The typical method of earning profit involves selling your crypto assets once the market price rises and buying more when it falls. However, there are alternative ways to generate income reliably. Through staking, you can leverage your cryptocurrencies to create passive income without selling them.

Staking in crypto can be compared to depositing funds into a yield-generating savings account in a traditional bank. However, this comparison has its limitations. When you deposit money into banks, they lend it out, and you receive interest on your account balance. What happens when you stake your crypto?

What is staking?

Staking is a method of earning passive income from cryptocurrencies with the Proof-of-Stake (PoS) consensus algorithm and its variations. It involves locking up a certain number of coins in a wallet in exchange for yield to support the functioning of the blockchain (ensuring network security and validating transactions).

When you stake your crypto, you lock up your coins in a blockchain network to support its operations. In return, you earn rewards in the form of additional cryptocurrency. The rewards vary depending on the network, the amount staked, and the staking period.

About the Proof-of-Stake algorithm

Proof-of-Stake (PoS) is a consensus mechanism used to validate transactions. In this system, computing nodes (validators) compete to generate new blocks and verify transactions based on the number of coins they have staked in the blockchain. The more coins they have locked up, the greater their potential profit. Additionally, some blockchains consider factors such as the duration for which coins/tokens have been held.

Simply put, the bigger the stake locked in by the validator, the higher the chance the validator generates a new block and gets a reward for it.

Staking involves earning rewards by supporting the blockchain with locked-up coins. In PoS networks, crypto holders can earn passive income by becoming validators or by delegating their crypto to a node operator.

One popular variation of PoS is Delegated-proof-of-stake (DPoS).

The main advantage of DPoS is that coin owners can participate in staking without running their own computing node or blocking large amounts of coins in their wallets. Instead, they can delegate this task to a validator who manages a node, allowing them to invest much less money.

Staking is a more affordable passive income option than mining, requiring expensive video cards and other powerful equipment. This is especially true if you don't plan to set up a node and become a validator. When you delegate tokens to a validator, the entry threshold is minimal or non-existent.

How to earn passive income from staking

Earning passive income from staking typically involves these steps:

- Choose a cryptocurrency: Select a cryptocurrency that supports staking.

- Set up your wallet: Tangem Wallet now supports staking for the TRON, Solana, and Cosmos networks.

- Acquire the cryptocurrency: Buy, swap, or receive the cryptocurrency you plan to stake.

- Stake your tokens: Deposit your tokens into the staking pool. The next section explains how to do this.

- Earn rewards: Once staked, your tokens will start accruing rewards, which are usually additional tokens.

- Monitor and reinvest: Regularly check your staking rewards and consider reinvesting them to compound your earnings.

How to stake crypto in Tangem Wallet

Staking in Tangem Wallet involves the following steps:

Open the Tangem Wallet app.

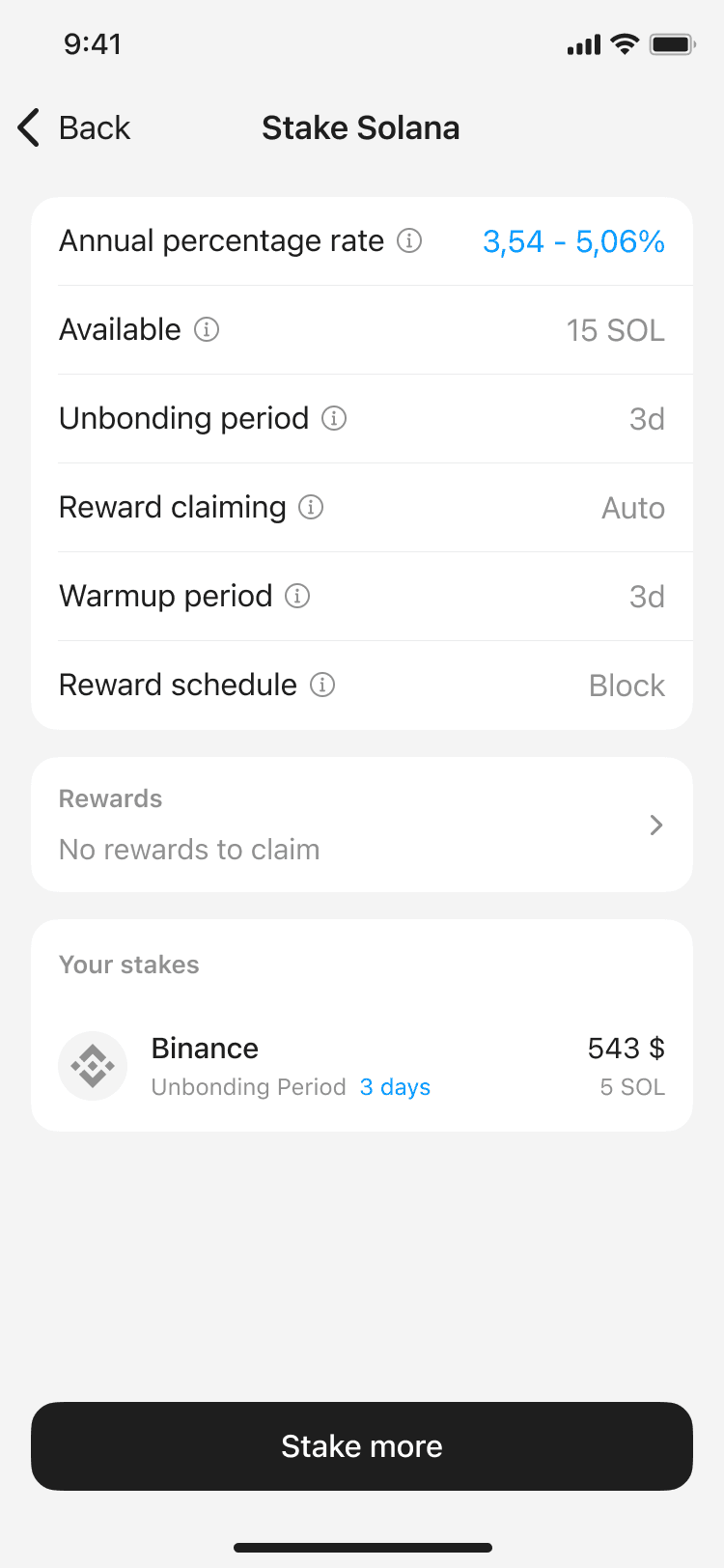

Select the token you want to stake, such as Solana (SOL), and tap Stake.

Review the information about staking the token, including the APR, Unbonding period, and reward schedule, and tap Stake again.

Enter the amount you want to stake and tap Next.

Tap and choose a validator. Validators are listed by APR offered. Tangem automatically recommends the most profitable validator, but you can choose any from the list.

- Tap Continue after choosing a validator.

Tap Stake to proceed with the transaction.

- Enter your access code/biometric ID and tap your Tangem Wallet to sign the transaction.

Tap Close.

Track your staked assets on the asset page.

How to claim staking rewards

Claiming rewards can be automatic or manual, depending on the blockchain network. In some networks, such as Solana, rewards are compounded to the staked amount, but you have to claim it manually by unstaking SOL. In others, like TRON, rewards must be manually claimed, usually by initiating a transaction that may require a gas fee.

Here’s an example of claiming TRX rewards in Tangem Wallet:

Tap Close to return to the homepage.

Open the Tangem Wallet app and go to the staked token page.

Tap on the Native staking bar.

Tap on Rewards and then Claim rewards.

- Enter your access code/biometric ID and sign the transaction with your Tangem Wallet.

Earned rewards will be deposited in your account and will be available for use as soon as the transaction is processed.

How to stake more tokens

Some networks allow you to stake more tokens after the initial staking operation. Here’s how to do that:

Open the Tangem app and go to the staked token page

Tap on the Native staking section.

Tap Stake more

Enter the amount you want to stake and tap Next.

Tap on the Validator section and choose a validator. Validators are listed by APR offered. Tangem automatically recommends the most profitable validator, but you can choose any from the list.

Click Continue after choosing a validator.

- Tap Stake to proceed with the transaction.

- Enter your access code/biometric ID and tap your Tangem Wallet to sign the transaction.

Tap Close.

You can track your staked assets on the asset page.

How to unstake tokens in Tangem Wallet

To unstake your cryptocurrency, follow these steps:

Open the Tangem app and log into your wallet.

On the home screen, select the cryptocurrency you have staked.

Tap Native staking on the token page.

Please select the appropriate validator under Your stakes. If a validator in this section is unavailable, the warm-up period is not yet over (this applies only to Solana).

- Review all the details before tapping Unstake.

- Enter your access code/biometric ID and scan your wallet to sign the transaction. Before withdrawing your staked coins, you must wait for the unbonding period to end.

Which cryptocurrencies can you stake in Tangem Wallet?

According to our roadmap, the assets currently available for staking are Solana (SOL), Tron, and Cosmos. However, more networks will be added soon, including Polygon (MATIC) on ETH, Polkadot, Cardano, Avalanche, Binance Smart Chain, Near, Tezos, Cronos, and Kava.

Risks of staking crypto

Staking crypto involves certain risks every investor must know about. They include:

- Market risk: Market volatility can rapidly reduce the value of the staked cryptocurrency. The main concern with market volatility is that you may be unable to withdraw your funds quickly due to the unbonding or lock-up period.

- Inflation: If the token’s inflation rate is higher than the staking rewards, the value of your holdings may decrease in real terms.

- Slashing: Slashing is a penalty imposed on validators for malicious behavior or failure to validate transactions correctly, resulting in the loss of staked funds. StakeKit—Tangem Wallet’s staking provider—covers slashing protections and all node downtime.

Staking can be a simple and profitable way to generate passive income, but it does come with risks. Avoid staking all your funds in one network. This way, if the value of some tokens drops, the growth in the value of others can compensate, providing a more stable income.

Staking glossary

Annual Percentage Rate (APR): is a standardized metric used to express the cost of borrowing or the potential return on lending or staking a certain amount of cryptocurrency over a year. It incorporates both the interest rate and any additional fees associated with the investment activity.

Native staking: The process of staking a cryptocurrency directly on a native blockchain network with the network’s native mechanisms. Native staking in Tangem Wallet allows participants to earn rewards and contribute directly to the network's security and consensus.

Network fees: Transaction fees paid to miners or validators for processing transactions on a blockchain.

Lock-up period: During which staked assets cannot be withdrawn or transferred.

Reward: The compensation received for staking. It usually comes in the form of tokens. For example, you receive more Solana tokens for staking Solana.

Reward claiming: The process of stakers retrieving their earned rewards from the validator. Depending on the blockchain protocol, rewards may be automatically distributed to your wallet or require manual claiming through a transaction. Manual claiming often involves paying a network fee to initiate reward transfers.

Reward schedule: The predetermined timetable and structure for distributing staking rewards to participants in a blockchain network. The reward schedule outlines how often rewards are distributed (e.g., daily, weekly, per block) and the rewards participants can expect. This schedule can be influenced by factors such as the total amount staked, network performance, and inflation rate.

Slashing: Slashing is a penalty imposed on validators for malicious behavior or failure to validate transactions correctly, resulting in the loss of staked funds. StakeKit—Tangem Wallet’s staking provider—covers slashing protections and all node downtime.

Unbonding period: The duration required to unlock staked assets before they can be withdrawn or transferred. The assets remain locked during this period, and staking rewards are not accrued. The length of the unbonding period varies depending on the blockchain.

Validator: A PoS blockchain participant responsible for verifying transactions and maintaining the network's integrity.

Warmup period: The time interval between when assets are initially staked and when they start earning rewards. During the warmup period, the assets are locked but do not yet generate staking rewards. The length of this period depends on the specific blockchain protocol.

FAQ staking in Tangem Wallet

How do I stake in Tangem Wallet?

To stake in Tangem Wallet, go to the asset you want, select Stake, and follow the prompts to stake your tokens.

Which cryptocurrencies can I stake using Tangem Wallet?

Tangem Wallet supports staking for multiple cryptocurrencies, depending on the networks integrated into the wallet. Currently supported networks include Solana, Cosmos, and TRON, but this list continuously expands.

How are staking rewards claimed?

The method of claiming rewards varies based on the network. Some networks automatically distribute rewards, while others may require manual claiming. Tangem Wallet will guide you through the appropriate process based on the network you’re staking on.

What is an unbonding period?

The unbonding period refers to the time it takes for staked tokens to become available for withdrawal after you have unstaked them. The unbonding period varies by network, typically from a few days to several weeks.

Are there any fees for staking in Tangem Wallet?

While Tangem does not charge you additional fees for staking, the staking provider does. The network you are staking on will also have transaction fees for delegating tokens and claiming rewards. Make sure to check the specific network’s fee structure.

Can I unstake my tokens at any time?

Yes, you can unstake your tokens, but most networks have an unbonding (lock-up) period during which your tokens will not be available for withdrawal or transfer. This unbonding period varies depending on the network.

How long does it take to start earning rewards after staking?

The time it takes to start earning staking rewards depends on the network. Some networks may take a few hours, while others might take several days before rewards accumulate.

Can I switch validators?

In networks like TRON, you can switch validators. However, you can't switch validators in Solana without unstaking, waiting for the unbonding period, and staking again.

What happens to my tokens while they are staked?

When your tokens are staked, they are locked in the network to help validate transactions. You cannot transfer or trade them during this time, but you can continue to own the tokens and earn rewards.

Is staking in Tangem Wallet secure?

Yes, staking in Tangem Wallet is secure since Tangem Wallet is non-custodial, you have full control of your private keys. It’s always good to choose a reputable validator.

Will staking affect the value of my tokens?

Staking itself does not affect the market value of your tokens. However, price fluctuations in the market may impact the overall value of your staked assets and rewards.

What is the difference between staking and yield farming?

Staking involves locking your tokens in a blockchain network to support its operations, while yield farming typically involves providing liquidity to decentralized finance (DeFi) platforms in exchange for rewards. Both processes offer rewards but operate in different ecosystems.

How can I track my staking rewards in Tangem Wallet?

Tangem Wallet has a user-friendly interface for tracking your staked tokens and rewards. You can view your current staking status and earned rewards directly in the app.

What is the minimum amount needed to stake in Tangem Wallet?

The minimum staking amount varies depending on the network you are staking on. Some networks have a very low minimum requirement, while others may require a higher amount.

Can I stake multiple cryptocurrencies simultaneously in Tangem Wallet?

Yes, you can stake multiple cryptocurrencies at once. You can manage each staking operation independently within your Tangem Wallet.

Does staking in Tangem Wallet require the app to be open?

No. Once your tokens are staked, they will continue earning rewards without needing the Tangem Wallet app to be open. Staking is a network-based process, so rewards accumulate regardless of whether the Tangem app is in use.

How do I choose a validator for staking?

When staking in Tangem Wallet, you will see a list of available validators. Choosing a validator with a good reputation, high uptime, and low commission rates is crucial. Learn more about choosing a validator here.

Can I transfer my staked tokens to another wallet?

No, you cannot transfer staked tokens directly to another wallet while they are still staked. You must first unstake your tokens and wait through the unbonding period before they become transferable.

Are staking rewards fixed or variable?

Staking rewards are generally variable and depend on several factors, including the overall network performance, the validator's performance, and the total number of tokens staked. Based on these conditions, rewards may fluctuate over time.

Can I compound my staking rewards in Tangem Wallet?

Yes, you can compound your staking rewards by restaking the rewards you’ve earned. However, this process isn’t always automatic—depends on the network. You might need to use the restake option in Tangem Wallet.

Why do I need to keep some tokens available for fees when staking?

Most blockchain networks charge transaction fees for delegating, unstaking, and claiming rewards. When performing staking-related transactions, keeping a balance of tokens available to cover these fees is important.

What happens if my validator becomes inactive?

If your validator becomes inactive or is penalized, your rewards may be reduced. In rare cases, some of your staked tokens might be slashed. However, you’re protected from slashing and node downtimes when you stake in Tangem Wallet.

Can I delegate my staked tokens to multiple validators?

In Tangem Wallet, you’re limited to one validator per staking transaction.

How do I know if my staking rewards are taxable?

In some jurisdictions, staking rewards are considered taxable income. Consult with a tax professional to understand how staking is treated in your region and ensure proper reporting.

What is the Annual Percentage Rate (APR) for staking in Tangem Wallet?

The APR for staking varies by network and validator performance. Tangem Wallet estimates expected rewards based on the current APR, but this figure may fluctuate over time depending on network conditions.

Will I receive rewards during the unbonding period?

Staking rewards stop accumulating once you initiate the unstaking process and begin the unbonding period.

Can I pause staking temporarily?

Once you stake your tokens, they are locked for the duration of the staking period or until you decide to unstake them. You cannot pause staking. However, you can initiate the unstaking process at any time, but remember there is an unbonding period.

Do I need to stake the entire balance of my tokens?

No, you can choose how much of your token balance you want to stake. The only requirement is to leave a portion of tokens available for transaction fees.

How do I view the performance of my chosen validator?

On the validator's website, you can view key performance metrics, such as uptime, commission rates, and total delegations. This information helps you evaluate whether your validator performs optimally and earns consistent rewards.

Can I participate in governance through staking?

Yes, many networks allow stakers to participate in governance by voting on proposals. The weight of your vote is typically proportional to the amount of tokens you have staked. However, you cannot participate directly from the Tangem app.

How does staking in Tangem Wallet differ from staking on an exchange?

Staking in Tangem Wallet is non-custodial, meaning you have full control over your private keys and staked assets. On the other hand, staking through an exchange is custodial, and the exchange controls your private keys. Non-custodial staking offers greater security.