What is а Decentralized Exchange (DEX)?

AI summary

Decentralized exchanges (DEXs) allow users to trade cryptocurrencies directly from their wallets using blockchain-based smart contracts, eliminating the need for centralized intermediaries and reducing custodial risk. While DEXs offer transparency, user control, and permissionless access, they also face challenges like smart contract vulnerabilities, liquidity limitations, and potential user errors. As DeFi grows and technology advances, DEXs are expected to remain a foundational element of the crypto ecosystem.

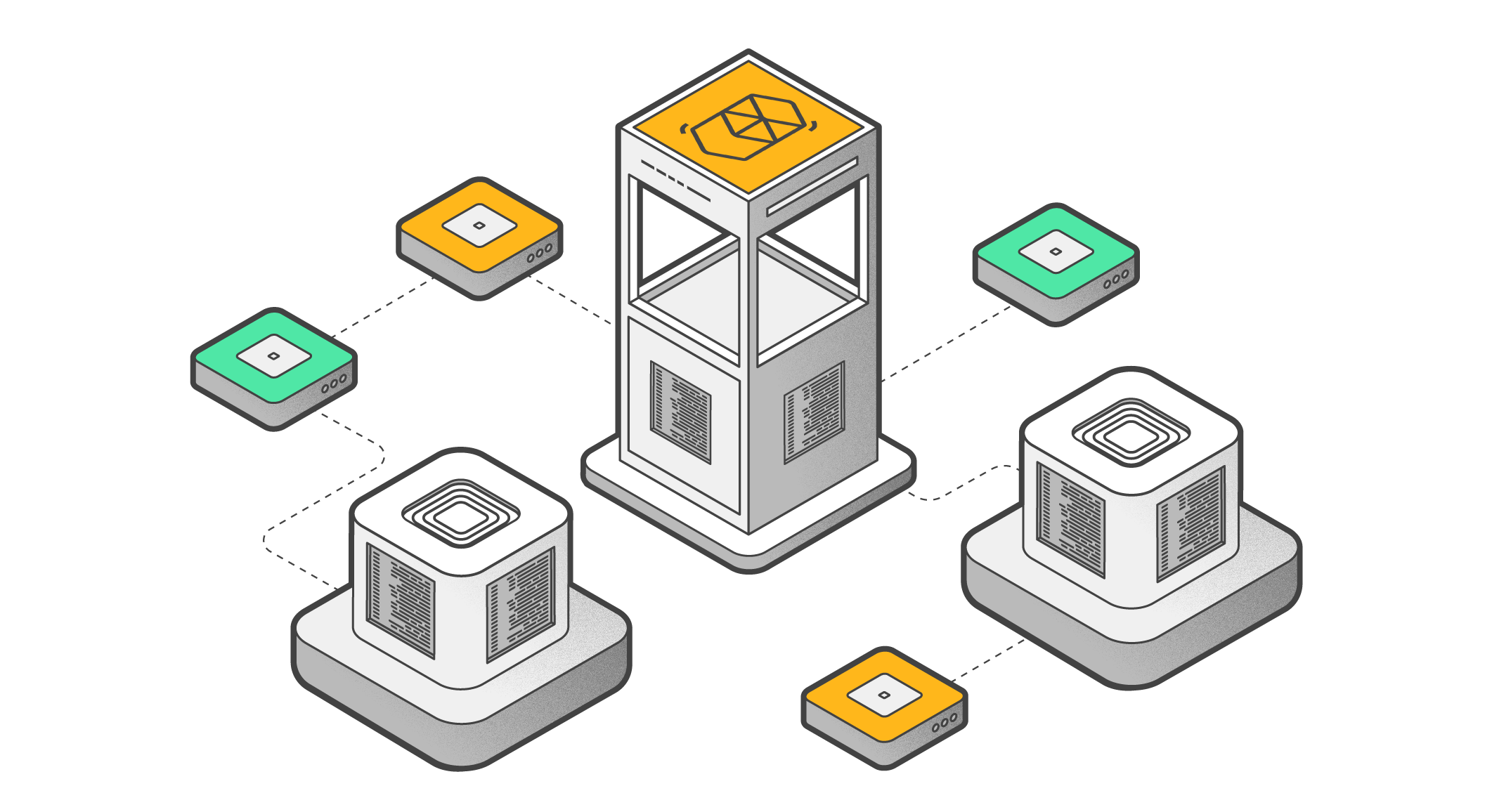

A decentralized exchange (DEX) is a peer-to-peer marketplace that allows users to trade cryptocurrencies directly from their wallets without relying on a centralized intermediary. Instead of banks, brokers, or custodial platforms, DEXs use smart contracts deployed on blockchain networks to execute trades. Because users retain control of their private keys and funds, DEXs reduce custodial risk and align closely with the core principles of blockchain technology: transparency, censorship resistance, and permissionless access.

Decentralized exchanges are a foundational component of decentralized finance (DeFi) and enable a wide range of on-chain financial products, including token swaps, lending, derivatives, and yield farming.

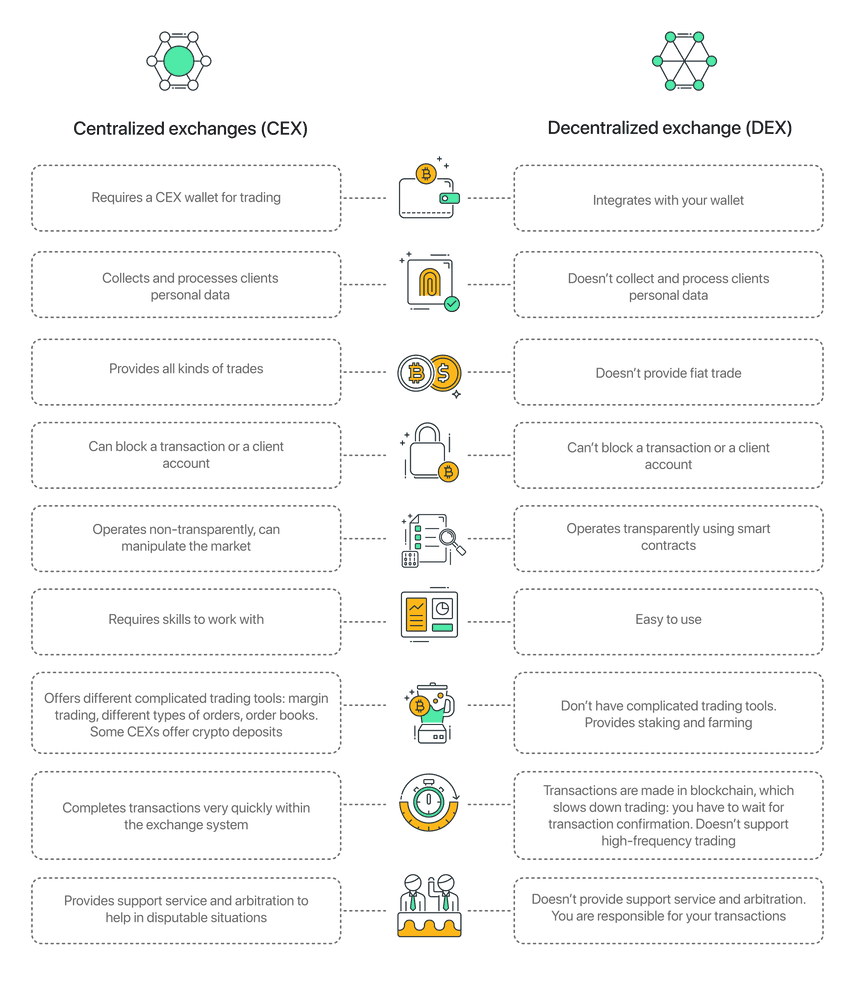

CEXs vs. DEXs: What’s the Difference?

Centralized Exchanges (CEXs)

Centralized exchanges act as intermediaries. Users deposit funds into exchange-controlled wallets, and the platform manages order matching, execution, and custody.

Pros | Cons |

High liquidity | Users do not control private keys |

Advanced trading tools | Custodial and counterparty risk |

User-friendly interfaces | Vulnerable to hacks, freezes, or regulatory shutdowns |

Decentralized Exchanges (DEXs)

DEXs operate directly on blockchain networks. Smart contracts execute trades, and users interact through self-custodial wallets.

Pros | Cons |

Full control over funds | It can be less intuitive for beginners |

Transparent, on-chain execution | Liquidity varies by trading pair |

No centralized point of failure | Network fees and congestion may impact usability |

How Does a Decentralized Exchange Work?

DEXs execute trades using on-chain smart contracts rather than internal matching engines. Users connect their wallets, approve transactions, and interact directly with protocol logic.

Common DEX costs include:

- Network fees (gas): Paid to blockchain validators

- Trading fees: Distributed to liquidity providers, token holders, or the protocol treasury

Many DEXs are governed by decentralized autonomous organizations (DAOs), allowing token holders to vote on protocol upgrades, fees, and governance rules.

Types of Decentralized Exchanges

1. Order Book DEXs

Order book DEXs maintain a list of open buy and sell orders and match them based on price and availability.

Key characteristics

- Familiar trading experience

- Precise price discovery

- Can be fully on-chain or hybrid (off-chain matching, on-chain settlement)

Examples: 0x, dYdX, Loopring, Serum

Why Order Book DEXs Are Making a Comeback: Layer-2 scaling solutions and high-throughput blockchains have significantly reduced costs and latency, making order-book DEXs more practical and liquid than in early implementations.

2. Automated Market Makers (AMMs)

AMMs replace order books with liquidity pools. Prices are set algorithmically based on the pool's asset ratio.

Why AMMs dominate DeFi

- Instant liquidity

- No need for counterparties

- Permissionless market creation

Liquidity providers earn fees by depositing assets into pools.

Popular AMM DEXs: Uniswap, Curve, PancakeSwap, SushiSwap, Balancer, Trader Joe

3. DEX Aggregators

DEX aggregators scan multiple decentralized exchanges to find the best price, lowest slippage, or cheapest gas fees for a trade.

Advantages of Decentralized Exchanges

- Deterministic Execution: Smart contracts ensure trades execute precisely as defined, without discretionary intervention.

- Transparency: All transactions and protocol rules are publicly verifiable on-chain.

- Reduced Counterparty Risk: Users trade directly from their wallets without surrendering custody to third parties.

- Financial Inclusion: Anyone with internet access and a self-custodial wallet can use a DEX, regardless of geography or identity requirements.

Risks and Challenges of DEXs

- Smart Contract Risk: Bugs or exploits in smart contracts can result in the loss of funds. Audits and peer review help, but they can’t eliminate risk.

- Liquidity Limitations: Low-liquidity pools can cause high slippage and poor trade execution.

- Front-Running and MEV: On-chain transparency allows bots to exploit transaction ordering for profit.

- Residual Centralization: Some DEXs rely on centralized infrastructure, admin keys, or off-chain components.

- Network Dependence: High congestion or downtime on the underlying blockchain can slow or increase trading costs.

- Scam Tokens: Permissionless token listings increase the risk of interacting with low-quality or malicious assets.

The Role of Liquidity in DEXs

Liquidity determines how efficiently traders can buy and sell assets without causing significant price swings. Low liquidity leads to:

- Higher slippage

- Slower execution

- Inaccurate price discovery

DEXs incentivize liquidity provision by sharing trading fees with liquidity providers (LPs).

How Liquidity Pools Work

Liquidity pools hold reserves of two or more assets. Most pools require deposits of equal value for each asset. After depositing, liquidity providers receive LP tokens, which:

- Represent their share of the pool

- Allow withdrawal of funds

- Enable collection of earned fees

The value of withdrawn assets may differ from the initial deposit due to price changes and impermanent loss.

How to Provide Liquidity on a DEX

You’ll need:

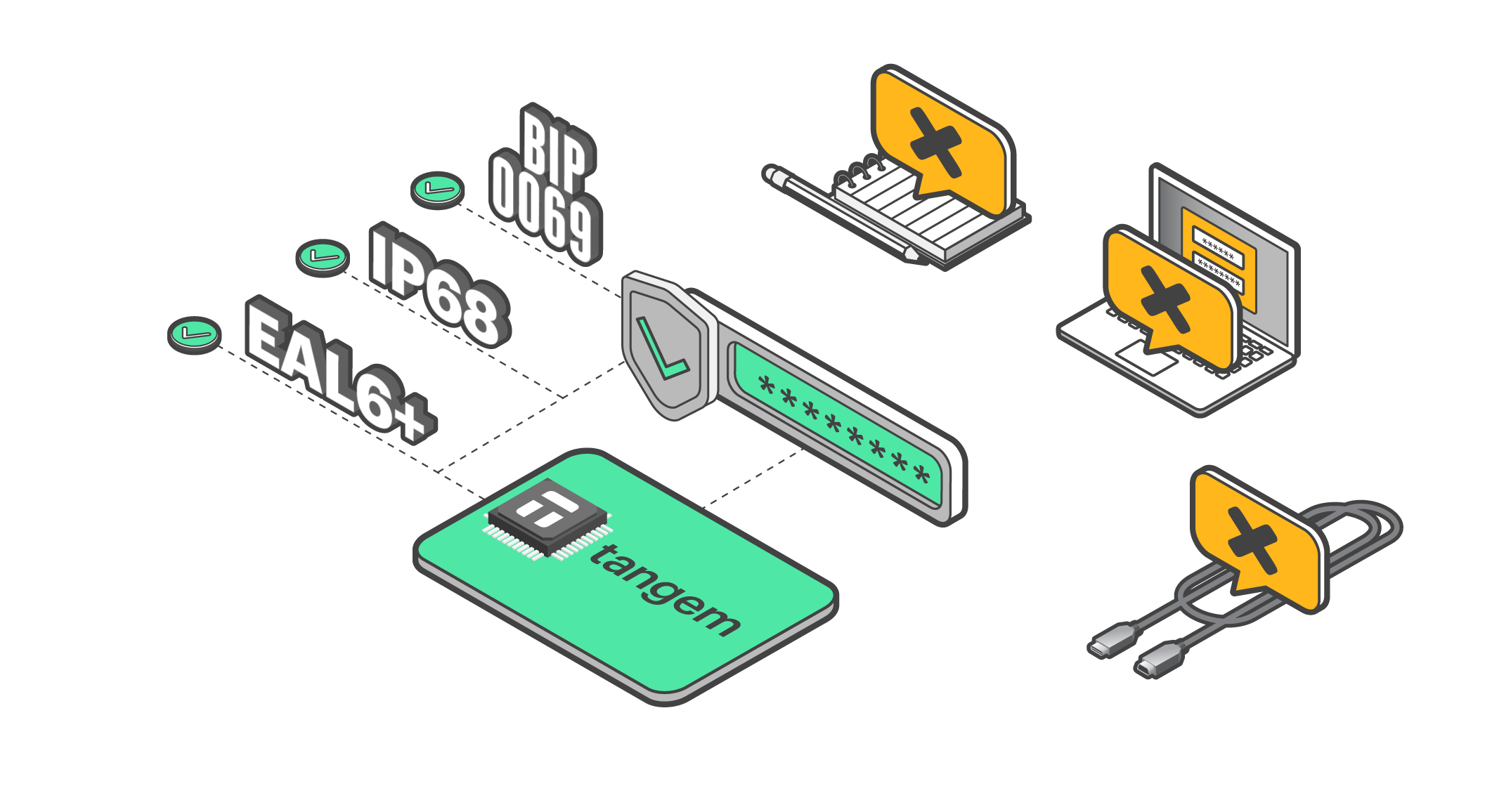

- A self-custodial wallet (such as Tangem Wallet)

- Cryptocurrency for gas fees and pool deposits

- A reputable DEX with strong liquidity and volume

After depositing into a pool, you can track your position and rewards directly on the DEX interface.

Key Terms Explained

- Liquidity: How easily traders can buy or sell assets without affecting the price.

- Liquidity Pool: A smart contract holding funds used for trading pairs.

- Yield: Earnings generated from trading fees and incentives.

- Exchange Fee: A small percentage charged on each swap, usually paid to liquidity providers.

FAQ: Decentralized Exchanges (DEXs)

Are DEXs safe to use?

DEXs eliminate custodial risk but introduce smart contract and user error risks. Safety depends on the protocol’s code quality and your own security practices.

Do I need KYC to use a DEX?

No. Most DEXs are permissionless and do not require identity verification.

Can I lose money providing liquidity?

Yes. Risks include impermanent loss, smart contract bugs, and market volatility.

Are DEXs legal?

DEX legality varies by jurisdiction. Since they are decentralized protocols, regulation often applies to users rather than to the protocols themselves.

What wallet do I need for a DEX?

You need a self-custodial Web3 wallet that supports the relevant blockchain, such as the Tangem Wallet.

Conclusion

Decentralized exchanges are a core pillar of the crypto ecosystem. By enabling permissionless, transparent, and non-custodial trading, DEXs give users direct control over their assets while supporting a growing universe of decentralized financial services. As infrastructure improves and usability increases, DEXs are likely to remain a central force in the evolution of DeFi and on-chain markets.