What Is a Cross-Chain Bridge and Why You Need It in Crypto

- AI summary

- What Is a Cross-Chain Bridge?

- Why Are Cross-Chain Bridges Essential in the Cryptocurrency Ecosystem?

- How Do Cross-Chain Bridges Work?

- Types of Cross-Chain Bridges

- Top Cross-Chain Bridges in 2026

- Key Benefits of Using Cross-Chain Bridges

- Challenges and Risks of Cross-Chain Bridges

- How to Safely Use Cross-Chain Bridges With Tangem Wallet

- Future of Cross-Chain Technology: Trends to Watch

- FAQ About Cross-Chain Bridges

- Conclusion: Are Cross-Chain Bridges Worth It?

AI summary

The article explains the importance of cross-chain swaps, which enable the exchange of digital assets across different blockchain networks and are essential for interoperability in the expanding blockchain ecosystem. It compares centralized exchanges (CEXs), which offer convenience but carry custodial and privacy risks, with decentralized exchanges (DEXs), which provide greater transparency and user control. The article also discusses the technical challenges and common reasons for cross-chain swap failures, such as bridge complexities, liquidity issues, and transaction errors, as well as how refunds are handled when swaps fail.

Crypto did not start as a multi-chain world. Bitcoin stood alone, then Ethereum arrived, and today we have hundreds of blockchains, each optimized for different goals, such as speed, security, privacy, or smart contracts. That diversity is powerful, but it creates a problem: most blockchains cannot communicate with each other. Cross-chain bridges address this gap by enabling the transfer of assets and data between different blockchains. Without bridges, your cryptocurrency remains locked within a single network. With them, you can use your assets wherever the best opportunities exist. In this guide, we break down how cross-chain bridges work, why they matter, their risks, and how to use them safely with Tangem Wallet.

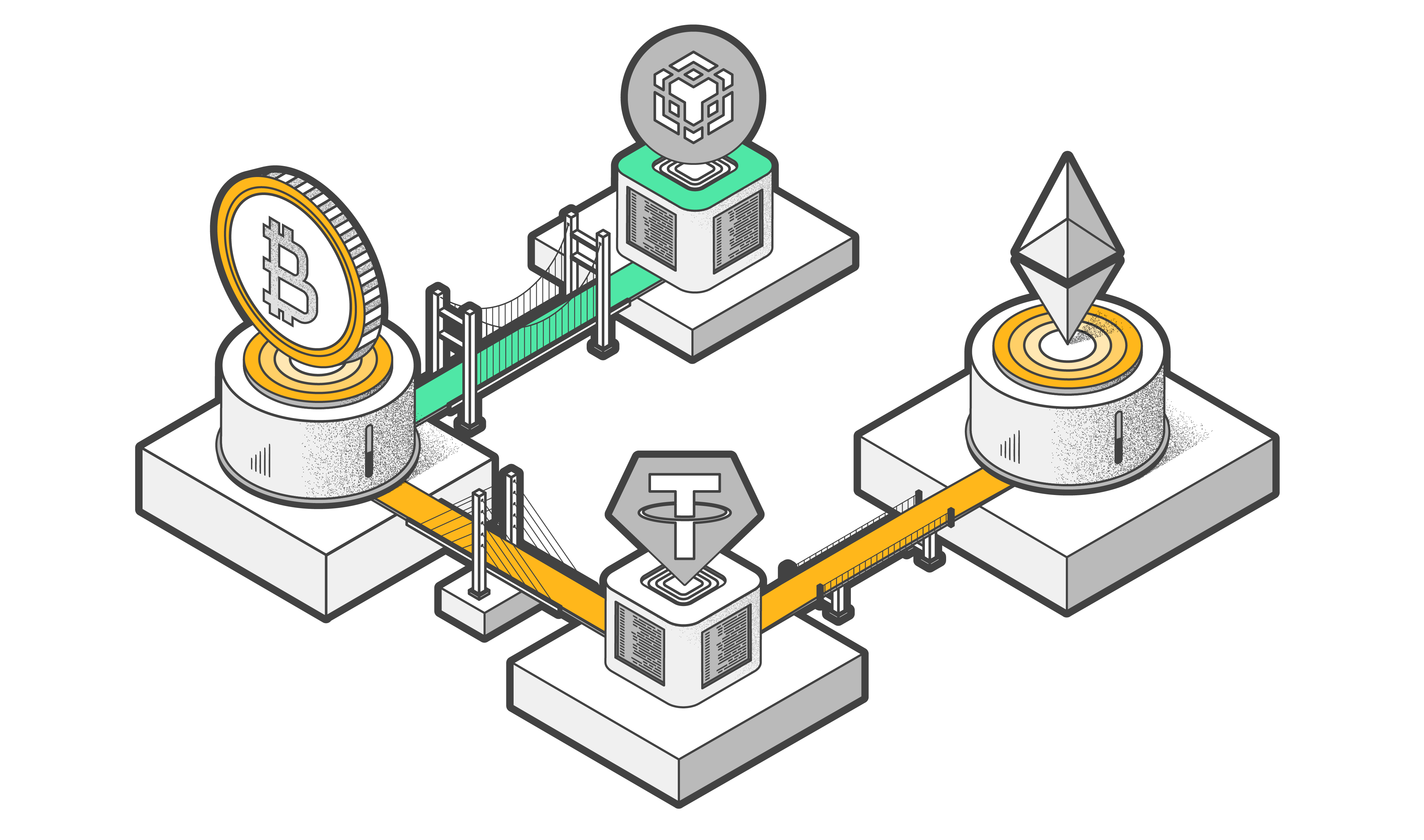

What Is a Cross-Chain Bridge?

A cross-chain bridge is a protocol that enables the transfer of tokens, NFTs, or data between two or more blockchains. It acts as both a translator and a courier. For example, if you hold USDC on Ethereum but want to use it on Solana, a cross-chain bridge enables this possibility. The bridge locks or burns your Ethereum-based USDC and then mints or releases an equivalent amount on Solana. The key idea is simple. Your value moves, even though the blockchains themselves remain separate.

Why Are Cross-Chain Bridges Essential in the Cryptocurrency Ecosystem?

Blockchains specialize. Ethereum dominates DeFi. Solana offers speed and low fees. Bitcoin focuses on security. Layer 2 networks reduce congestion. No single chain does everything well.

Cross-chain bridges solve three major problems:

- Liquidity fragmentation: Without bridges, liquidity stays trapped. Bridges allow capital to flow where it is most useful.

- Limited user access: Users should not need to sell assets just to switch ecosystems. Bridges remove that friction.

- Innovation bottlenecks: Developers can build apps that leverage multiple chains instead of choosing just one.

In short, bridges turn isolated blockchains into a connected ecosystem.

How Do Cross-Chain Bridges Work?

Most cross-chain bridges follow one of two models, either locking or burning assets on the source chain while minting or releasing equivalent tokens on the destination chain.

- Lock and mint: The system locks tokens on the source chain and mints equivalent wrapped tokens on the destination chain.

- Burn and mint: Tokens are burned on the source chain and minted on the destination chain.

When you bridge assets, you usually go through these steps:

- Connect your wallet to the bridge

- Choose source and destination chains

- Approve the transaction

- Pay the network fee

- Receive bridged assets on the target chain

Some bridges abstract this complexity so the process feels like a single transaction.

The Role of Smart Contracts and Oracles in Bridging Assets

Smart contracts handle locking, minting, and releasing assets. They define the rules and enforce them automatically. Oracles or relayer networks verify that an event happened on one chain before triggering an action on another. The verification layer plays a critical role. If attackers compromise it or it fails, the bridge can lose funds. Bridge security, therefore, depends heavily on strong smart contract audits, decentralized architecture, and robust validator design.

Types of Cross-Chain Bridges

1. Decentralized (Trustless) Bridges

Decentralized bridges rely on smart contracts and distributed validators, rather than a central authority. Examples include bridges that use light clients, zero-knowledge proofs, or large validator sets.

Pros of Decentralized Bridges | Cons of Decentralized Bridges |

Higher transparency | More complex architecture |

Reduced single points of failure | Slower transactions in some cases |

On-chain verification |

2. Centralized (Trusted) Bridges

Centralized bridges rely on a company or entity to custody funds and execute transfers. These bridges often appeal to beginners but carry higher counterparty risk.

Pros | Cons |

Faster transactions | Requires trust in a third party |

Simple user experience | Higher risk if the custodian gets compromised |

3. Hybrid Bridges

Hybrid bridges combine decentralized validation with centralized components for speed and usability. They aim to strike a balance between security and convenience. Many modern bridges follow this approach to remain competitive.

Top Cross-Chain Bridges in 2026

1. Multichain: Versatility and Supported Blockchains

Multichain supports dozens of blockchains and assets. It gained popularity for its broad compatibility and flexible routing. It works well for users who regularly move assets across multiple ecosystems, as its history demonstrates the importance of due diligence when selecting a bridge.

2. Celer cBridge: Speed and Low Fees

Celer cBridge focuses on fast transfers and low costs. It uses a liquidity pool model rather than wrapped assets, which reduces friction. It is popular among DeFi users who need frequent, smaller transfers.

3. Portal Token Bridge (Formerly Wormhole): What’s New?

Portal, formerly Wormhole, continues to focus on secure, audited cross-chain messaging. It supports major ecosystems like Ethereum, Solana, and BNB Chain. Portal emphasizes ecosystem integrations over token transfers.

4. Synapse Bridge: Best for DeFi Applications

Synapse shines in DeFi use cases. It supports native asset swaps across chains and integrates deeply with liquidity pools. If you use lending, yield farming, or stablecoin strategies, Synapse often offers smoother execution.

5. Umbria Narni Bridge: A Newcomer With Unique Features

Umbria Narni Bridge stands out with its gas fee optimization model. It allows users to pay destination-chain fees with assets from the source chain, thereby solving the common problem of receiving tokens on a new chain without sufficient gas to utilize them.

Key Benefits of Using Cross-Chain Bridges

- Expanding Access to DeFi and DApps: Bridges unlock access to thousands of decentralized applications (DApps) across multiple blockchain networks. You can chase better yields, new protocols, or exclusive NFT drops without selling assets.

- Reducing Transaction Fees and Processing Times: Transferring assets to faster and more cost-effective networks can save significant fees, especially during periods of congestion on Ethereum.

- Improving Liquidity Across Blockchain Networks: Liquidity flows where opportunity exists. Bridges ensure capital does not sit idle on one chain while demand rises on another.

Challenges and Risks of Cross-Chain Bridges

- Security Vulnerabilities and Past Exploits: Bridges remain one of the most targeted attack vectors in crypto history. Hacks often result from flawed smart contracts or compromised validators. No bridge is risk-free.

- Potential Delays and Transaction Failures: Congestion, oracle delays, or validator downtime can cause transactions to slow or halt. Sometimes funds arrive late but intact. Sometimes transactions fail and require manual recovery.

How to Reduce Smart Contract Risks

- Use well-audited bridges

- Avoid bridging large sums in one transaction

- Test with small amounts first

- Monitor official announcements and audits

How to Safely Use Cross-Chain Bridges With Tangem Wallet

Tangem Wallet simplifies secure asset management while keeping private keys offline.

Step-by-Step Guide to Transferring Assets Between Blockchains

- Open the Tangem Wallet and select the asset

- Connect to a supported bridge via WalletConnect

- Choose source and destination networks

- Review transaction details carefully

- Confirm and wait for completion

Tips to Avoid Common Mistakes

- Always double-check destination addresses

- Ensure you have enough gas on the source chain

- Start with a test transaction

- Avoid unofficial or cloned bridge websites

Future of Cross-Chain Technology: Trends to Watch

- Interoperability and Multi-Chain Ecosystems: The future is not one chain to rule them all. Many chains are working together. Interoperability will become a default expectation, not a premium feature.

- The Role of Emerging Technologies Like CCIP: Protocols like Chainlink CCIP aim to standardize cross-chain messaging, reducing the need for dozens of custom bridges and improving overall security.

FAQ About Cross-Chain Bridges

What Is a Cross-Chain Bridge?

A cross-chain bridge enables the transfer of assets or data between blockchains. For example, moving ETH from Ethereum to Arbitrum requires a bridge.

What Is the Difference Between Cross-Chain and Multi-Chain?

Cross-chain means assets move between blockchains. Multi-chain refers to an app that exists on multiple blockchains, but does not necessarily transfer assets between them.

How Does Tangem Wallet Ensure Security During Cross-Chain Transactions?

Tangem uses secure chip technology and offline key storage. Transactions require physical card interaction, reducing the risk of remote attacks. You keep full custody at every step.

What Is the Bridge Fee for ChainPort?

ChainPort fees vary by asset and network. Fees usually include a bridge fee plus standard network gas costs.

Why Do Swaps Fail?

Swaps fail due to insufficient gas, slippage issues, oracle delays, or network congestion.

Do I Still Need to Pay Network Fees After a Transaction Fails?

Yes. Network fees compensate validators for processing transactions, even if they fail.

What Are the Expectations in 2026?

- Fewer but more robust bridges

- Native cross-chain functionality in wallets

- Improved UX with abstracted complexity

- Stronger security standards and insurance mechanisms

Conclusion: Are Cross-Chain Bridges Worth It?

Cross-chain bridges unlock flexibility, liquidity, and opportunity. They allow users to follow innovation wherever it goes. At the same time, bridges introduce risk. Hacks, delays, and complexity remain real concerns.

Use bridges when:

- You need access to better apps or yields

- Fees on your current chain are too high

- Liquidity opportunities justify the risk

Avoid them when:

- You move large sums without testing

- You rely on unverified or unaudited protocols

With secure hardware wallets, such as Tangem Wallet, and a cautious approach, cross-chain bridges can become a powerful part of your crypto strategy rather than a liability. The multi-chain future is already here. Bridges are how you move through it safely.