How To Swap Your Crypto Securely in Tangem Wallet

Most platforms—crypto wallets and exchanges—offer thousands of coins and tokens, and the average crypto user has a portfolio of at least ten cryptocurrencies. So, what if you had to exchange one asset for another? You can accomplish this in several ways:

- Centralized Exchanges (CEX)

A centralized cryptocurrency exchange is the most popular choice for crypto swaps because CEXs offer many token options and lower commissions. But there are trade-offs as well. For example, to exchange cryptocurrency, you must entrust your funds to the platform's wallet, whose private keys are not under your control.

This means that as long as your cryptocurrency is in this wallet, you do not have ultimate control over it. You lose your assets if the exchange is taken down, censored, or hacked.

- Decentralized Exchange (DEX)

Another option is to use a decentralized exchange or DEX. You can exchange one crypto asset for another from the safety of your crypto wallet, where you control the private keys. However, there is a compromise: DEX protocols are almost always based on a specific underlying blockchain. Users can only swap tokens with the same blockchain foundation; for example, you can't swap BTC for KAS or SOL for SHIB.

So, while decentralized exchanges provide greater security by allowing you to control your private keys on your hardware wallet, their options are limited by the underlying network.

- Blockchain bridges

A blockchain bridge allows you to transfer assets from one blockchain to another, addressing one of the main issues with blockchains: a lack of interoperability.

Bridges create synthetic derivatives that represent an asset from one blockchain on another. If you use a bridge to send one Solana coin to an Ethereum wallet, the wallet will receive a token "wrapped" by the bridge and converted to a token on the target blockchain.

In this scenario, the Ethereum wallet would receive a "bridge" version of Solana that had been converted into an ERC-20 token — the generic token standard for fungible tokens on the Ethereum blockchain.

What are cross-chain swaps

Cross-chain swaps are relatively simple: centralized platforms like ChangeNOW, Changelly, and OKX DEX/Bridge provide them as a service. Let's say you want to swap SOL for BTC. In this case, the platform offers a "rate" for the exchange, which includes a commission, and sends your cryptocurrency from its platform wallet.

A cryptocurrency swap is a two-part transaction. On the one hand, you have a set amount of cryptocurrency that will leave your wallet and go to the swap provider. On the other hand, the swap provider will send you the desired asset in return. For example, the provider could offer to swap 0.01 BTC for 0.5 ETH.

To accept the offer, you must provide your Ethereum wallet address, where you will receive the ETH. You must also send 0.01 BTC from your BTC wallet to the address specified by the swap platform.

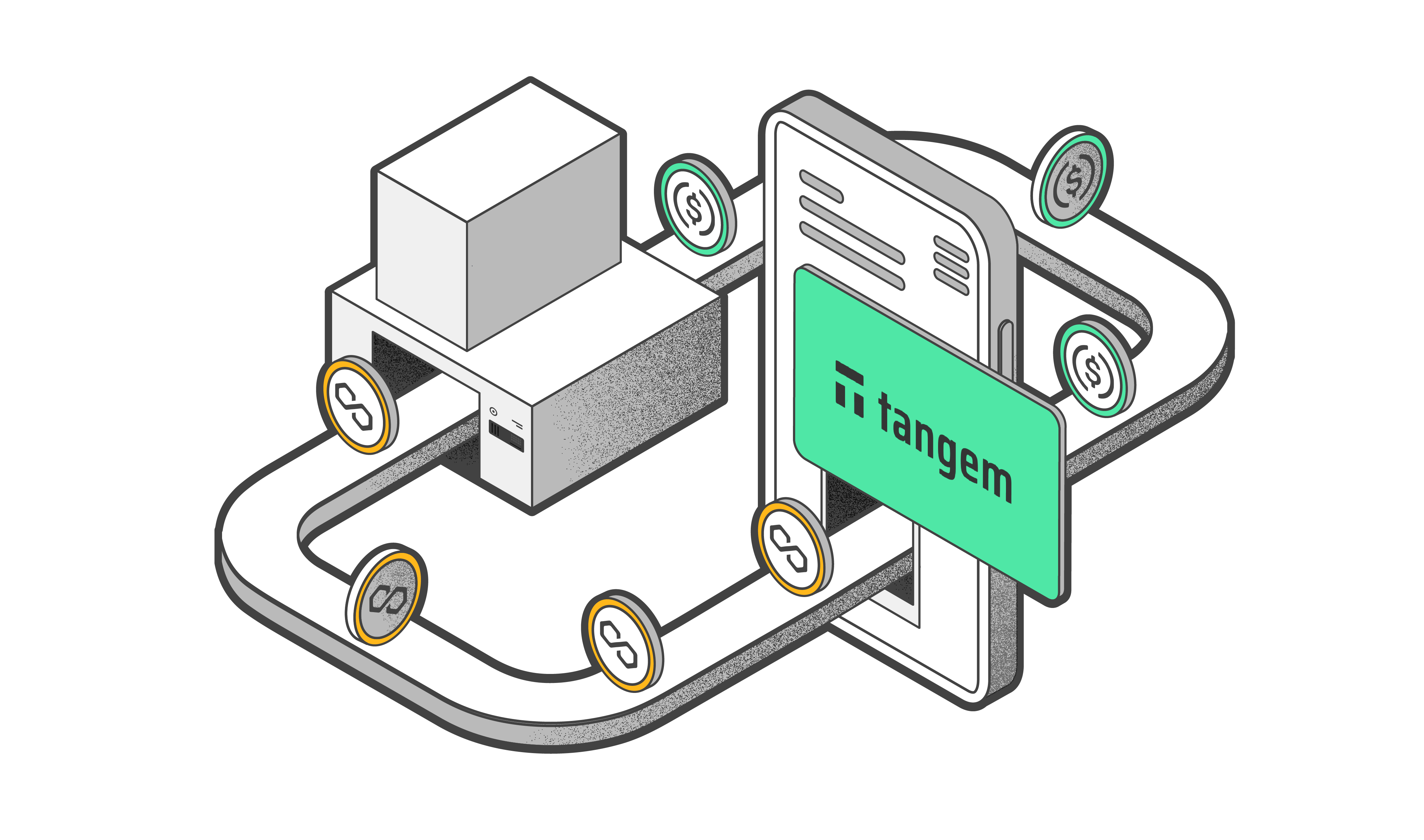

Swapping in Tangem Express

The most secure way to swap your cryptocurrency is using the Tangem Express. Tangem Express provides several swap providers that function as an aggregator for these services. Plus, you can be confident that you're using the official service when choosing any swap provider within Tangem Express. This ensures you don't become a victim of phishing websites or unofficial apps.

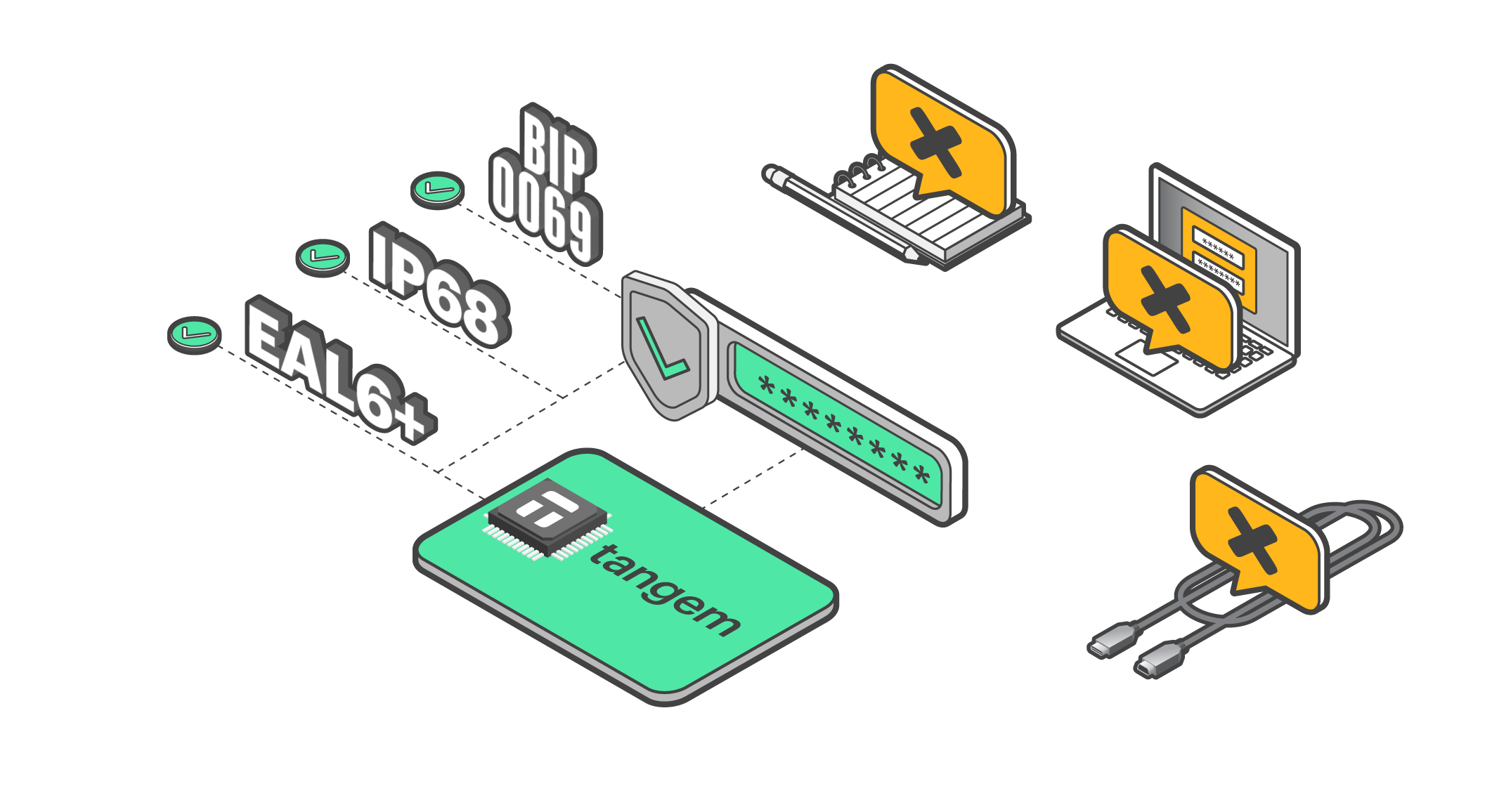

Protecting your assets from hackers with secure element

As you know, hackers can intercept outgoing and incoming cryptocurrency transactions from software wallets. Hardware wallets like Tangem use a secure element chip to sign offline transactions — making it impossible to reveal your private keys. The chip itself is also completely tamper-resistant.

Verifying signature and transaction ID

The swap provider will receive your transaction and send back their cryptographically signed confirmation and the corresponding crypto. Tangem's secure element verifies the incoming transaction's signature to ensure the provider fulfilled the swap.

The ID of the incoming transaction is also checked to ensure that it matches the one you agreed to. Only that specific transaction can be executed. In short, changing any of those details would result in a different transaction ID, preventing the swap from being completed.

How to swap one token for another in Tangem

Here's how swaps — same-chain and cross-chain swaps — work in Tangem Wallet

- Go to the Tangem app.

- Open the token page, for example, USDT, and tap Swap.

- Enter the asset you want to receive, such as Solana (SOL). Tangem Express will automatically show you the provider with the best rates.

- Tap the provider shown to see all providers available and their rates. If the assets involved in the swap are on the same network, both DEX and CEX providers will appear.

If the transaction is strictly a cross-chain swap, only the CEX provider will be made available. - Tap Fee to choose the network transaction fees.

You can choose between Market (average fee rate) and Fast (more expensive but offers a better transaction speed) - Tap Swap and enter your access code or biometric ID. Scan your Tangem card to approve the transaction.

- Tap Status to track the transaction on the provider's page.

When the swap is complete, your account will be funded with the swapped token.

Why choose Tangem for cross-chain swaps

- Simple and convenient

Tangem Express does the optimization work between DEXs, CEXs, and Bridges. And you don't even need to leave the Tangem app to enjoy this feature.

- Best rates

Tangem can offer you lower prices by allowing you to pick between various swap providers.

- Full control

No third party is required to secure your tokens while doing so. You remain in complete control of your private keys and assets.

- Many tokens supported

Tangem Express allows you to exchange many tokens across different networks.

FAQ: Tangem Express

Can providers in Tangem Express block the crypto swaps?

Tangem Express is an aggregator that offers a simple, user-friendly interface for swapping tokens without leaving the wallet. Swaps occur on exchanges (CEX & DEX) following their terms of service. Security-wise, swapping via Tangem Express is almost identical to swapping on exchanges. However, crypto swaps in our wallet reduce the chances of errors and other vulnerabilities associated with keeping your assets in hot wallets.

In what cases is KYC needed for CEX providers?

The need for KYC depends on the provider's terms of service. Tangem cannot define the rules for KYC and is not responsible for the actions of exchanges, their rules, security issues, and more. As a user, you can decide whether to trust the provider before using them. In the future, we will add more providers to give users more options.

Which coins can be exchanged through DEX, and which pairs are available?

The DEX providers in Tangem Express are 1INCH Liquidity Protocol and OKX DEX.

Why are the commissions so high?

Commissions on exchanges cover operational costs and security measures and contribute to the platform's sustainability. High commissions can result from liquidity, transaction speed, and network fees. DEX platforms might have lower fees but could face challenges related to liquidity.

The fee for swapping with DEX includes the swap provider's commission (1INCH) and the network fee.

In the case of CEX providers, the fee includes the service provider's commission and the network fees for sending the token to and from the exchange back to the user's address.

Tangem AG provides only hardware wallets and non-custodial software solutions for managing digital assets. Tangem is not regulated as a financial services provider or cryptocurrency exchange. Tangem does not hold, custody, or control users’ assets or transactions. Crypto transaction services are provided by third-party providers. Tangem provides no advice or recommendation on the use of these third-party services.

Staking and yield generation services are provided by third-party blockchain protocols and decentralized finance (DeFi) platforms. Tangem provides non-custodial access only. Earnings from staking are not guaranteed, may fluctuate significantly, and depend entirely on network or protocol conditions. Users participate at their own risk.