commissions for creating the next block in the chain.

Mining entails three main functions: verifying transactions, creating blocks, and issuing new coins.

To put it simply, the blockchain is a secure database and its performance is supported not by a particular server, but by hundreds of thousands of computers. The owners of these computers – miners – receive rewards in the form of the network’s native coin as payment.

The history of mining

The very first miner was Bitcoin’s creator, Satoshi Nakamoto. When BTC first appeared, it was possible to mine it using the central processing unit (CPU) of a computer.

The capabilities of a graphics processing unit (GPU) were first called upon for use in Bitcoin mining by somebody using the pseudonym ArtForz. In July 2010, he posted a photo with his first mining farm – the “Artfarm” – and boasted about having earned over 1,700 BTC in six days.

The use of video cards for mining sparked a revolution, and mining crypto using CPUs fell by the wayside, while a genuine arms race between GPU manufacturers ensued. In September 2010, a CUDA-based miner for NVIDIA video cards was released and, in October the same year, ATI Radeon released a solution based on OpenCL. Miners began to purchase video cards en masse, and mining grew at an industrial scale.

The first ASICs began to appear in 2012. In the world of crypto, an ASIC, or application-specific integrated circuit, is a chip designed to mine a specific cryptocurrency using a specific algorithm. These powerful single-purpose devices are able to mine coins much faster, and mining on video cards became ineffective (on networks that supported ASIC mining).

Mining methods

There are three main ways to mine cryptocurrency.

Cloud mining

This is the simplest way to mine, and well suited to beginners. You don’t need to research, buy, install or configure any equipment yourself. Instead, you rent a certain hash rate volume from a remote server.

The hash rate is the total computing power required by the network to mine coins. The term also refers to the number of hashes that mining equipment can calculate per second. The higher the figure, the more powerful the equipment.

With this method, the actual crypto mining is taken care of by professionals working on your behalf. All you need to do is top up your personal account in the cloud service and withdraw the rewards received from mining to your crypto wallet.

Remember that there are no 100% guarantees of profit. When starting out in mining, therefore, you should be aware of all the risks involved. You will also need to select your cloud service carefully to make sure you aren’t dealing with scammers.

Solo mining

This method involves mining cryptocurrencies alone. You will need to choose, buy and configure the equipment yourself.

It’s worth noting that solo mining is becoming more difficult every year. Mining Bitcoin independently, for example, is now practically impossible. Despite this, there have been a few success stories in recent times. On 23 May 2023, a solo miner using equipment with a processing power of 750 TH/s (terahashes per second) mined Bitcoin block no. 790,958.

The speed of the Bitcoin network on 23 May was 367.07 EH/s (exahashes per second). With a hash rate of just 750 TH/s, the miner had a 1-in-489,000 chance of solving the block.

In January 2023, a solo miner with a hardware hash rate of just 10 TH/s also mined a Bitcoin block independently. The miner’s share of the network hash rate was a meagre 0.000000036%. Based on the block’s mining complexity at the time, a miner with this hash rate would have been expected to create a block once every 500 years.

Clearly, there are some cases of incredible luck. Successfully mining blocks on the Bitcoin network alone, however, remains a real rarity. For this reason, very few people mine solo, with most miners preferring to come together as a team and mine within pools.

To better illustrate the incredible computing power now being used to mine Bitcoin and the futility of attempting to do so without ASICs, we can attempt to translate the abstract concept of a terahash into something more concrete. Assuming that the NVIDIA GeForce RTX 3080 video card can operate at 100 MH/s (and this is still very optimistic), then that first miner’s “modest 750 TH/s” represents 7.5 million RTX 3080 cards, while the second one would have needed 100,000 video cards to generate 10 TH/s. The average ASIC, meanwhile, can provide speeds of around 10 TH/s, and advanced models can reach 200 TH/s.

Mining in pools

This method of mining cryptocurrency combines equipment power, allowing those involved to carry out complex calculations quickly. The pool operates on the basis of a server which breaks up a large computational task into smaller ones and sends them to the miners. The pool has a coordinator who monitors the work of the participants and divides the rewards among them.

How to start mining cryptocurrency

First of all, you should assess your knowledge, skills and financial capacity realistically. You’ll need to be able to comfortably disassemble and reassemble a computer tower, and have some money for the equipment and rather eye-watering electricity bills.

Here are the steps you’ll need to take if you want to start mining crypto.

Mining risks: How profitable is mining crypto?

If you’ve decided to become a miner, you’ll need to take all of the risks to your earnings into account.

Firstly, you should be mindful of the high levels of volatility in the crypto market. If there’s a sharp drop in the value of a token, your profit may decrease significantly. In this case, you may want to wait for better times, when the coin you’re mining begins to rise in price again. There are, however, situations when this doesn’t happen, and the miners are forced to sell their equipment in order to at least partially cover their losses.

You should also bear in mind that miners are continually upgrading their equipment, and there may come a time when your mining farm is unable to compete with more powerful devices.

Equipment failure is another risk, and parts are not cheap.

Of course, you also need to remember to keep your crypto assets secure. The mining farm itself may be subject to an attack, causing you to lose all your earnings. Furthermore, if you store your coins in an unreliable location, you could eventually lose everything you’ve earned. You should therefore choose a cold storage option like Tangem Wallet, the world’s most secure crypto wallet.

Conclusion

Many experts believe that mining, especially solo mining, has become obsolete. It’s very difficult to make money on your own, and it will take anything from six months to one and a half years to earn back what you’ve invested in crypto mining equipment.

Electricity prices are also going up all over the world, which significantly reduces the profitability of mining and may even put miners in the red.

When mining first emerged, it mainly attracted people who were excited about blockchain technology and cryptocurrencies – people who were much more interested in the ideas behind it than making money. It now looks as though things have come full circle, and mining will once again become the preserve of nerds. Perhaps they’ll even be able to take cryptocurrency mining to the next level.