All about Fantom

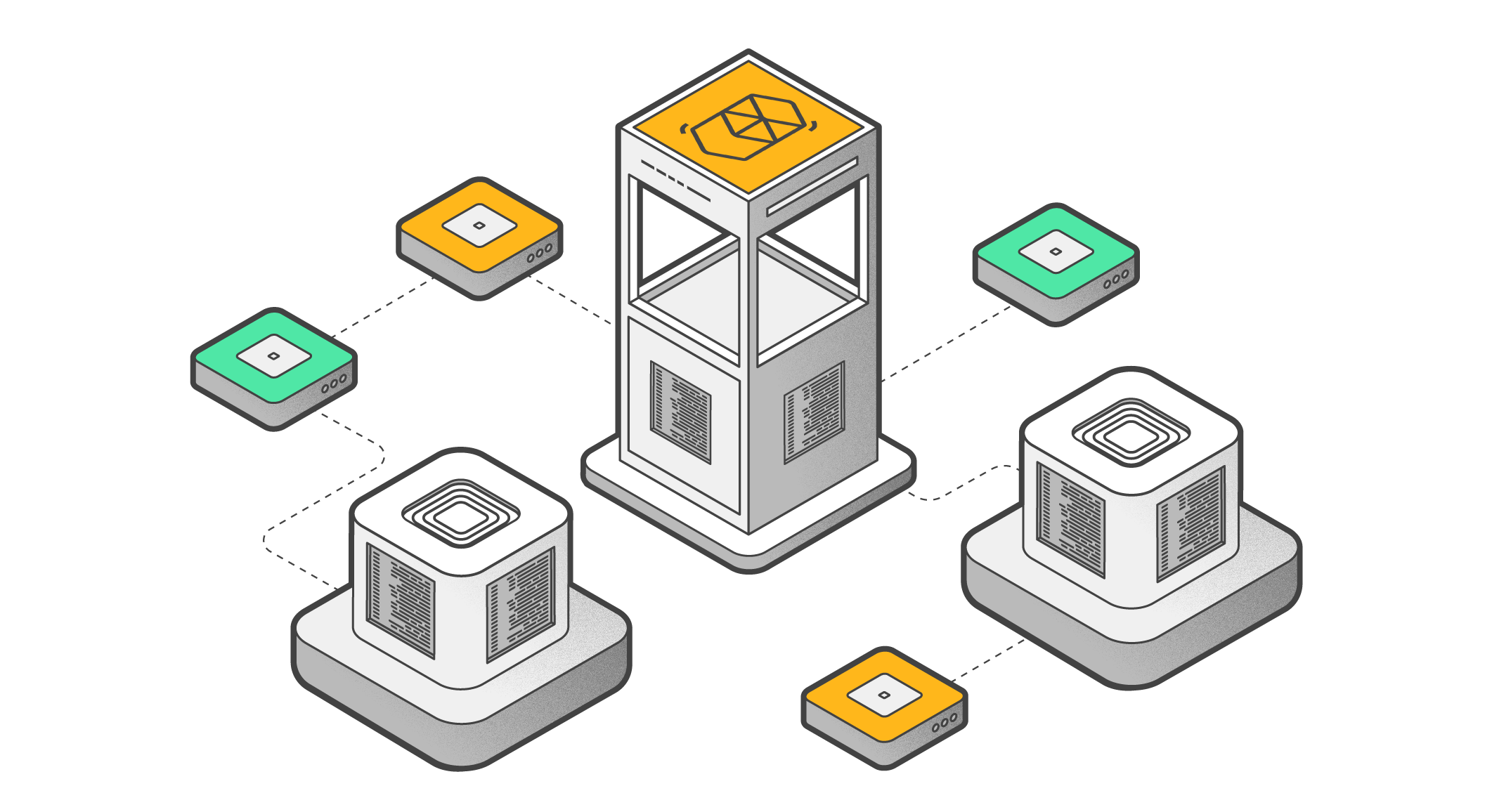

Fantom is a decentralized smart contract execution environment, described by its creators as a faster and cheaper alternative to Ethereum 1.0. Its key offering is an ecosystem of utilities and services wrapped in a convenient interface that developers can use to make DApps.

Each DApp built on the Fantom platform can use its own blockchain with proprietary tokens, bespoke management rules, an independent economy and more. The DApps can interact with applications running on other Fantom networks, which is why the developers sometimes make the bold claim that Fantom is a ‘network of networks’. Fantom is also compatible with the Ethereum Virtual Machine, which can be used to create smart contracts that interact with Ethereum contracts.

What else? Fantom is fast. In the whitepaper, the developers claimed a maximum theoretical speed of 300,000 TPS, though this figure has been significantly revised down to 4,500 – by no means a bad output. Transactions cost less than a cent and, thanks to the speedy consensus mechanism, are confirmed within a couple of seconds.

How does it work?

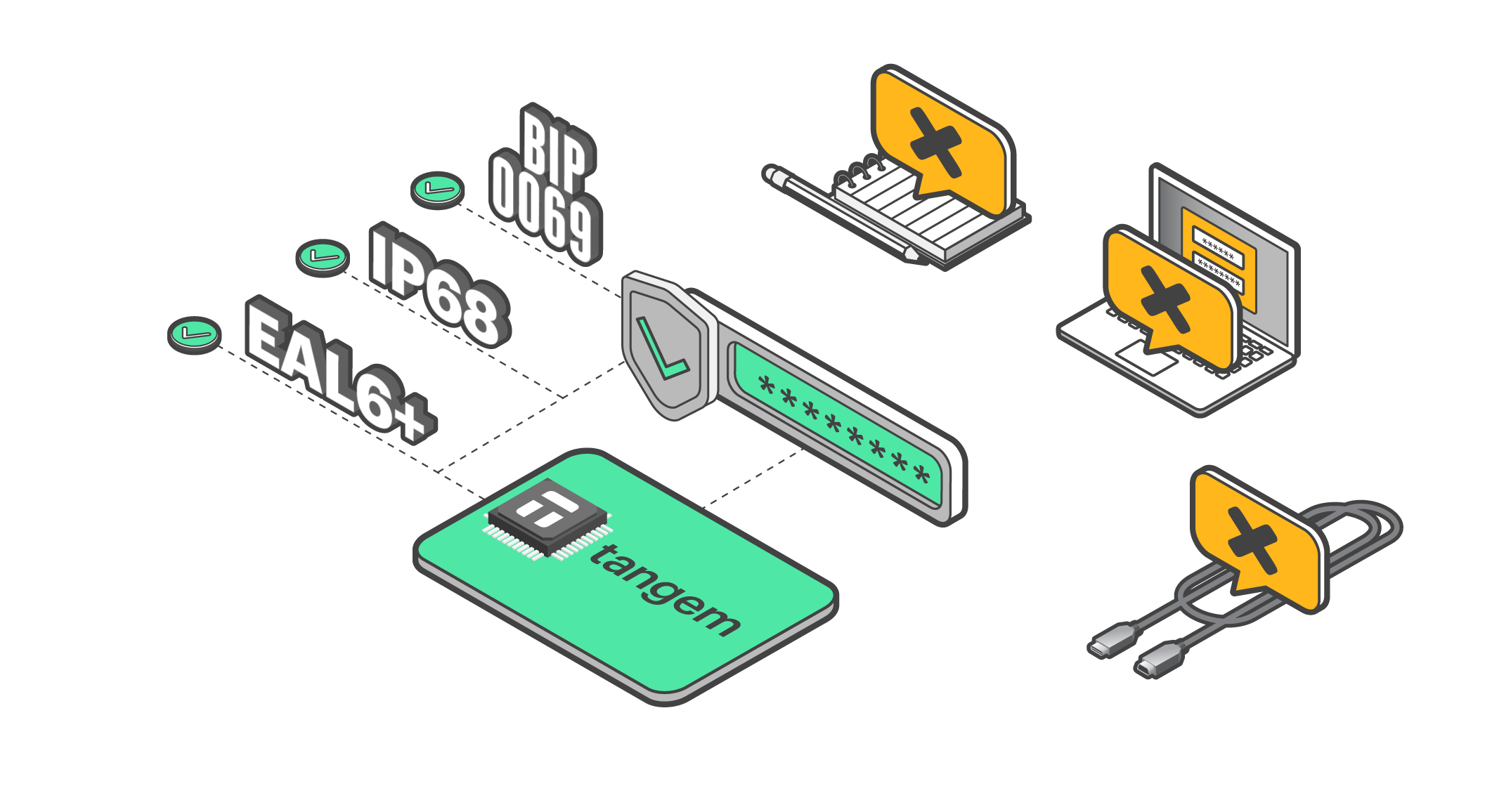

Fantom is based on the Opera network, which is compatible with the Ethereum Virtual Machine (EVM), and a proof-of-stake (PoS) consensus mechanism based on the proprietary Lachesis algorithm, which is asynchronous Byzantine fault tolerant (aBFT) and uses a directed acyclic graph (DAG). The developers believe the algorithm is potentially revolutionary.

To understand how Lachesis works, we need to remind ourselves of what Byzantine fault tolerance is. Its name comes from a thought exercise known as the ‘Byzantine generals problem’, whereby military generals are planning to attack a city from different sides and need to coordinate their actions (form a consensus) by sending plans to each other via messengers. There is, however, no guarantee that the messengers will not be bribed, intercepted or replaced by enemy couriers. The generals themselves are not above suspicion either, as any one of them might turn out to be a traitor.

Blockchain nodes therefore take on the role of the generals, and must come to a unified decision on the time and order of a set of transactions, despite any compromised nodes that might be trying to sabotage their efforts. A fault-tolerant network is established when the correct consensus is reached despite a third of the network nodes being compromised.

In many networks, Byzantine fault tolerance is achieved by setting a maximum latency threshold for messages from nodes. With the asynchronous (aBFT) approach used in Fantom, some messages are allowed to be lost or delayed indefinitely. This means that the Fantom nodes don’t need to communicate with each other all the time, and will process the data when it’s convenient for them to do so.

The Lachesis network is leaderless. Each node stores a local directed acyclic graph (DAG) consisting of event blocks which contain transactions. The graph stores time-based data, which is used to calculate the exact order of events and therefore the transactions.

In the classic consensus model, nodes create and then validate blocks sequentially, and the blockchain is forced to ‘wait’ until each one is added. With Lachesis, the validators arrive at a consensus independently of each other, and then pass the relevant information to other network participants, rather than the entire block.

Summary: Looking back at the allegory of the generals, the classic approach can be described as follows: the messenger brings the command to the general and waits while the latter checks it, consults with the staff, draws arrows on the maps and writes a signature. An order is given to the courier, who then brings it to the next general. This process is repeated until all of the generals have confirmed the documents. With Lachesis, the messenger simply delivers the papers to all of the commanders and doesn’t wait for them to be examined.

Tokens

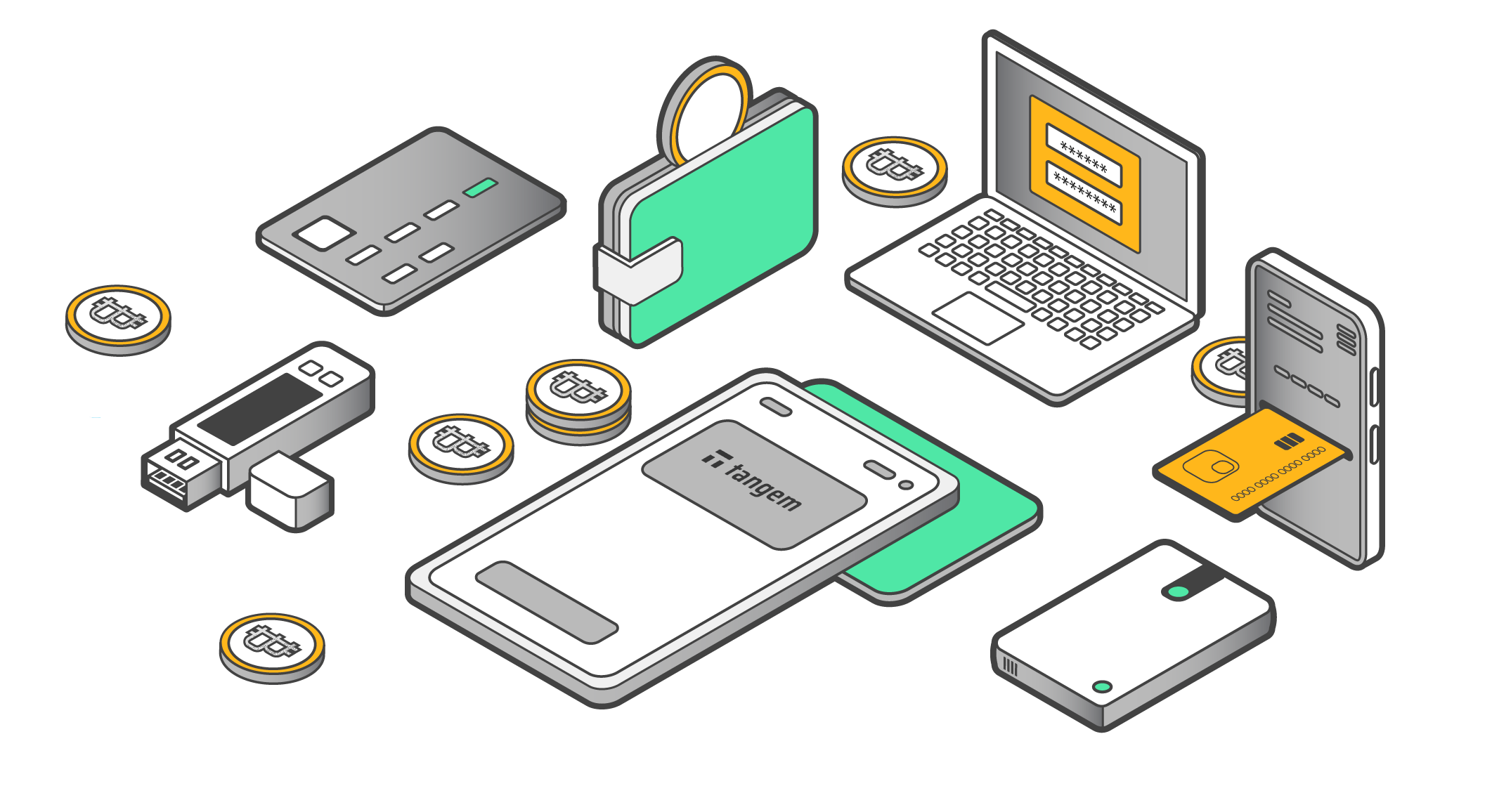

Fantom uses the FTM token, which exists in three forms: the native FTM coin on Fantom, a BEP-20 (BNB Smart Chain) version and an ERC-20 (Ethereum) version. They are all connected by cross-chain bridges, supporting the transfer of assets between networks. This can also be done through Binance, which supports FTM on all of the above networks.

Transaction commissions can fluctuate depending on network loads, but are usually no more than 0.1 FTM. Even at its very peak the figure didn’t exceed 2 cents, and at the time of writing it stands at USD 0.000349.

Any FTM holder can stake coins by delegating them to a chosen validator. Profitability depends on time: the longer the delegation period, the higher the percentage. There are a number of resources that allow you to estimate yields and interest rates. To become a validator, you need to stake at least 500,000 FTM (currently USD 280,000) and run a fairly powerful node, for example on Amazon's AWS. The monthly cost of renting a server with the required specifications starts at USD 400 per month.

What are the downsides?

Fantom is pretty impressive on the whole, barring a couple of issues. Some users are unhappy that Fantom hasn’t been able to deliver the promised speed of 300,000 TPS. Another issue is the low level of decentralization. There are currently just 64 validators on the network and the Nakamoto Coefficient is 3, meaning that just 3–4 validators need to collude in order to create problems. The FTM token price also fell from USD 1.7 to USD 0.1 last year (FTM is currently trading at USD 0.5). This was partly caused by the departure of the Chair of the Technology Council for the Fantom Foundation Andre Cronje, who didn’t just leave the project but the entire DeFi space. This led to a drop in the token prices of projects he supported, affecting Fantom in turn.

Projects

Thanks to the low commissions, high transaction speeds and intuitive developer kit, many different projects have been built on Fantom. They are mostly trading services for crypto exchanges and aggregators, and include the following:

SpookySwap — the largest and most popular decentralized exchange (DEX) on Fantom. It uses the BOO token and offers many easy-to-use trading tools with low commissions.

ProtoFi — a project that calls itself a ‘next-generation decentralized bank’. Users can open an account and receive interest on their ‘deposits’. The ‘investors’ become co-owners and receive a share of the ProtoFi income pool. Two tokens – Proton and Electron – are used to maintain the ecosystem.

SuperFarm — an NFT ecosystem that allows users to mint NFTs quickly and without the need for any expert knowledge. The platform also provides opportunities for creators to engage with the community.